Ethereum's Evolving Landscape: A Glimpse Ahead

One year on from the monumental shift to a proof-of-stake model, Ethereum stands as a testament to significant strides in reducing its energy consumption and enhancing network accessibility. However, amidst these triumphs, the road ahead does present its fair share of lingering technical challenges.

The eagerly awaited Merge event unfolded gracefully on September 15, 2022, where the Ethereum mainnet seamlessly merged with the Beacon Chain, a distinct blockchain operating on the proof-of-stake consensus mechanism.

The most conspicuous transformation post-Merge was Ethereum's departure from the power-intensive proof-of-work (PoW) to the more environmentally friendly PoS, resulting in a noteworthy dip in the overall power usage. Illuminating this monumental shift, data from The Cambridge Centre for Alternative Finance showcases Ethereum's energy consumption plummeting by a staggering 99.9%, a stark contrast to the once approximately 21 terawatt hours under the PoW protocol.

The Merge led to a reduction of over 99% in Ethereum's energy usage. Source: CCAF

The Merge led to a reduction of over 99% in Ethereum's energy usage. Source: CCAF

Ethereum experiences a shift towards deflation

In the economic realm, Ethereum took on a new identity post-Merge, adopting an economically deflationary characteristic. The issuance of new Ether (ETH) for the purpose of network security was outweighed by the amount of ETH permanently removed from circulation. Ultrasound.money's Ethereum data paints a vivid picture, indicating that slightly over 300,000 ETH (equivalent to $488 million at current prices) have been meticulously burned since the Merge. At the ongoing burn rate, ETH's total supply dwindles at a rate of 0.25% per year.

Alterations in the ETH circulation post-Merge. Source: Ultrasound Money

Alterations in the ETH circulation post-Merge. Source: Ultrasound Money

Despite optimistic expectations of a price surge due to this deflationary pressure, such hopes were somewhat subdued by macroeconomic challenges like the banking crisis and an upswing in inflation. Intriguingly, Ethereum's growth in value took a back seat to Bitcoin's impressive surge in the first quarter of the year, seemingly capitalizing on the conventional financial instability arising from the banking crisis.

However, beyond the realm of mere price dynamics, the primary goal of the proof-of-stake upgrade was to usher in stakers to bolster network security. Subsequently, the Shapella upgrade in April 2023 fueled a significant movement towards staking ETH, with liquid staking providers such as Lido and Rocket Pool reaping the most benefits.

