CryptoFlow Dominates as Grayscale's Loss Narrows to $95M: Bitcoin ETF Surges

The recent introduction of spot bitcoin exchange-traded funds (ETFs) has made a lasting impact on the market, with Bitwise's bitcoin ETF (BITB) emerging as the leader in terms of attracting funds. Preliminary data indicates that BITB experienced the most significant influx of funds among the newly issued products that began trading on Thursday. Following closely behind was Fidelity's fund (FBTC), as revealed in a BitMex Research post citing Bloomberg data.

Spot ETF Day 1 Flows - UPDATE

— BitMEX Research (@BitMEXResearch) January 12, 2024

Bitwise and Ark numbers now confirmed by Bloomberg. Bitwise still in the lead!

The Bitcoin Dev supporting provider is leading!

$720m of reported day 1 inflow

No GBTC data yet pic.twitter.com/kMJiiwrI7S

Recognizing the potential incompleteness of the data, analysts underscore that most issuers only provided preliminary information about inflows until the market opened on Friday. Eric Balchunas, an ETF analyst at Bloomberg Intelligence, emphasized in a post that obtaining comprehensive data might face further delays until Friday evening. James Butterfill, Head of Research at CoinShares, suggested that the full picture might not become clear until early next week.

$IBIT inflow tame at $111m, but the data is delayed, rest of the $1b in volume will show up in tonight's flow #. Also check out the % prem at 16bps. Fidelity was -4bps. Rest tight too. That's great, this was a worry of cash creates (wide prems) but APs, mkt makers crushed it. pic.twitter.com/RqtY35pgoq

— Eric Balchunas (@EricBalchunas) January 12, 2024

On the inaugural trading day, BITB attracted an impressive $238 million in net assets, solidifying its position as the leading fund in terms of fund inflows. Fidelity's FBTC closely followed suit with $227 million in net assets. Grayscale's GBTC, which operated as a closed-end fund without allowing redemptions until Thursday, experienced $95 million in outflows, a figure lower than some observers had predicted.

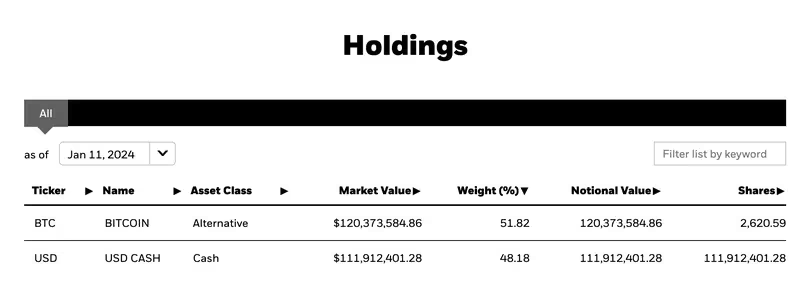

BlackRock's IBIT, highly anticipated in the newly issued ETFs due to the asset manager's influence and size, experienced the third-largest inflow, amounting to $110 million. Despite having the second-highest first-day trading volume among bitcoin ETFs on Thursday, IBIT held $120 million in bitcoin (BTC) and an additional $112 million in cash as of Thursday, according to the fund's website. Balchunas noted that part of Thursday's inflow might be reflected in Friday's data.

Imp note, most of this flow data comes T+0 but cr/rd recording takes time to get into shares out regardless, hence why IBIT could see blob of money tonight. Also, GBTC is T+1 so NONE of the activity from yest will be reflected in flows till Fri at earliest and poss Tue night.

— Eric Balchunas (@EricBalchunas) January 12, 2024

BlackRock's iShares Bitcoin Trust (IBIT): Unveiling Assets as of January 11th

BlackRock's iShares Bitcoin Trust (IBIT): Unveiling Assets as of January 11th

Spot bitcoin ETFs collectively reported a massive first day in trading volume, reaching a combined daily volume of $4.6 billion. Grayscale's GBTC and BlackRock's IBIT led the pack, as highlighted by data from Bloomberg Intelligence analyst James Seyffart. Eric Balchunas, ETF analyst at Bloomberg Intelligence, praised this achievement, referring to it as the "biggest Day One splash in ETF history."

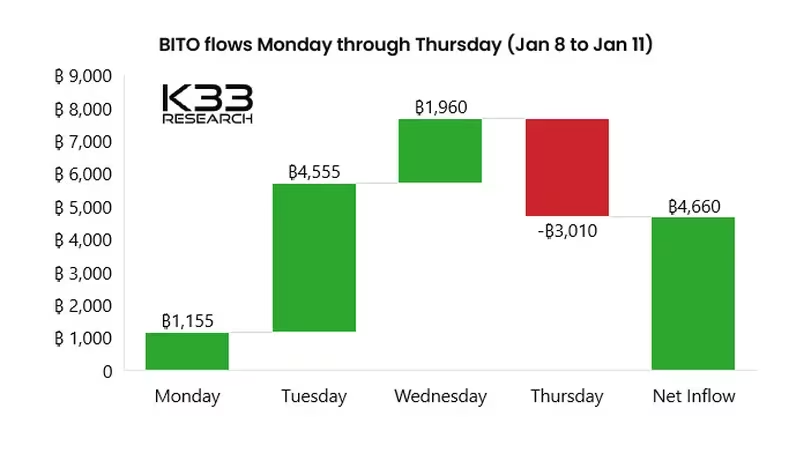

In comparison, ProShares' futures-based bitcoin ETF (BITO), launched in October 2021 near the peak of the crypto bull market, attracted $570 million in inflows with a $1 billion trading volume on its first day. However, BITO witnessed outflows of 3,000 BTC, roughly equivalent to $140 million, on Thursday. Investors likely redirected some funds to more user-friendly spot-based ETFs, although the fund's assets remained positive throughout the week, as per K33 Research data shared with Bitsday.

BITO Fund Dynamics: Analyzing Flows from January 8 to January 11 with Insights from K33 Research

BITO Fund Dynamics: Analyzing Flows from January 8 to January 11 with Insights from K33 Research

The debut of spot bitcoin ETFs on Thursday marked a significant milestone for the digital asset industry. These ETFs provide exposure to the largest and oldest cryptocurrency in a format more easily accessible through conventional financial channels. This increased accessibility is anticipated to facilitate the entry of mainstream investors into the bitcoin market. Industry observers expect that these products will attract billions of dollars in new investments into bitcoin over time. Standard Chartered analysts have forecasted that spot ETFs may see inflows ranging from $50 billion to $100 billion this year.

Read More: Cryptocurrency Market Surges as SEC Greenlights Spot Bitcoin ETFs: Bitcoin Soars Beyond $47K, Ether and Grayscale's GBTC Experience Significant Gains

Trending

Press Releases

Deep Dives