CryptoCurrents Chronicle: Navigating the Bitcoin Surge and ETF Waves

Bitcoin's price, represented by the ticker BTC, has experienced a decline to $36,995 after a recent low of $34,500 on November 14, followed by a recovery to an intra-day peak of $37,650. This surge is attributed to the renewed interest in a Bitcoin exchange-traded fund (ETF), generating substantial inflows as available liquid supply diminishes, propelling crypto market prices upward.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

The anticipated approval of a spot BTC ETF is enhancing the overall confidence in the market

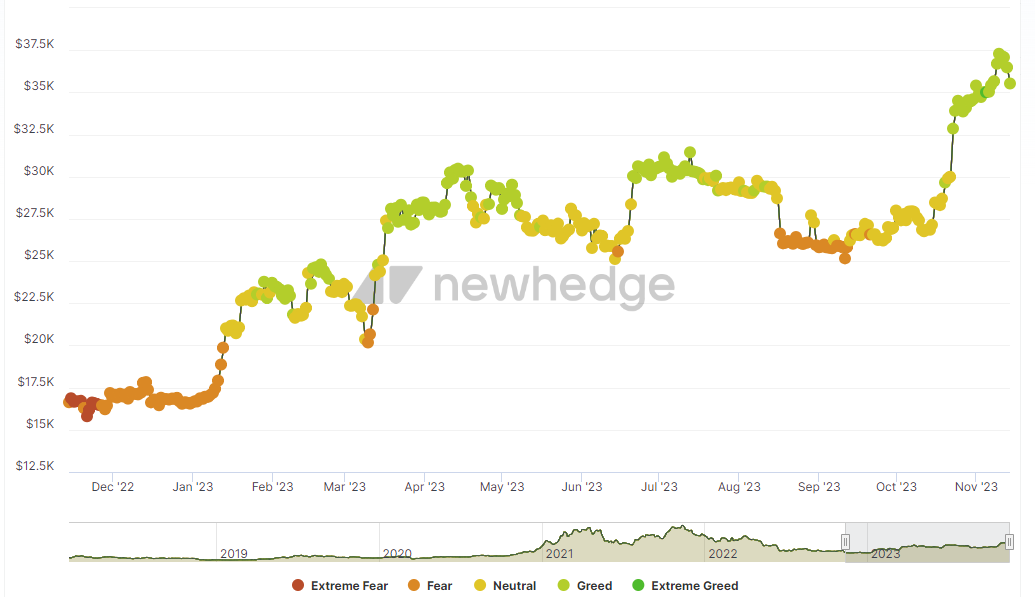

Despite prevailing macro challenges, Bitcoin's price shows resilience, boasting a remarkable 126% year-to-date gain. Options market data indicates a trend among traders favoring the $40,000 level. Over the past two weeks, market sentiment, as gauged by the Crypto Fear and Greed index, has shifted firmly into the "Greed" category.

Fear and Greed Index. Source: Newhedge

Fear and Greed Index. Source: Newhedge

In mid-October, a flurry of amendments for spot Bitcoin ETFs occurred, with the Securities and Exchange Commission (SEC) opening the window for approval on November 9.

New Research note from me today. We still believe 90% chance by Jan 10 for spot #Bitcoin ETF approvals. But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur pic.twitter.com/u6dBva1ytD

— James Seyffart (@JSeyff) November 8, 2023

While major players like BlackRock, Fidelity, ARK Invest, and 21Shares have sought approval, the SEC has historically rejected such applications. The approval window extends until November 17, with the possibility of an extension until January 10 if the SEC maintains its pattern of delay.

If approved, analysts estimate a potential $600 billion surge in demand, with CryptoQuant analysts foreseeing a $1 trillion boost in Bitcoin's market capitalization. Galaxy Digital predicts a substantial 74% price increase in the year following a spot BTC ETF launch.

