Evidence of Bullish Trends in Bitcoin's Onchain Data

Despite the surface calmness of the market, subtle shifts in onchain data indicate a growing inclination towards bullish trends.

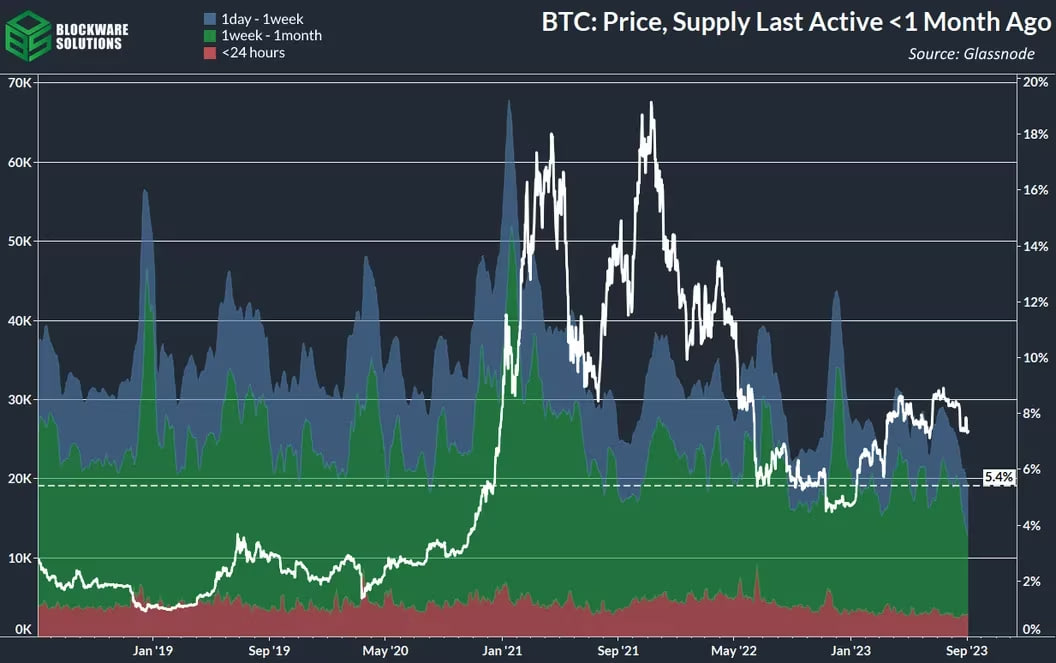

BTC price and recent active supply data sourced from Blockware Solutions and Glassnode.

Beneath the seemingly tranquil façade of the cryptocurrency market, there exists a latent optimism for Bitcoin (BTC), suggesting the potential for a substantial surge in price.

As per insights from Blockware Solutions and Glassnode, the proportion of actively traded Bitcoin within the past month plummeted to a historically low 5.4% earlier this week. This drop signifies a reduction in coin circulation, indicating a weakening on the supply front. Currently, the circulating supply of Bitcoin totals 19.48 million.

Blockware Solutions emphasized in a communication, "Price dynamics are determined at the margin, which implies that those engaging in frequent Bitcoin transactions heavily influence short-term price movements. With the ongoing increase in supply-side illiquidity, as evidenced by reduced supply turnover, any catalyst in demand could lead to a substantial price surge."

Approximately 70% of the circulating supply has remained dormant for over a year, underscoring a significant portion of holders adhering to a 'buy and hold' strategy. According to Glassnode's definition, long-term holders are addresses that retain coins for a minimum of 155 days.

Anticipating Positive Triggers

Besides the forthcoming launch of a spot Bitcoin-exchange-traded fund (ETF), still a few months away, prevalent macroeconomic and regulatory concerns lean towards a bearish sentiment.

David Lawant, the Head of Research at FalconX, highlighted, "The macroeconomic scenario is currently more uncertain than ever, and the prevailing sentiment of 'higher for longer' could exert a constraint on risk assets, including the crypto market. Additionally, there's potential selling pressure stemming from government-seized wallets, Chapter 11 portfolios, and substantial token unlocks expected over the next 6-12 months. Finally, there's an air of uncertainty regarding whether further regulatory actions will be taken in the U.S."

Trending

Press Releases

Deep Dives