- Home

- Latest News

- CryptoQuant Insights: Unveiling the Post-Bitcoin ETF Era – Navigating the 'Sell the News' Surge

CryptoQuant Insights: Unveiling the Post-Bitcoin ETF Era – Navigating the 'Sell the News' Surge

Bitcoin faces a potential significant decline, with projections pointing towards a possible plunge to $32,000 in the event of a spot ETF approval, according to insights provided by CryptoQuant, a prominent data provider in the cryptocurrency space. The company's analysis suggests that the present unrealized profits of traders have reached a historical threshold that typically precedes a corrective downturn, painting the approval scenario as a potential "sell the news" event.

The concept of "sell the news" is a well-known phenomenon in financial markets. It describes a situation where asset prices, leverage, and market sentiment surge in anticipation of a positive event, only to sharply decline after the event's occurrence. This trend arises as experienced traders take advantage of the crowded long trade, strategically trapping leveraged positions and forcing closures or liquidations as prices move unfavorably.

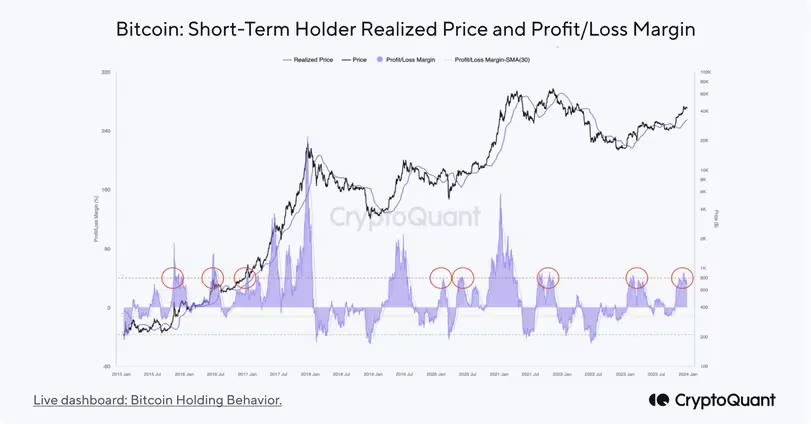

While the approval of an ETF is generally considered a positive development, expected to attract institutional inflows and sustain consistent buying pressure on Bitcoin, CryptoQuant highlights that short-term Bitcoin holders are currently observing high unrealized profit margins of approximately 30%, historically signaling an impending correction.

Capriole Investments underscores the importance of adopting a "conservative portfolio management" approach leading up to a potential spot ETF approval. With Bitcoin having surged over 60% since the initiation of ETF speculation a few months ago, the investment firm cautions against increased volatility in the near future. The risk associated with long Bitcoin positions is deemed significantly higher compared to previous weeks, Capriole wrote in a blog post.

Examining Bitcoin's historical patterns reveals the recurrence of "sell the news" events. In 2017, Bitcoin reached its pinnacle at $20,000 following the listing of BTC futures on the CME. Similarly, in 2021, after Coinbase's IPO, the cryptocurrency achieved a remarkable high of $65,000 before undergoing a subsequent decline. Presently, Bitcoin is valued at $42,450, marking a substantial increase from its starting value of $16,000 for the year. Daily trading volume remains consistent at $80 billion, as reported by CoinMarketCap.

Read More: Leadership Shift at Grayscale: Barry Silbert Steps Down as Chairman, Mark Shifke Set to Assume Role

Trending

Press Releases

Deep Dives