CryptoLend Pro

Coinbase, the prominent cryptocurrency exchange, has recently unveiled a new crypto lending service aimed squarely at institutional investors operating within the vast and dynamic landscape of the United States. This strategic move appears to be a calculated response to the tumultuous and ever-evolving conditions that have unfolded within the cryptocurrency lending market, which has seen its fair share of ups and downs.

In a noteworthy development, Coinbase has taken the bold step of introducing an advanced cryptocurrency lending platform, specifically tailored to meet the unique needs and demands of institutional investors within the United States. This new addition seamlessly integrates into their extensive array of services, including Coinbase Prime, and was officially made available starting from the 6th of September.

In the words of a Coinbase representative, the company has embarked on a journey to offer a digital asset lending program exclusively for its institutional Prime clients. This program, they highlight, provides institutions with the flexibility to lend their digital assets to Coinbase under standardized terms, all within a carefully structured framework that qualifies for the Regulation D exemption - a pivotal aspect of this initiative.

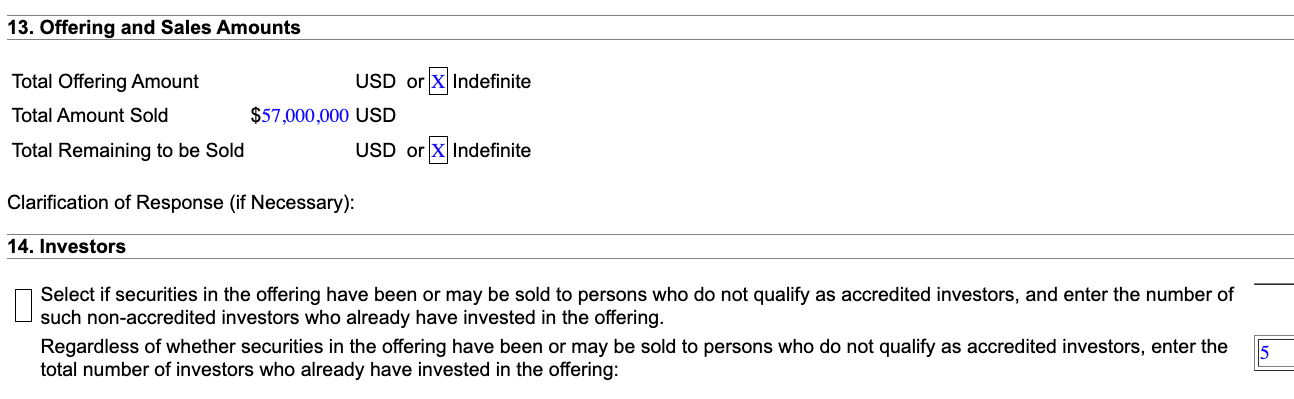

Intriguingly, recent submissions made to the U.S. Securities and Exchange Commission unveil that Coinbase has already garnered a substantial sum of $57 million in investments from its loyal customer base since the inception of the lending program on the 28th of August. By the 1st of September, a noteworthy quintet of investors had eagerly joined the ranks.

Information sourced from a filing with the U.S. Securities and Exchange Commission by Coinbase Credit. Source: Filed Documents with the SEC by Coinbase

Information sourced from a filing with the U.S. Securities and Exchange Commission by Coinbase Credit. Source: Filed Documents with the SEC by Coinbase

This strategic move dovetails neatly with Coinbase's overarching mission to usher in a new era in financial systems. This mission is grounded in the idea of reshaping an archaic financial infrastructure that has persisted for over a century. They seek to leverage the power of cryptocurrency to empower individuals by providing them with greater economic freedom and unprecedented opportunities. A spokesperson for Coinbase underscored this commitment and vision.

The unveiling of this latest crypto lending product by Coinbase is particularly significant, especially in light of the suspension of new loan issuances on Coinbase Borrow in May 2023. It's worth noting that the Borrow program was carefully designed to allow users to access substantial sums, up to $1 million in Bitcoin (BTC), while providing $25,700 as collateral. Interestingly, this freshly introduced institutional program is overseen and managed by Coinbase Credit, which shares operational synergy with the Coinbase Borrow entity.

Notably, these developments come on the heels of the U.S. Securities and Exchange Commission (SEC) levying charges against Coinbase. The SEC alleged that Coinbase had engaged in the offering and sale of unregistered securities in connection with its crypto staking services, which permitted users to earn yields through their participation. Coinbase staunchly defended itself, vehemently contesting the SEC's allegations. Consequently, Coinbase found itself in the position of temporarily halting its staking program in four states - namely, California, New Jersey, South Carolina, and Wisconsin - while the legal proceedings unfolded.

The crypto lending industry has experienced its fair share of turmoil, notably during the preceding year, when major industry players such as BlockFi, Celsius, and Genesis Global encountered financial woes, primarily attributable to a lack of liquidity stemming from the bear market of 2022. Many fervent crypto enthusiasts argue that this sector must learn valuable lessons from these unfortunate incidents and proactively address the complex issues associated with short-term assets and liabilities.

Trending

Press Releases

Deep Dives