Deciphering the Cryptocurrency Conundrum: A Comprehensive Analysis

The bullish momentum that previously drove Bitcoin (BTC) prices down to $34,503, resulting in a remarkable 27.9% "Uptober" gain, appears to be losing steam on November 2nd, as BTC experienced a 2% decline in intraday trading. Despite the positive response to the Federal Reserve's decision on November 1st to pause interest rate hikes, there are growing concerns about the overheated state of the Bitcoin market, particularly in the realm of BTC derivatives.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Long positions in Bitcoin were closed

As we know, the cryptocurrency market can be highly volatile, and this recent dip in BTC prices suggests a possible shift in investor sentiment.

Market sentiment is often influenced by a combination of factors, including economic indicators, global events, and even social media chatter. It's important to keep an eye on these variables to better understand how they might impact the market in the coming weeks.

The recent contraction in Bitcoin's price hasn't raised alarms for all analysts; some believe that it might be the beginning of a new bullish trend. However, predicting the trajectory of cryptocurrencies remains a challenging task, as it's subject to various market dynamics, investor psychology, and regulatory developments.

Now, let's delve into the factors that are currently affecting the price of Bitcoin.

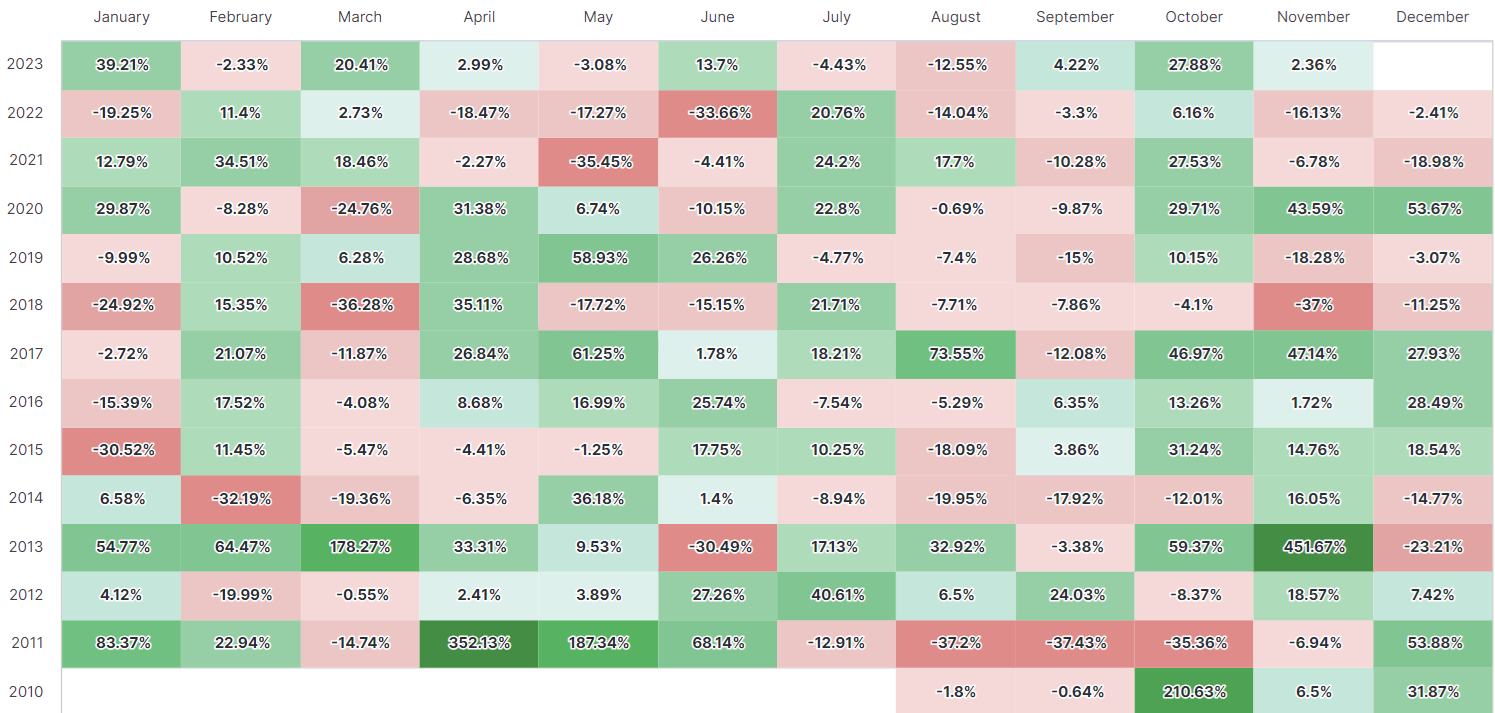

Bitcoin price monthly returns. Source: Newhedge

Bitcoin price monthly returns. Source: Newhedge

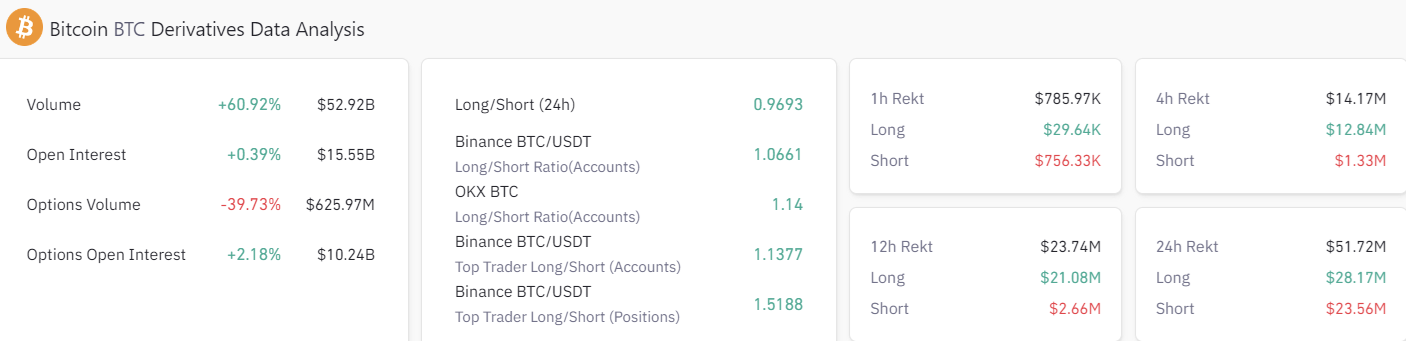

Liquidation of Bitcoin long positions is an essential factor to consider. While short traders' liquidation contributed to the surge in Bitcoin's price last month, the current trend is different. On November 2nd alone, Bitcoin long liquidations spiked to over $21.1 million within a 12-hour period, with a total of more than $28.2 million liquidated in the preceding 24 hours. The intricate relationship between long and short positions reflects the tug-of-war within the cryptocurrency market.