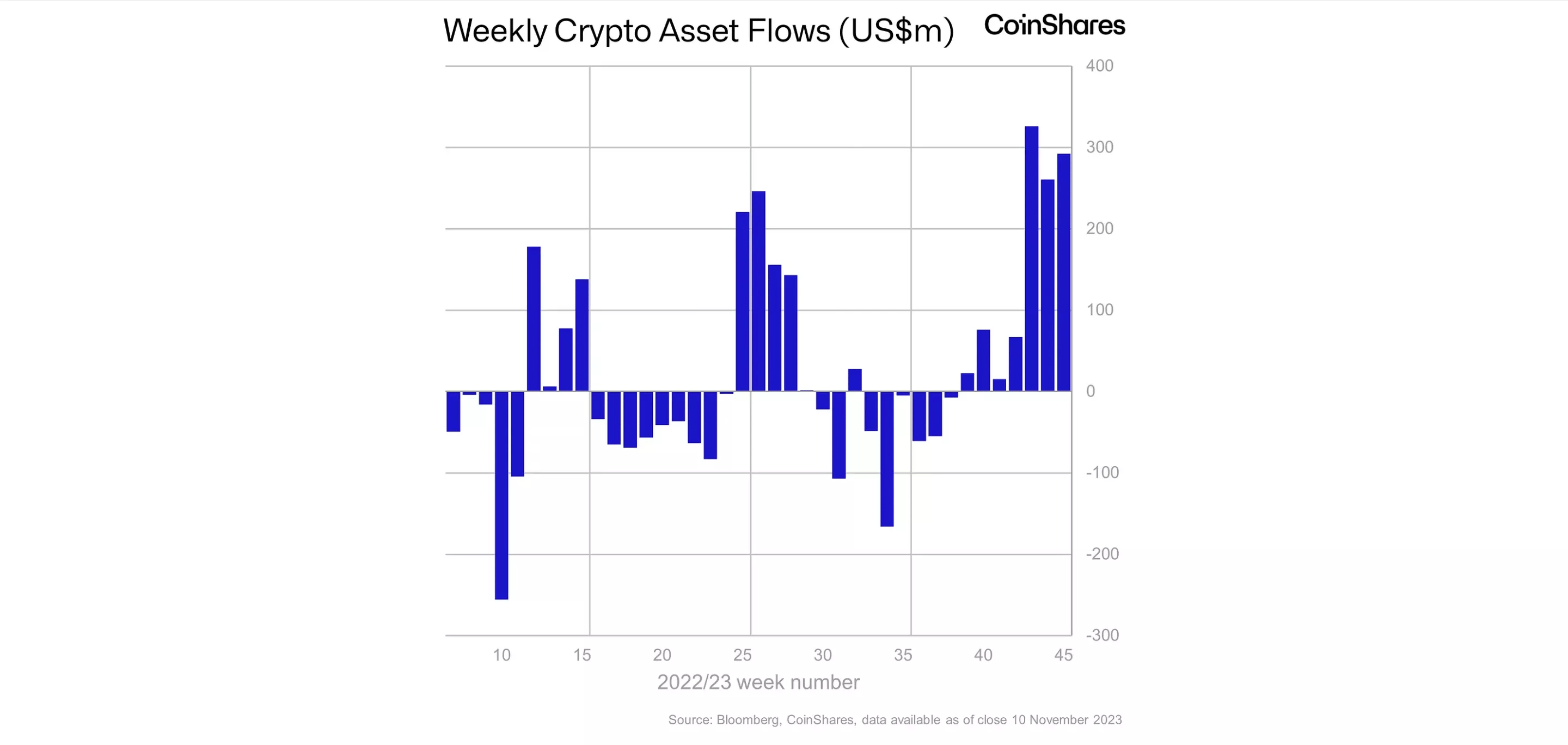

Over $1 billion has been invested by institutional players in the cryptocurrency market

Institutional investors have not waited for ETF approval to enter the market, injecting over $1 billion into crypto assets over the past year, with more than $240 million specifically directed towards Bitcoin.

Crypto asset institutional investor inflow. Source: CoinShares Institutional investors now constitute 19.8% of Bitcoin trading volume.

Crypto asset institutional investor inflow. Source: CoinShares Institutional investors now constitute 19.8% of Bitcoin trading volume.

???? Digital asset investment products saw inflows totalling US$293m last week.

— CoinShares (@CoinSharesCo) November 13, 2023

???? Year to Date inflows: US$1.14bn (3rd highest yearly inflows on record)

– #Bitcoin –

???? $BTC: US$240m innflows (year to date inflows: US$1.08bn)

