- Home

- Cryptocurrency

- DAO Governance and Staking Pools: Vitalik's Insights

DAO Governance and Staking Pools: Vitalik's Insights

Vitalik Buterin, a luminary in the Ethereum ecosystem and one of its founding members, has raised poignant concerns about the potential consolidation of power within decentralized autonomous organizations (DAOs) regarding the selection of node operators within liquidity staking pools.

In a thought-provoking and extensive blog post published on the eve of September 30, Buterin sounded a clarion call about the dangers that could lurk within the burgeoning trend of staking pools embracing the DAO approach to govern node operators. These operators hold a crucial responsibility in managing the financial assets of the pool, making their governance critical.

Buterin meticulously laid out a scenario where a solitary staking token gains an overwhelming influence within the DAO framework. This dominance, he argued, could potentially place a vulnerable governance mechanism at the helm, effectively controlling a substantial portion of Ethereum validators, thereby creating a precarious situation.

To illustrate this point, Buterin chose the staking protocol Lido as a case in point. Lido's ticker symbol, LDO, was observed to be trading at $1.69 at the time of his analysis. Lido's DAO, he explained, employs a mechanism that bestows special privileges, namely whitelisting, to select node operators. However, Buterin was quick to highlight the need for a more robust defense strategy, cautioning that solely depending on such measures might be akin to building a castle on shifting sands.

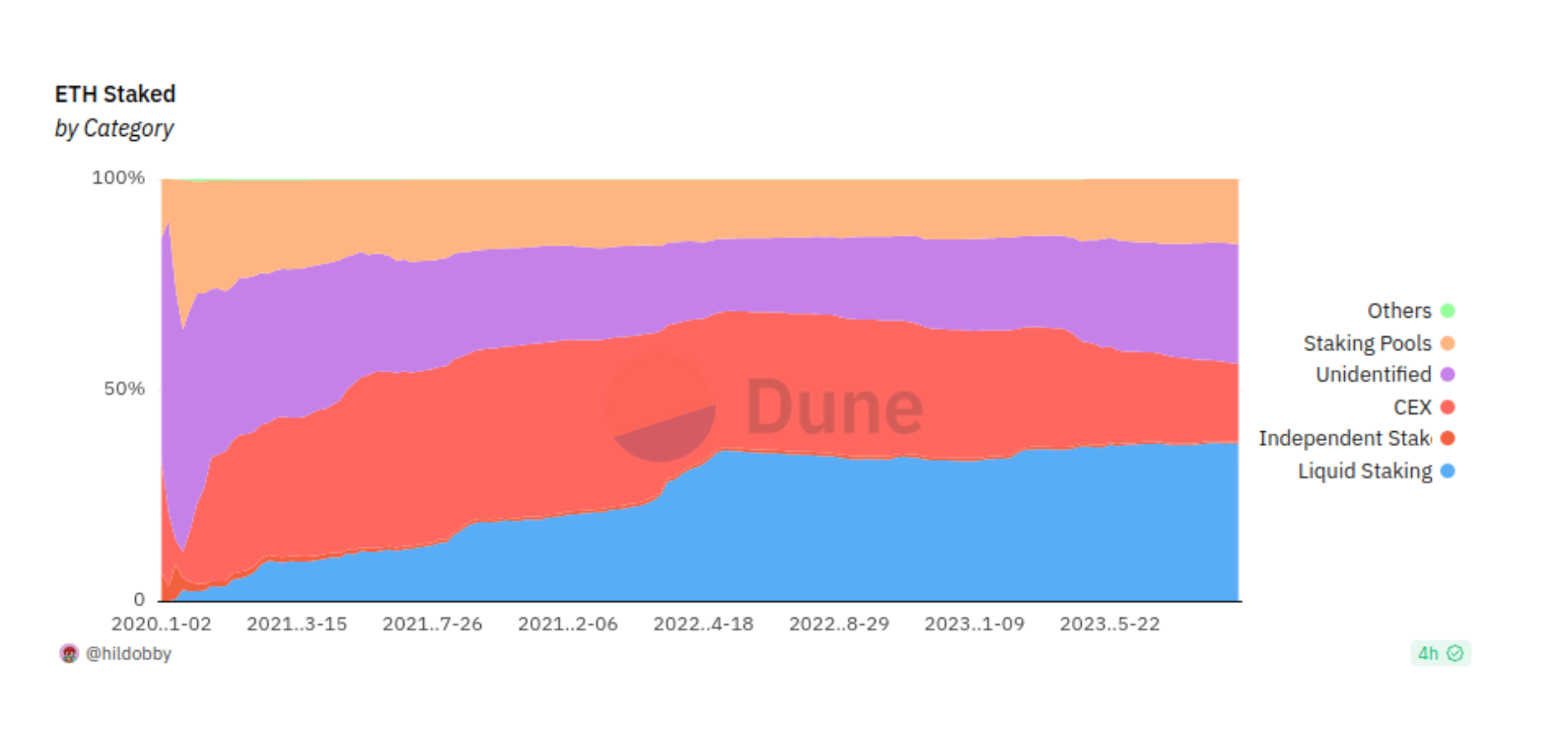

ETH staked by category chart. Source: Vitalik Buterin

ETH staked by category chart. Source: Vitalik Buterin

Expanding on this theme, Buterin delved into the intriguing workings of Rocket Pool, a model where aspiring node operators can gain entry by making an 8 Ether (ETH) deposit, valuing at $1,679 at that particular juncture or approximately $13,406 in terms of fiat currency. However, he astutely pointed out the inherent risks in this seemingly open and accessible approach. In no uncertain terms, he stated that this strategy could inadvertently open doors for attackers to potentially orchestrate a 51% attack on the network, transferring a significant portion of the ensuing costs onto unsuspecting users.

In the spirit of offering constructive solutions, Buterin envisioned a path to mitigating these risks by advocating for ecosystem participants to diversify their engagements and rely on a multitude of liquid staking providers. Such a diversification, he opined, would act as a bulwark against the emergence of any excessively dominant provider, thus curbing the systemic risk that could follow. Nonetheless, Buterin remained cautious about the long-term sustainability of relying heavily on moralistic pressure as a problem-solving tool, foreseeing potential challenges in this approach down the line.

Read more: Crypto Transparency Act

Trending

Press Releases

Deep Dives