CryptoConvo: SEC and Fidelity's Bitcoin ETF Discourse

The Securities and Exchange Commission (SEC) of the United States recently embarked on a comprehensive dialogue with Fidelity Investments to gain further insights into its groundbreaking application for a spot Bitcoin (BTC) exchange-traded fund (ETF), as per a filing dated December 7. The meeting brought together two esteemed representatives from the Cboe BZX Exchange, a notable contingent of six SEC personnel, and an impressive nine-strong team from Fidelity, with a primary focus on the intricacies surrounding the Wise Origin Bitcoin Trust.

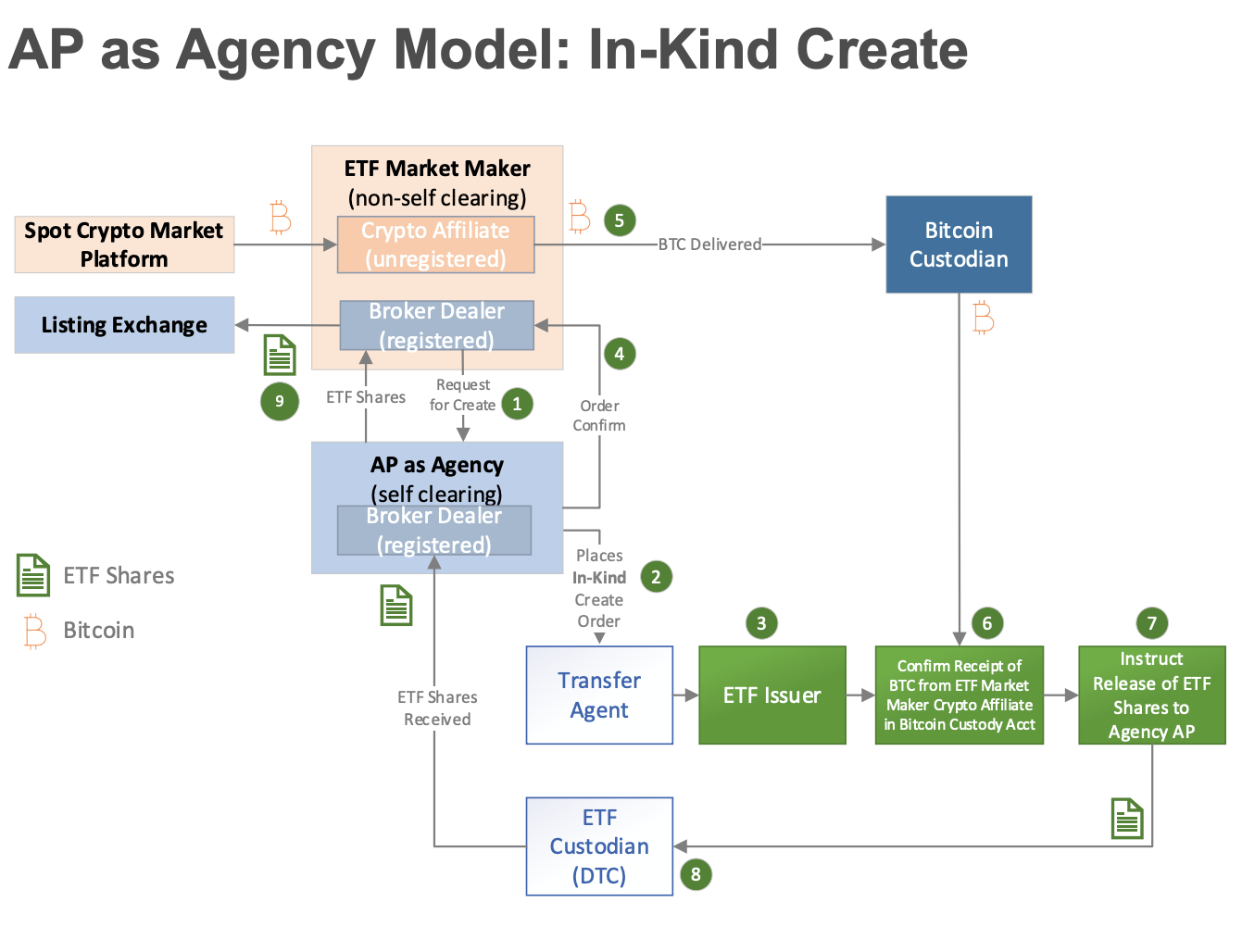

The engaging discourse revolved around the proposed rule modification by Cboe BZX, seeking approval for listing and trading shares of the Wise Origin Bitcoin Trust under the regulatory umbrella of Cboe BZX Rule 14.11(e)(4). Fidelity supplemented the dialogue with an insightful presentation, incorporating captivating PowerPoint slides that artfully illuminated the operational intricacies of the Bitcoin ETF.

AP as agency model graph. Source: SEC

AP as agency model graph. Source: SEC

Within the filing, there was a conspicuous emphasis on the pivotal role of physical creations in augmenting efficiency in arbitrage and hedge activities. In articulating the most effective approach to the discerning U.S. regulator, the filing ardently advocated for the facilitation of physical creation and redemption, underscoring that such measures are not merely desirable but indispensable for elevating trading efficiency and fortifying secondary market pricing for all esteemed participants.

Fidelity's initial foray into the realm of spot Bitcoin ETFs transpired on June 19, a strategic move swiftly following in the footsteps of analogous filings by financial giants such as BlackRock and a cohort of other illustrious asset managers. However, it's worth noting that the SEC had previously, albeit regrettably, rebuffed Fidelity's audacious application for a spot Bitcoin ETF back in the annals of 2022.

Recent developments, like ripples in the vast financial ocean, suggest that the SEC is actively fostering a symbiotic relationship with a multitude of spot Bitcoin ETF applicants. The focus of these interactions is not merely superficial but delves into the very bedrock of their proposals, scrutinizing with meticulous attention those pivotal technical details that orbit around the prospect of U.S. exchanges embracing the listing of shares from such visionary ETFs. Additional insights from memos released by the SEC in the auspicious month of November reveal that the commission also held discreet tête-à-têtes with representatives from the eminent BlackRock and the illustrious Grayscale.

As the financial landscape becomes increasingly permeated with speculative whispers, a pervasive question lingers in the minds of market enthusiasts: When will the auspicious moment arrive for the SEC to extend its coveted approval to a spot Bitcoin ETF? Hashdex, an active participant among the esteemed 13 asset managers vying for this prestigious accolade, cautiously anticipates the unfolding of this historic event by the second quarter of 2024. However, the precise timing of this watershed moment remains shrouded in the enigmatic veil of uncertainty, as attested by Hashdex's U.S. and Europe head of product, Dramane Meite, who eloquently states that the narrative around the spot Bitcoin ETF in 2023 shifted from a mere question of 'if' to a profound contemplation of 'when.'

In a parallel narrative strand, the sagacious Bloomberg ETF analysts, Eric Balchunas and James Seyffart, exude unwavering confidence in predicting that January 10 could potentially emerge as the epochal moment witnessing the simultaneous approval of all spot Bitcoin ETFs. This optimistic projection aligns harmoniously with the ticking clock of the SEC's deadline, poised to either herald the dawn of approval or the somber echo of denial, specifically in response to ARK Invest's application.

You might also like: Crypto Horizons: El Salvador's Soaring Initiatives

Trending

Press Releases

Deep Dives