Ethereum's Ballet: Navigating the Market Rhythms

Following a dazzling surge that catapulted Ethereum to a yearly zenith of $2.4K, the subsequent dance with selling pressure resulted in a noteworthy rejection.

At this juncture, ETH finds itself meandering through a critical price range, and a potential breakout from this range holds the promise of charting the cryptocurrency's course for upcoming maneuvers.

In dissecting the Daily Chart

Ethereum has flaunted rather conspicuous bullish signals, with the price flaunting a robust uptrend that elegantly retraced above the pivotal resistance level of $2.1K. Despite encountering a transient hiccup, the cryptocurrency gracefully sustained its upward trajectory, reaching an annual apogee of $2.4K. This particular price action exudes an air of a reinvigorated bullish market, hinting at a resurgence in demand and heightened enthusiasm among market participants.

It's paramount to acknowledge the customary rhythm of short-term corrections that tend to follow each exuberant surge. As glimpsed from the chart, Ethereum's upward momentum encountered a mild rebuff upon gracefully tapping the upper boundary of the wedge, leading to a modest 10% downturn.

The discernible divergence between the price and the RSI indicator further lends credence to the likelihood of a brief retracement preceding the initiation of the next bullish pirouette. In such a choreography, the $2K support zone is anticipated to be Ethereum's next point of arrival in the daily timeframe.

Source: TradingView

Source: TradingView

The chart spanning a 4-hour timeframe

A closer scrutiny of the 4-Hour Chart unveils a scenario where Ethereum's robust upward ballet lost some of its gusto upon encountering a pivotal resistance zone, gracefully embracing the $2.4K price range and the upper echelon of the ascending wedge pattern. On the flip side, the expanded bearish divergence between the price and RSI played a pivotal role in orchestrating a rather substantial rejection.

However, Ethereum has already gracefully pirouetted to a crucial support region, artfully spanning the price range between 0.5 ($2,211) and 0.618 ($2,166) Fibonacci levels, not forgetting the steadfast support level of $2K. A graceful misstep below these critical support levels may well signify a significant downturn in the market ballet.

Despite the prevailing bullish sentiment and the apparent choreography directed by buyers in the current market dynamics, a certain specter of a temporary consolidation correction phase looms in the short term, lending an air of heightened volatility to the stage.

Source: TradingView

Source: TradingView

Segueing to On-chain Analysis

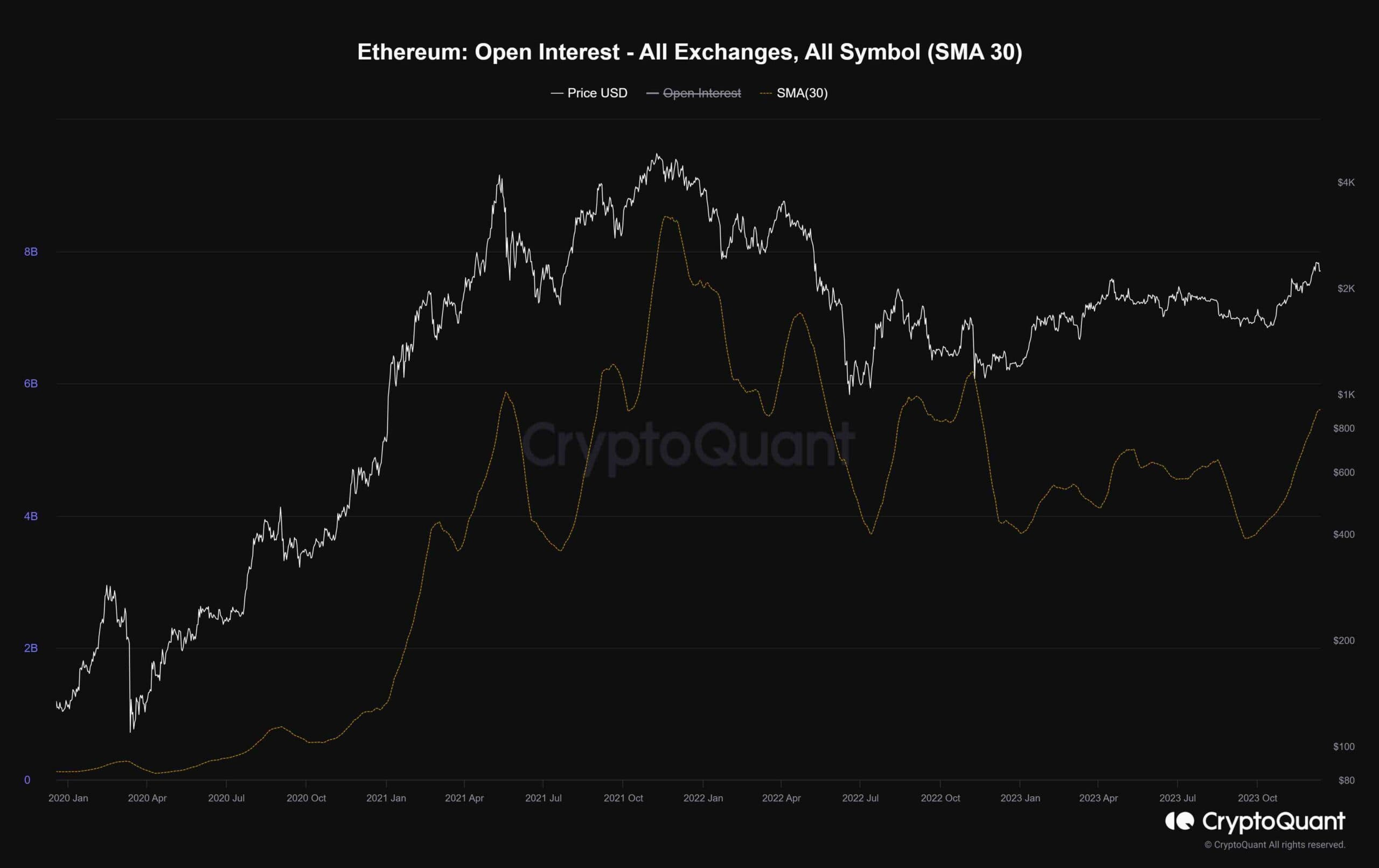

Ethereum's price has recently executed an impressive leap, reclaiming the $2.1K price range, evoking hopeful anticipation among market participants of the grand commencement of a new long-term bull market. Consequently, a meticulous examination of the sentiment in the futures market emerges as a revealing tableau that can offer valuable insights into Ethereum's overarching prospects.

The visual symphony depicted in this chart showcases Ethereum's open interest, a metric akin to the rhythmic pulse of the number of open perpetual futures contracts on a daily basis. Traditionally, higher values indicate an uptick in volatility and the potential for bearish reversals, while lower values suggest a more measured and harmonious trend. As the chart elegantly illustrates, a gradual crescendo in the Open Interest metric often accompanies bullish market crescendos. However, should this symphony reach a crescendo of elevated levels, it could serve as an ominous prelude to a potential major market reversal.

The open interest has been on an upward cadence but has yet to reach the soaring heights observed during the all-time highs. Consequently, while corrections are always part of the choreography, the futures market is still gracefully pirouetting away from the brink of overheating. The ongoing bullish ballet, gracefully supported by moderate levels of open interest, is poised to waltz on the stage in the weeks to come. Remaining attuned to this melodic metric will be crucial for sensing potential shifts in market sentiment and adapting strategies with the fluidity of a seasoned dancer.

Source: CryptoQuant

Source: CryptoQuant

Read more about: Ripple's Crypto Conundrum: Chart Insights

Trending

Press Releases

Deep Dives