???? Short Bitcoin: US$7m outflows

???? Bitcoin ETP… pic.twitter.com/6UK1aDtF96

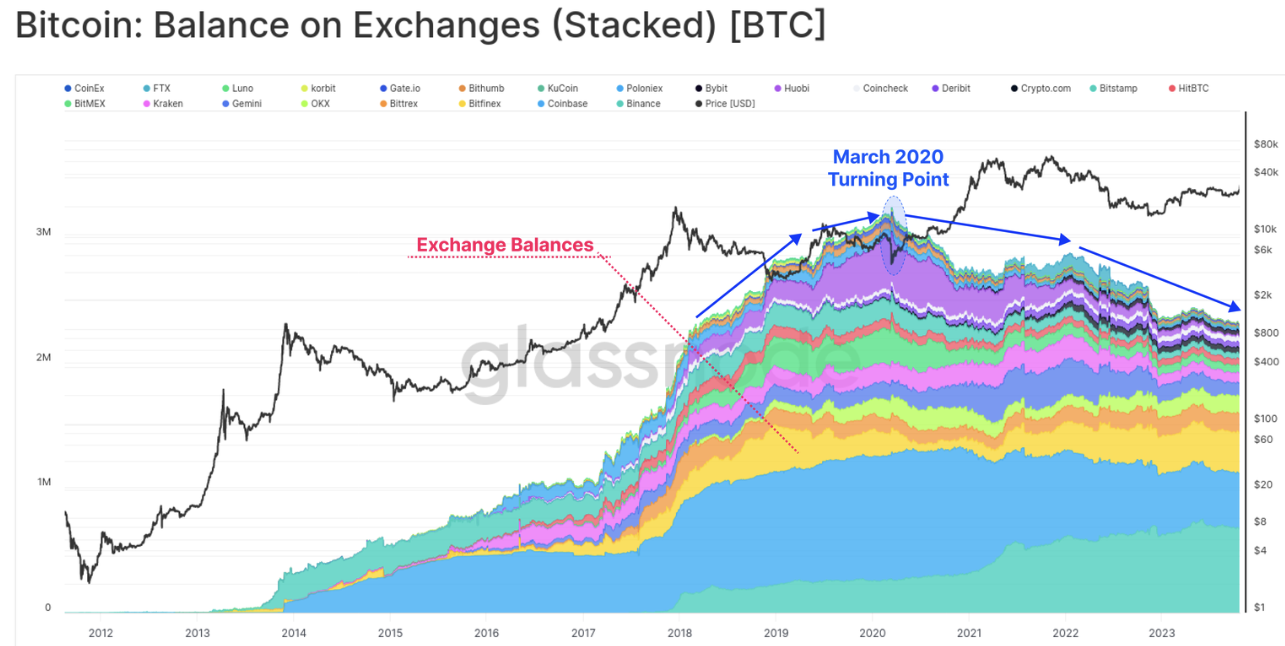

The availability of Bitcoin is contracting

As institutional interest grows, the available supply of Bitcoin on exchanges is diminishing. Despite price gains, the BTC supply on exchanges remains below the May 3, 2023 peak, with over 200,000 Bitcoin withdrawn since then.

BTC balance on exchanges. Source: Glassnode

BTC balance on exchanges. Source: Glassnode

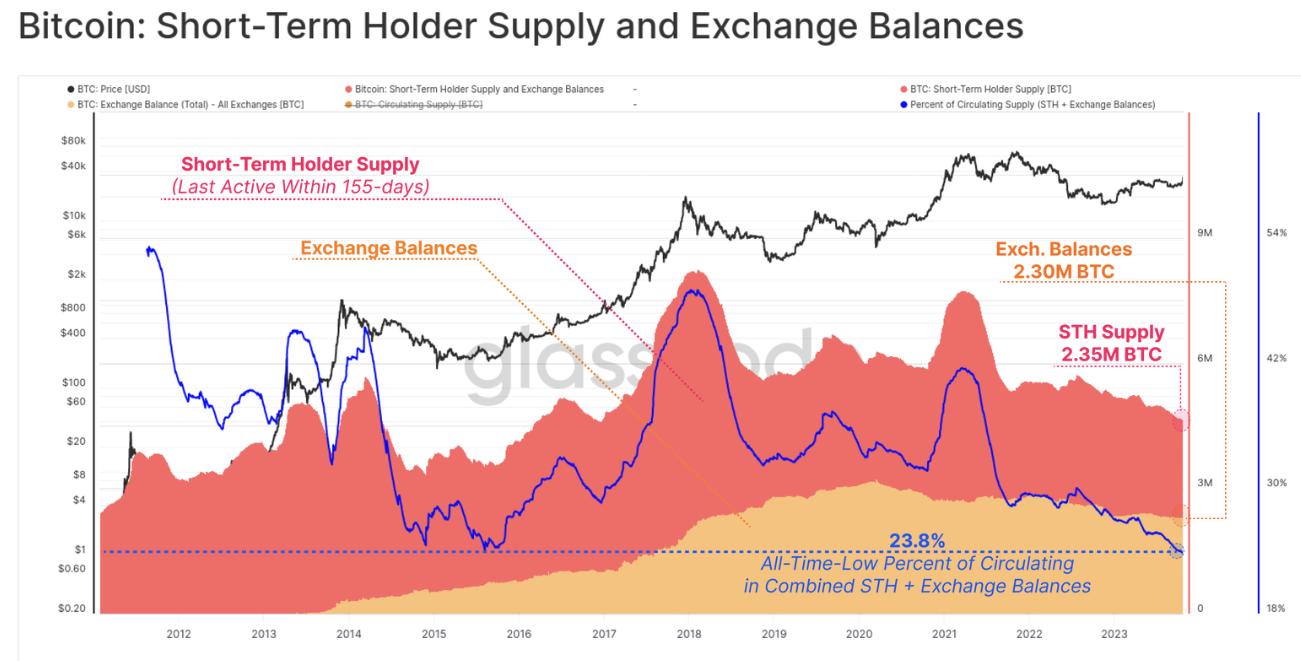

This trend, coupled with long-term holders acquiring 92% of newly minted BTC on November 7, signals a historically low available supply, constituting only 23.8% of the circulating supply. Analysts at Glassnode emphasize the significance of combining short-term holder supply and exchange balances to assess available Bitcoin supply.

BTC available supply. Source: Glassnode

BTC available supply. Source: Glassnode

Read more about: Strategic Tide: Grayscale's Cryptocurrency Chess

Trending

Press Releases

Deep Dives