Cryptocurrency Exchange CoinEx: Recovering from Recent Hack

CoinEx, a leading cryptocurrency exchange, is gearing up to reinstate its essential deposit and withdrawal services for its valued users after enduring a sizable setback—a $70 million hack that sent ripples through its operations just over a week ago. The source of this unfortunate incident? Compromised hot wallet private keys, a critical vulnerability that the exchange has since been diligently addressing.

In their earlier communications, CoinEx made it abundantly clear that their primary focus was on fortifying their platform by engineering a robust, state-of-the-art wallet system. This revamp is aimed at enhancing the seamless management of activities across an impressive array of 211 blockchains and 737 tokens—an ambitious portfolio that CoinEx prided itself on even before the disruptive hacking incident unfolded.

In a recent update that brought a glimmer of hope, the exchange made an official announcement regarding the resumption of deposit and withdrawal services for notable cryptocurrencies such as BTC, ETH, USDT, USDC, and various others, effectively starting from September 21. This move, undoubtedly, marks a significant step towards restoring faith and normalcy for their users.

CoinEx will resume deposits and withdrawals with 11 cryptocurrencies.

CoinEx will resume deposits and withdrawals with 11 cryptocurrencies.

In line with this, CoinEx has undertaken a meticulous process of refreshing deposit addresses for the listed tokens while also going the extra mile to generate fresh deposit addresses, assuring users of heightened security and efficiency in their transactions.

Amidst this, the exchange issued a precautionary advisory to its esteemed users, urging them to steer clear of depositing funds into outdated addresses on the platform. A critical caveat, as disregarding this could lead to the unfortunate and irreversible loss of valuable assets—a situation the exchange is keen on averting:

We ensure the new wallet system is stable, and we will gradually resume deposit and withdrawal services for more assets.

Furthermore, CoinEx raised a flag about the potential backlog of pending withdrawals that could be encountered upon the resumption of full-fledged operations. This cautionary note is a testament to their commitment to ensuring a smooth and hassle-free experience for their users during this transitional phase.

In a reassuring move, the exchange emphasized the unwavering implementation of a 100% asset reserve policy—a safeguarding measure meticulously designed to protect users from any looming security threats. This has been reiterated in previous updates, highlighting the priority of safeguarding users' assets and reassuring them that their holdings remained unscathed. The CoinEx User Asset Security Foundation is poised to cover any financial losses, providing an additional layer of security and peace of mind.

As the dust began to settle, CoinEx disclosed the root cause of the security breach—the compromise of private keys for several of their hot wallet addresses. This breach allowed hackers to illicitly withdraw a staggering sum of approximately $70 million in diverse cryptocurrencies. It's important to note that these hot wallets were initially intended as provisional storage for user deposits, withdrawals, and temporary storage, underscoring the critical nature of this breach.

Intriguingly, blockchain analytics company Elliptic established a link between the cyber attack and the notorious North Korean “Lazarus Group,” a revelation that heightened concerns about the far-reaching implications of this incident. Meanwhile, the exchange remained steadfast in its investigative efforts to unmask the identity of the perpetrators, displaying resilience in the face of adversity.

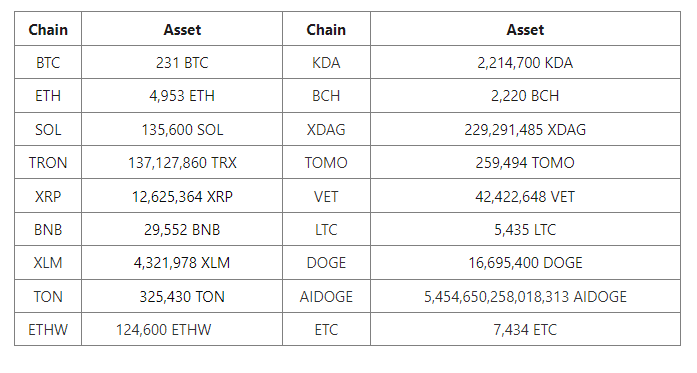

On the 20th of September, CoinEx released a comprehensive breakdown of the assets that had fallen prey to the nefarious activities of the hackers. The staggering haul included 231 BTC ($5.7 million), 4,953 ETH ($8 million), 135,600 SOL ($2.6 million), and a staggering 137 million TRON tokens ($11 million). These stolen assets constituted a substantial portion of the high-value tokens that bore the brunt of this sophisticated breach, leaving the crypto community at large reflecting on the vulnerability of their digital assets in the evolving landscape of cybersecurity.

You might also like: Bitcoin Holds Strong at $26.4K, Despite Potential Sell-Offs Amid Weekly Gains

Trending

Press Releases

Deep Dives