Market Dynamics: Bitcoin and S&P 500 Face Quarterly Setback while Bonds Gain Appeal

The appeal of bonds over risk assets like bitcoin and the S&P 500 is currently at its highest since 2009. Bitcoin, being a non-yield bearing risk asset, has experienced a 14% decline in the third quarter, potentially ending at $26,100. Meanwhile, the S&P 500, considered a benchmark for risk assets, has seen a nearly 3% decrease, closing at $4,320.05.

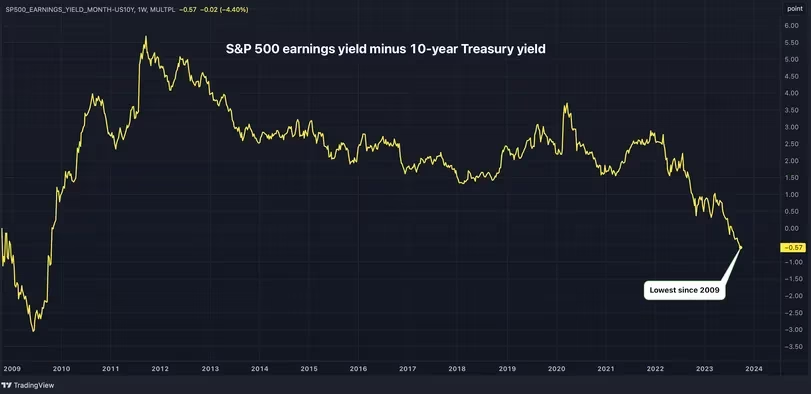

The equity risk premium, which measures the difference between the S&P 500's earnings yield and the yield on the U.S. 10-year Treasury note, has dropped to -0.58, the lowest since 2009. This indicates that the appeal of investing in stocks and other risk assets has diminished in comparison to the relatively higher returns offered by secure government bonds.

Treasury securities, being backed by the U.S. government, are considered risk-free. The 10-year yield serves as a benchmark risk-free rate against which the returns of other assets are evaluated. The gap between the S&P 500's dividend yield and the 10-year Treasury yield has also narrowed to -2.87, the lowest since July 2007.

The margin has dropped to its lowest point since 2009, which discourages investments in stocks and other high-risk assets. (Source: TradingView) With bonds offering lucrative yields, the incentive to invest in bitcoin diminishes. Although bitcoin is often viewed as a haven asset akin to digital gold, it historically functions more as a measure of liquidity and can act as a leading indicator for stocks.

The margin has dropped to its lowest point since 2009, which discourages investments in stocks and other high-risk assets. (Source: TradingView) With bonds offering lucrative yields, the incentive to invest in bitcoin diminishes. Although bitcoin is often viewed as a haven asset akin to digital gold, it historically functions more as a measure of liquidity and can act as a leading indicator for stocks.

According to Alex McFarlane, co-founder of Keyring Network, bitcoin's status as a non-yield bearing, risk-on asset makes it susceptible to adverse effects from a high USD risk-free rate due to portfolio rebalancing. McFarlane suggests that unless bitcoin can provide a risk-free rate (unlike Proof-of-Stake), it cannot be traded as a separate, orthogonal portfolio component.

The earnings yield of the S&P 500 is calculated by dividing the earnings per share of the index's component companies by the current index level. On the other hand, the dividend yield represents the basic return anticipated from investing in the index companies. Assessing the relative appeal of these two assets is crucial for money managers.

Spread between S&P 500’s dividend yield and 10y U.S. Treasury yield back to where it was in October 2007 pic.twitter.com/VHpXjLKDkc

— Liz Ann Sonders (@LizAnnSonders) September 20, 2023

Read more: Dogecoin Surpasses Bitcoin in Price Stability During Crypto Trading Slowdown

Trending

Press Releases

Deep Dives

Русский

Русский