Bitcoin derivatives overview. Source: Coinglass

Bitcoin derivatives overview. Source: Coinglass

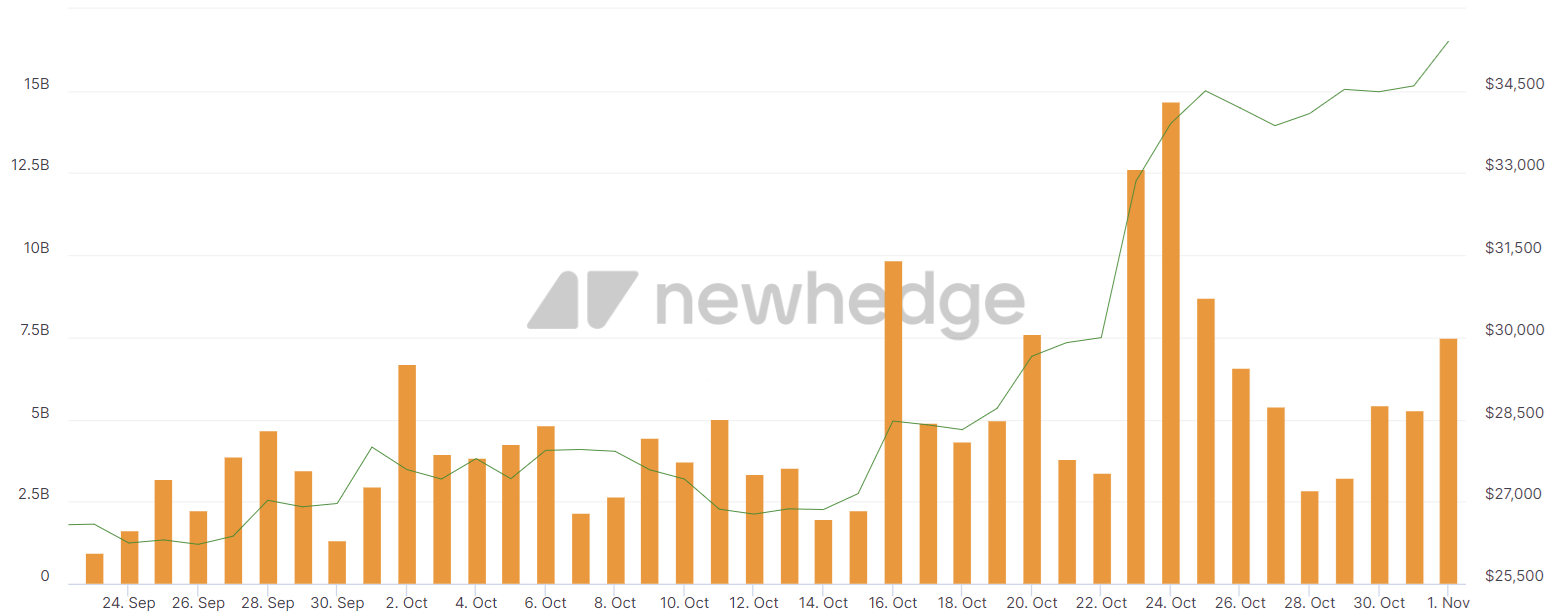

When BTC long positions are liquidated without corresponding buying pressure, it has a negative impact on the Bitcoin price. The trading volumes for Bitcoin have declined by over $7 billion from the year-to-date high set on October 24th, which was $14.7 billion. Such shifts in trading volumes could be an indication of changing investor sentiment, and they're essential to consider in our analysis.

Bitcoin trading volume. Source: Newhedge

Bitcoin trading volume. Source: Newhedge

The lack of consistent liquidity and trading volume has led some analysts to question the sustainability of the current Bitcoin price rally. This volatility can be attributed to the relatively nascent nature of the cryptocurrency market, which is still evolving and maturing. It's not uncommon to witness fluctuations, but these changes can test the nerves of even the most seasoned investors.

Futures market signals and record profits:

