Ethereum's Impending Crossroads: Navigating the 'Death Cross'

"Decoding the Cryptic Conundrum: Exploring Ethereum's Unpredictable 'Death Cross' Phenomenon" Ethereum's Daily Chart by TradingView

Ethereum's Daily Chart by TradingView

Within the intricate world of asset analysis, a captivating phenomenon known as the "death cross" comes to light when an asset's 50-day simple moving average descends below its 200-day simple moving average. Despite Ether (ETH) showcasing a commendable surge of 3.5% during the past week, a significant development looms on the horizon: the potential emergence of a looming "death cross."

Drawing insights from data furnished by the charting platform TradingView, it becomes apparent that Ether's 50-day simple moving average is on the verge of intersecting beneath its 200-day moving average. Notably, this cryptocurrency has encountered a death cross previously, specifically in late January of 2022.

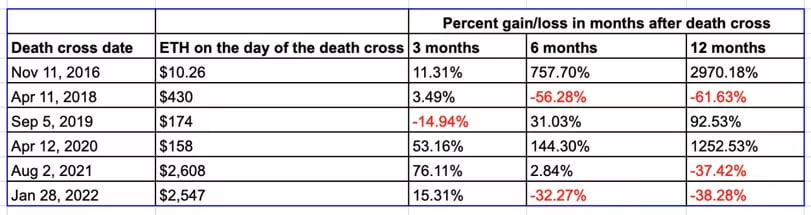

The traditional interpretation of the death cross signifies a scenario where the short-term trend demonstrates weaker performance compared to its long-term counterpart. This occurrence often serves as a bearish indicator with implications that tend to persist. However, historical data brings about a layer of intricacy. Over the course of Ether's existence, six instances of death crosses have emerged. Surprisingly, only three of these occurrences adhered to the projected trend, while the remaining instances turned out to be misleading signals that confounded traders. The death cross should not be trusted as a reliable standalone indicator, as indicated by TradingView.

The death cross should not be trusted as a reliable standalone indicator, as indicated by TradingView.

To illustrate, consider the aftermath of death cross confirmations on April 11, 2018, August 2, 2021, and January 28, 2022. During the subsequent year, Ether experienced significant double-digit losses. Paradoxically, traders who adopted short positions based on these death crosses would have witnessed substantial gains.

In contrast, those who opted for short positions in the aftermath of the first, third, and fourth death crosses missed out on the remarkable triple-digit price surges that followed. Intriguingly, the majority of death crosses revealed themselves as counterintuitive indicators. A fascinating pattern emerged where prices defied the anticipated downward trend, leading moving averages to align in a "golden cross" within three to six months after the preceding death cross.

In essence, the death cross proves its unreliability as a standalone indicator. Nevertheless, the imminent threat of a death cross does align with the prevailing bearish sentiment in the Ether options market, coupled with persistent concerns surrounding the slowdown in Ethereum's network usage. At the time of writing, Ether's valuation stands at $1,710.

In the realm of cryptocurrency trends, characterized by their unpredictability, the death cross emerges as an enigmatic signal, challenging conventional interpretations and highlighting the intricate dynamics that shape market behavior.

Trending

Press Releases

Deep Dives