Institutional Dilemma: A Divided Focus on Bitcoin and Ether, Insights from Bybit Research

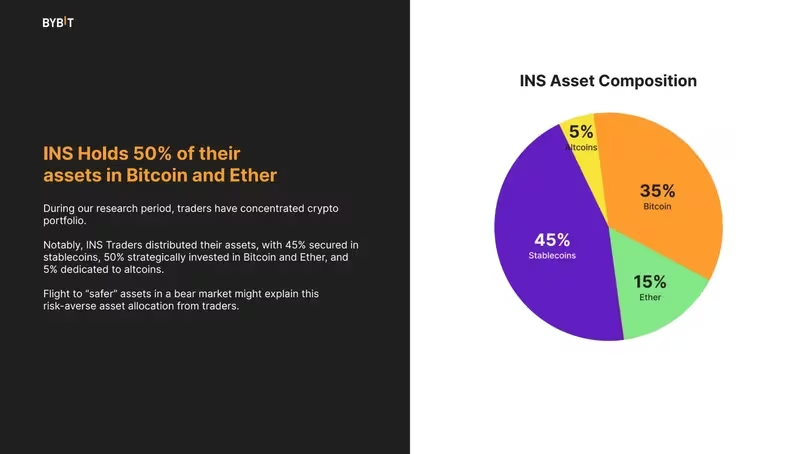

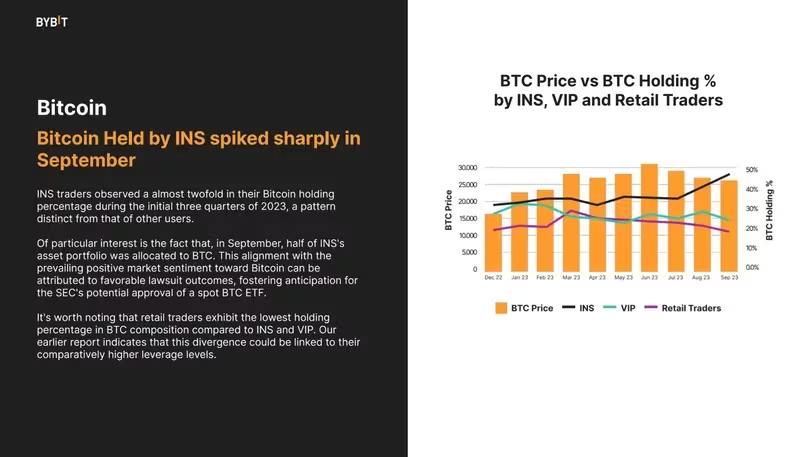

Throughout the first three quarters of 2023, institutional investors have unmistakably favored assets perceived as "safe," a trend evident in data provided by Bybit.

Source: Bybit

Source: Bybit

The primary focus has been on Bitcoin (BTC), with institutional holdings nearly doubling during this timeframe. By September, half of their investment portfolio was allocated to BTC, propelled by optimistic market sentiment and anticipation of the potential approval of a spot BTC exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC). Interestingly, this contrasts with the relatively lower BTC holdings observed among retail traders, a dynamic that may be linked to their higher leverage levels, as underscored by insights from Bybit's research.

Source: Bybit

Source: Bybit

In stark contrast to the enthusiasm for Bitcoin, institutional investors and significant Bitcoin holders (referred to as "whales") have taken a cautious stance towards altcoins, as outlined in the report. Despite a brief surge in altcoin holdings in May, there has been a general decline, particularly among institutional investors, starting in August. This downward trend reflects a prudent approach in light of the inherent volatility associated with these alternative assets.

The report also highlights a decrease in holdings of Ether (ETH) following the Shapella upgrade on the Ethereum blockchain. However, there was a noteworthy uptick in institutional ETH holdings in September, aligning with a positive outlook in the cryptocurrency market driven by excitement surrounding ETF developments.

In terms of performance, Bitcoin has demonstrated robust year-to-date growth, experiencing an approximately 140% increase in price, whereas Ether has seen an 87% rise. In October, K33 Research adjusted its asset allocation strategy, recommending a shift back to Bitcoin. This adjustment was prompted by Ether's sustained underperformance against BTC since July 2022 and a tepid response to newly introduced futures-based ETH ETFs.

K33 Research articulated this sentiment in their October report, stating,

"We believe it's time to tap the brakes on ETH and reallocate back into BTC amid Ether's ongoing underperformance."

This recommendation reflects the evolving sentiments and strategic shifts among institutional investors in the cryptocurrency landscape.

Read More: Grove Secures $7.9M Funding to Strengthen Decentralized Infrastructure Services

Trending

Press Releases

Deep Dives