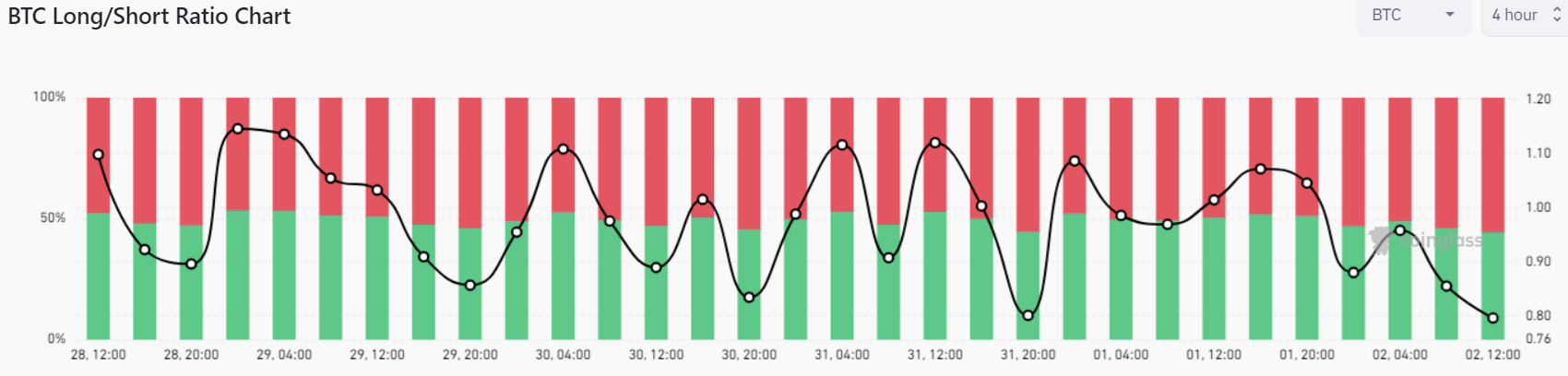

The futures market indicates that more than 55% of traders are holding short positions on Bitcoin, suggesting a potential pullback. However, it's important to remember that the futures market is just one piece of the puzzle. It reflects speculative positions taken by traders and may not always align with the underlying market sentiment.

