Kaiko Chronicles: Unraveling Bitcoin's 'Sell The Fact' Retreat on Binance and OKX

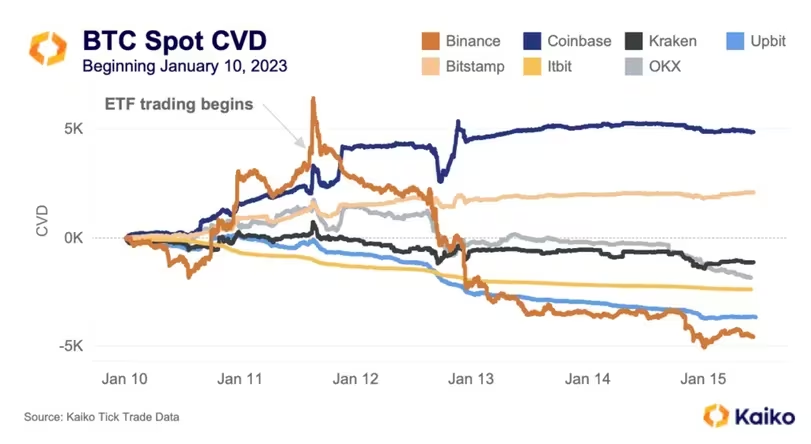

In recent days, the Bitcoin market has witnessed a notable retreat, with traders on Binance playing a pivotal role in the so-called "sell-the-fact" phenomenon. The commencement of trading for spot exchange-traded funds (ETFs) in the United States last Thursday has exerted downward pressure on Bitcoin (BTC). Data collected by Kaiko, an analytics firm based in Paris, points to Binance, the leading cryptocurrency exchange in terms of trading volumes, as the epicenter of significant selling pressure, alongside OKX and Upbit.

As of the latest update, Bitcoin, the predominant cryptocurrency by market value, is currently trading at $42,700. This reflects a 12% decline from the peak of $48,975 witnessed last Thursday. The drop in price seems to be closely tied to traders seizing profits from long (buy) positions that were initiated in anticipation of the ETFs' debut.

The cumulative volume delta (CVD) indicator, which tracks the net disparity between buying and selling volumes over time, serves as a key metric for assessing overall market bullish or bearish pressures. Positive CVD values indicate an excess of purchase volume, while negative values suggest the opposite.

Binance's spot market CVD turned positive last Thursday but has since experienced a continuous decline, signaling a capital outflow equivalent to nearly 5,000 BTC, according to Kaiko's data. Upbit in South Korea has seen the second-largest net capital outflow, followed by Itbit and OKX.

In a weekly report published on Monday, Kaiko highlighted,

“The ETFs began trading last Thursday, with a strong surge in cumulative volume delta (CVD) across all major exchanges; a net of nearly 3k BTC was market bought on Binance in the hour surrounding market open in the U.S. However, as some had feared, sell the news took hold, and Binance’s CVD quickly fell into the negative, as did OKX’s.”

Kaiko also noted,

“Itbit, another institutional exchange, though with lower volumes, showed consistent selling, along with Upbit, showing consistent selling with few retraces.”

Unveiling Bitcoin's Market Currents: Analyzing Spot CVD and Net Capital Flows Across Major Exchanges Since January 10th (Kaiko Insights)

Unveiling Bitcoin's Market Currents: Analyzing Spot CVD and Net Capital Flows Across Major Exchanges Since January 10th (Kaiko Insights)

Notably, the CVD on Coinbase, the primary custodian for most of the ETFs, and Bitstamp has remained positive, indicating a net capital inflow despite the prevailing weakness in prices.

Some analysts speculate the possibility of further price decline to $40,000 and below before the pullback loses momentum. The initial performance of the ETFs has been relatively lackluster compared to Bloomberg analysts’ projection of $4 billion in inflows on the first day alone, providing additional support for the argument of a more significant price drop.

Who knows what will happen today, and we don't want to mess with our recent prediction win re approval but we watching to see if $IBIT will break all-time day one flow/volume record of $2.1b (curr held by another blk ETF) and if the 11 of them as gp can get near/over $4b. pic.twitter.com/uVApgQdUk2

— Eric Balchunas (@EricBalchunas) January 11, 2024

On the second day of trading, #BTC ETFs (Jan 12th) saw inflows of USD677mn (ex-Grayscale). The cumulative first two trading days of the BTC ETFs have a balance of $1.4bn ex-Grayscale and $0.8bn including grayscale.

— Exante Data (@ExanteData) January 15, 2024

More than half of the flows went to the iShares Bitcoin ETF… pic.twitter.com/vtVXdXfvvN

Read More: ARK's Ongoing ETF Adjustments: Unloading $20.6M Worth of Coinbase Holdings

Trending

Press Releases

Deep Dives