Liquid staking dominance ensues

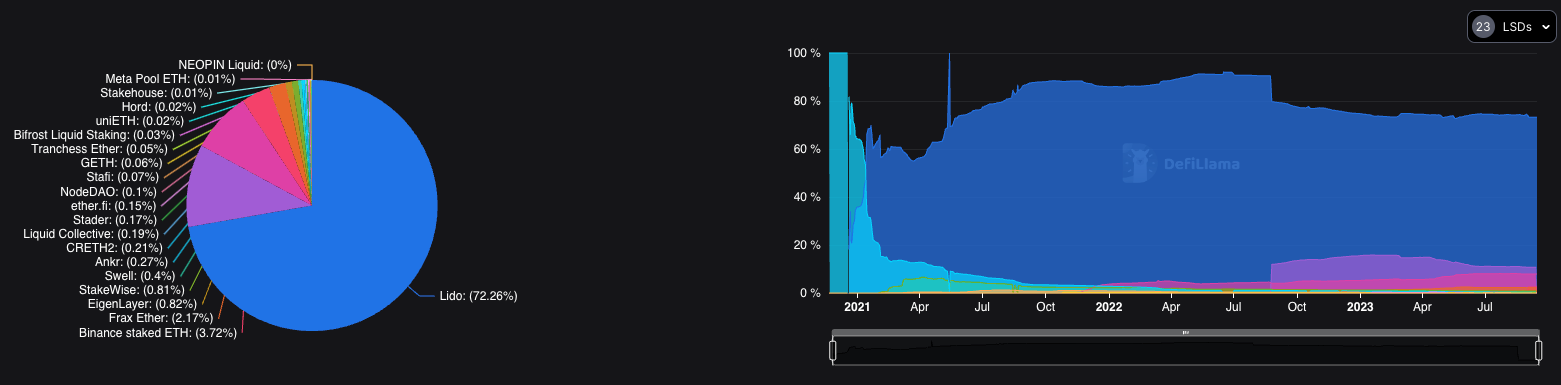

In the Ethereum landscape, a paradigm shift towards the dominance of liquid staking providers has been observed since the Merge. Presently, more than $19.5 billion worth of ETH is securely staked through liquid staking protocols, as reported by DefiLlama. Notably, Lido holds an enviable position, commanding a significant 72% of all staked ETH.

At present, Lido holds a 72% share of total Ethereum staking. Source: DeFiLlama

At present, Lido holds a 72% share of total Ethereum staking. Source: DeFiLlama

Nevertheless, amidst the applause for this transition to staking, removing barriers like expensive mining hardware, concerns have emerged regarding the level of control granted to staking providers, notably Lido Finance.

"Liquid staking undeniably bodes well for the network, democratizing governance and alleviating the influence of the affluent. Nonetheless, it has also given rise to a unique set of challenges," observed Feeny, Labry CEO.

Currently, at least five Ethereum liquid staking providers advocate for a 22% limit rule to preserve network decentralization. Interestingly, Lido opted not to participate in this vote, amassing a resounding 99.81% majority against self-imposed limitations. This development has sparked widespread concerns about the potential centralization of validation within the Ethereum ecosystem.

"At present, Lido wields considerable influence, controlling a substantial 32.26% of all staked Ether on the network, amounting to over $14 billion. While Ethereum may ultimately thrive with liquid staking, there remain numerous hurdles to overcome," concluded Feeny.

Feeny also shed light on the growing regulatory pressure on the crypto and blockchain sphere, particularly in the United States, a pressing concern for Ethereum's immediate future.

"Regulatory authorities, particularly in the U.S., appear resolute in their efforts to regulate and potentially stifle the growth of the U.S.-based blockchain industry," he expressed.

"The repercussions for Ethereum and the global blockchain community could be severe should blockchain enterprises find it exceedingly challenging to operate within the U.S."

Beyond the staking arena, another vital concern is the need for greater client diversity. During Korea Blockchain Week on September 5, Vitalik Buterin passionately addressed this issue, outlining six key challenges that demand collective attention to combat centralization.

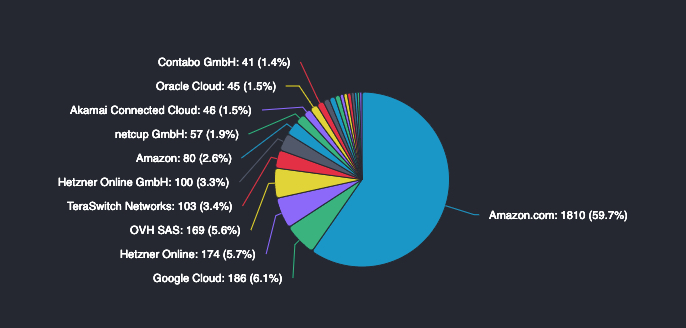

Currently, the lion's share of the 5,901 active Ethereum nodes heavily relies on centralized web providers such as Amazon Web Services, leaving the Ethereum blockchain susceptible to a central point of failure.

The dispersion of Ethereum nodes hosted by web service providers. Source: Ethernodes

The dispersion of Ethereum nodes hosted by web service providers. Source: Ethernodes

Buterin's primary solution revolves around the concept of statelessness, designed to reduce data requirements for node operators to nearly negligible levels. This would democratize node operation, making it accessible to everyday individuals by significantly slashing costs and hardware prerequisites.

"While this represents Buterin's primary concern regarding centralization, he acknowledges that overcoming these challenges may well be a journey spanning another 10 to 20 years."

Trending

Press Releases

Deep Dives