Bitcoin long versus short ratio. Source: Coinglass

Bitcoin long versus short ratio. Source: Coinglass

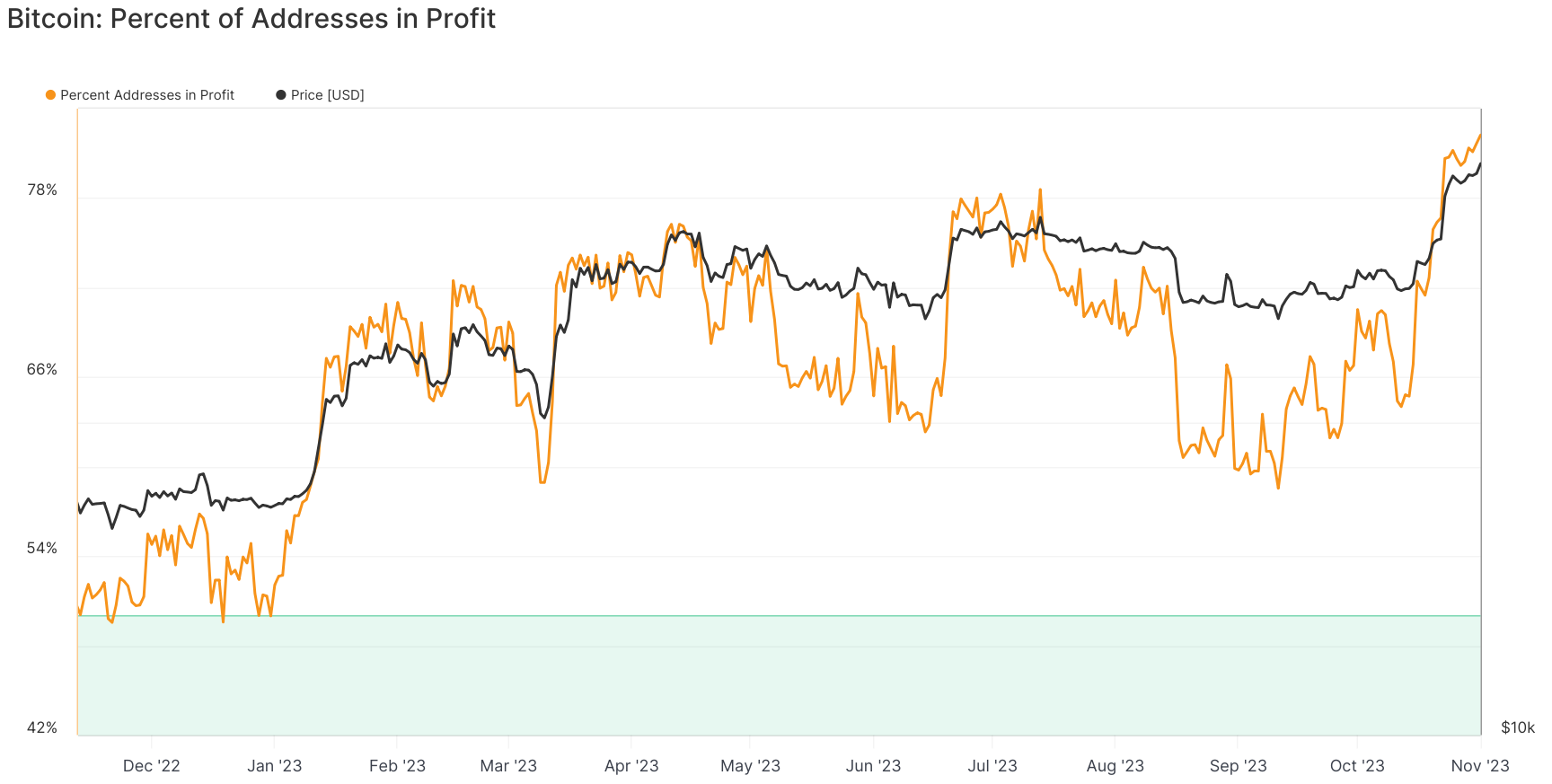

An unprecedented number of Bitcoin wallets are currently showing a positive return

Despite the setback in Bitcoin's price on November 2nd, a significant percentage of wallets are currently in profit. Over 81% of both short-term and long-term holders are currently enjoying profits. This reflects the resilience of long-term investors who continue to hold their positions, even in the face of short-term market fluctuations.

