- Home

- Latest News

- FTX Exploits: Unveiling Recent Transactions and Legal Proceedings

FTX Exploits: Unveiling Recent Transactions and Legal Proceedings

The cryptocurrency wallet address, which is intricately tied to the exploits within the FTX ecosystem, has shown noteworthy activity over the past 24 hours, moving a substantial sum of approximately $36.8 million worth of Ether (ETH). This transaction has caused a modest dip in the ETH ticker price, which now stands at $1,639, reflecting the complex and dynamic nature of the crypto market. This activity occurs in the midst of ongoing legal proceedings that revolve around the former CEO of the now-defunct crypto exchange, Sam Bankman-Fried (SBF).

Going back in time to November 11, 2022, we witnessed a significant event in the FTX and FTX U.S. landscape, where accounts were substantially depleted, resulting in a loss of a staggering $600 million. This unfortunate incident unfolded just hours after the crypto exchange filed for Chapter 11 bankruptcy protection. During this turbulent period, Ryne Miller, FTX's general counsel, swiftly communicated with traders to inform them of a hack that was attributed to malicious software:

FTX has regrettably fallen prey to a cybersecurity breach. Our dedicated chat support is available to provide assistance. We strongly urge our users to exercise caution and refrain from visiting the FTX website, as it might inadvertently download potentially harmful Trojans. It is worth noting that we have managed to recover a portion of the compromised funds, albeit with significant efforts.

Following a nearly ten-month period of relative quietude, the entity responsible for the FTX exploits embarked on the process of siphoning off the stolen assets. This commenced with the transfer of 10,250 ETH, valued at approximately $17.1 million, distributed across four distinct wallet addresses between the dates of September 30 and October 1, as per verified data from Spot On Chain.

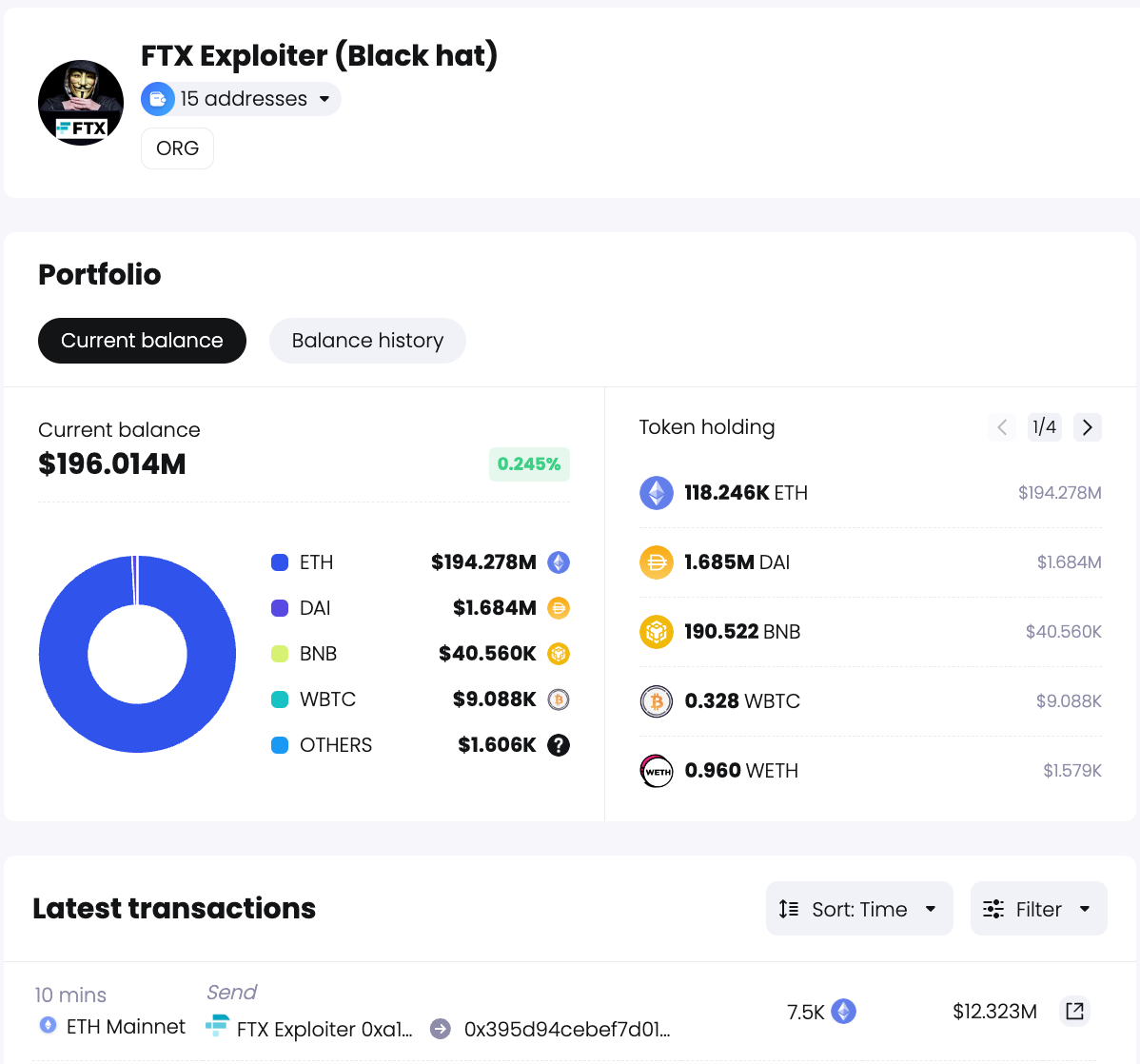

It is pertinent to mention that the exploiter originally held an impressive stash of 175,496 ETH, which was equivalent to a staggering $294 million at the time. However, the current state of their portfolio reflects a diminished value of $196.014 million.

Portfolio balance of FTX exploiter. Source: Spot On Chain

Portfolio balance of FTX exploiter. Source: Spot On Chain

During the timeframe spanning September 30 onwards, a cumulative total of 67,500 ETH has been systematically transferred from five out of the fifteen wallet addresses that can be linked to the FTX exploiter.

FTX exploiter transferred out 10,250 ETH from address 0x3e9. Source: Spot On Chain

FTX exploiter transferred out 10,250 ETH from address 0x3e9. Source: Spot On Chain

Among these transactions, 64,948 ETH, which translates to an approximate sum of $108 million, was routed through the Thorchain router, while a modest 52 ETH, valued at around $84,000, found its way into the Railgun contract. The remaining 2,500 ETH, with an approximate worth of $4.19 million, was thoughtfully exchanged for Bitcoin (tBTC).

Meanwhile, the legal proceedings surrounding SBF, in connection with the dramatic collapse of the FTX platform, officially commenced on October 3. In his defense, SBF, an enterprising individual, has steadfastly asserted his innocence against all seven counts of fraud and money laundering charges.

As the trial entered its second day, the Department of Justice (DOJ) and SBF's defense team presented their respective arguments before the jury. The DOJ has remained focused on highlighting SBF's purported role in misleading investors on the platform, while the defense has eloquently argued that Bankman-Fried was a young entrepreneur who, regrettably, encountered unfavorable outcomes as a result of certain business decisions that were made in earnest.

Read more: Optimism's Pioneering Network Innovations

Trending

Press Releases

Deep Dives