- Home

- Cryptocurrency

- Cryptocurrency Market Bleeds: Bitcoin, Ether, and Major Altcoins Plummet in Deep Red

Cryptocurrency Market Bleeds: Bitcoin, Ether, and Major Altcoins Plummet in Deep Red

Bitcoin and Ether recently found themselves at the forefront of a significant liquidation event, marking a tumultuous period in the cryptocurrency market. Over $335 million worth of positions were liquidated within the last 12 hours, painting a picture of heightened volatility as the Asia trading day commenced.

During this challenging start, Bitcoin witnessed a 5% decline over 24 hours, dropping to $41,300 before recovering to $42,000. Ether followed a similar trajectory, experiencing a dip to $2,170 and then bouncing back to $2,239. Solana's SOL also faced a momentary setback, plunging to $66 but showing resilience by climbing back to $70. Notably, a substantial portion of these losses occurred in the final 90 minutes of the reported period.

Greta Yuan, Head of Research at VDX, a regulated exchange in Hong Kong, linked the modest correction in the market to positive nonfarm payroll data and lower unemployment figures. Yuan pointed out that the robust labor market slightly tempered expectations of an early rate cut by the Federal Reserve, leading to a drop in gold prices and a rally in the US dollar index.

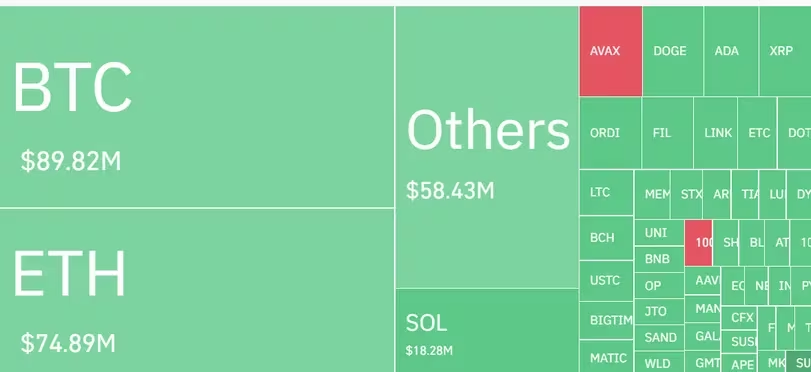

Data from Coinglass indicated that the liquidation events surpassed $335 million in the past 12 hours, with $300 million attributed to the liquidation of long positions. Bitcoin and Ether took the lead in the liquidation heatmap, with $89 million and $74 million liquidated, respectively.

Source: Coinglass

Source: Coinglass

Lucy Hu, Senior Analyst at Metalpha, suggested that the recent market correction reflects a logical profit-taking process. Traders may have achieved their price targets for the year, particularly given Bitcoin's impressive 70% rally since October. Hu emphasized the importance of monitoring the Consumer Price Index (CPI) and the upcoming U.S. Federal Reserve meeting for potential further corrections.

On-chain analyst Willy Woo introduced the possibility of a correction in Bitcoin prices down to $39,700.

The #Bitcoin CME Gap at 39.7k...

— Willy Woo (@woonomic) December 7, 2023

By my count 28 out of 30 gaps have been filled on CME daily candles (93%). The other unfilled gap is pictured in the lower left of this chart also. pic.twitter.com/EyccaJTTkr

This idea is rooted in the concept of the Bitcoin CME Gap at $39,700, where historical patterns suggest that price gaps in the CME futures market tend to be filled. This phenomenon is driven by price disparities at the opening and closing of the CME market, aligning with U.S. trading hours.

Read More: Victory Securities Secures Retail Crypto Trading License in Hong Kong

Trending

Press Releases

Deep Dives