Bitcoin addresses in profit. Source: Glassnode

Bitcoin addresses in profit. Source: Glassnode

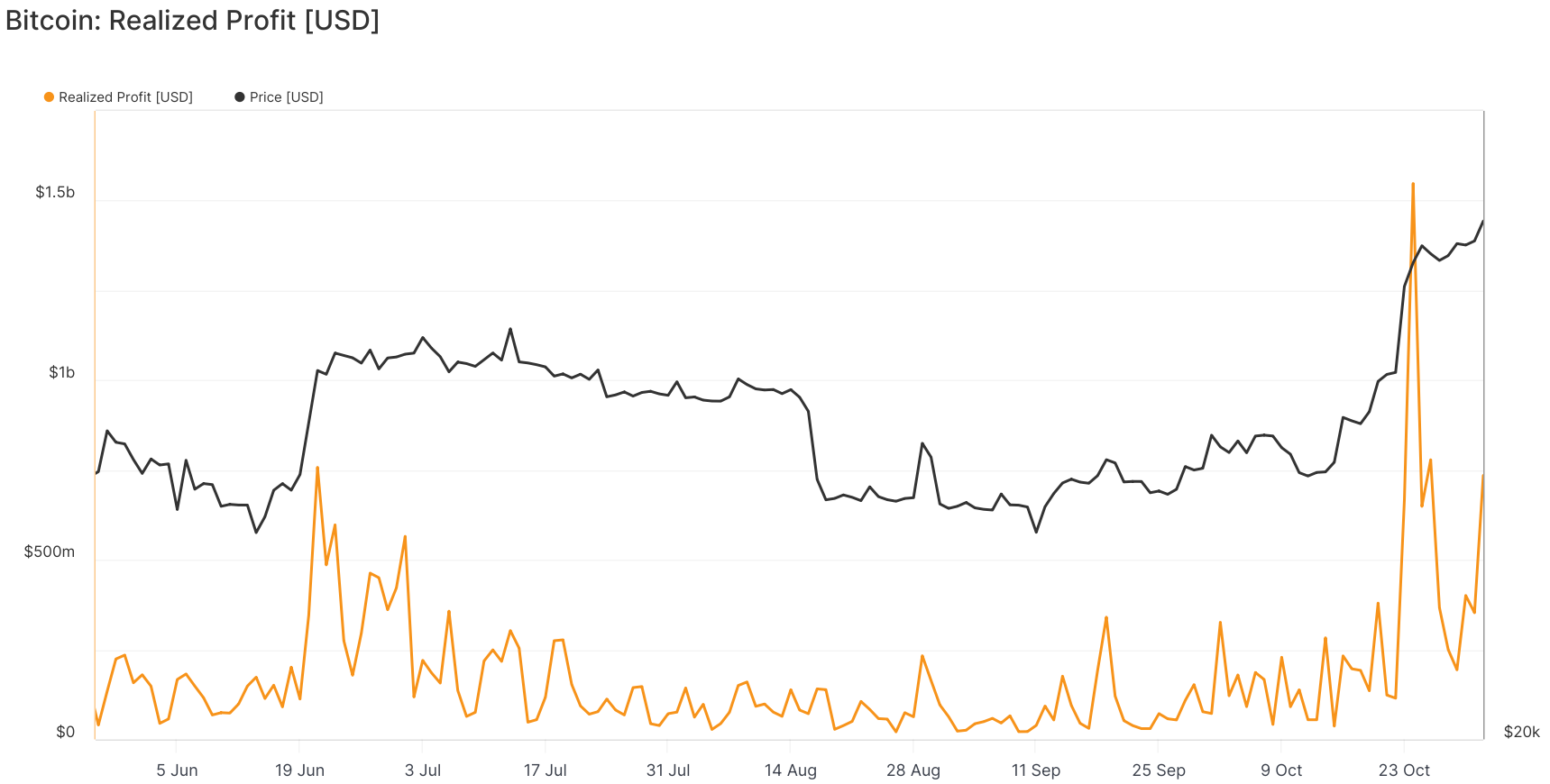

While profit-taking in October was supported by increased trading volume, the decrease in trading volume, combined with the high number of investors in profit, may contribute to a further decline in Bitcoin's price if more traders decide to realize their profits. Profit-taking is a common strategy in volatile markets, and it's something to watch closely in the coming days.

Bitcoin realized profit. Source: Glassnode

Bitcoin realized profit. Source: Glassnode

Spot Bitcoin ETF applications are in focus

Short-term uncertainties in the crypto market haven't altered the long-term perspective of institutional investors. It's worth noting that institutional interest in cryptocurrencies continues to grow, despite regulatory challenges. This institutional involvement adds a layer of legitimacy to the market, and their decisions can have a significant impact on market dynamics.

Despite the urgency of major financial firms, the SEC seems likely to continue delaying decisions on approving Bitcoin ETFs until 2024. Regulatory considerations are crucial for the cryptocurrency market's evolution, and they introduce a level of uncertainty. It's essential to monitor regulatory developments as they unfold.

Assessing the relationship between short-term challenges and long-term gains in the crypto market

Bitcoin's price remains closely tied to macroeconomic events, and the ongoing conflict between Israel and Hamas, regulatory actions, and interest rate hikes are expected to continue influencing BTC's price. It's a reminder that the cryptocurrency market is not isolated from the broader global landscape. Geopolitical events and policy decisions can send ripples through the market.

Despite Federal Reserve Chairman Jerome Powell's decision to pause interest rate increases, Bitcoin's price didn't immediately respond positively. This pause has led some analysts to believe that Bitcoin's price could potentially surpass $35,000 by Christmas. Market speculation about future price movements often adds an element of excitement and anticipation to the cryptocurrency space.

In the long term, market participants still anticipate a recovery in Bitcoin's price, especially as more financial institutions appear to be embracing BTC. This long-term perspective is rooted in the belief that cryptocurrencies have the potential to transform the financial landscape. However, it's essential to maintain a balanced outlook, considering both short-term challenges and long-term possibilities in this ever-evolving market.

Read more about: Blockchain Breakdown: Bitcoin's Rollercoaster Ride and the Road Ahead

Trending

Press Releases

Deep Dives