Crypto Traders Suffer $1B in Liquidations in Sharp Sell-Off for Bitcoin, Ether

In a late Thursday crash, the cryptocurrency markets experienced a significant decline, causing Bitcoin (BTC) to plummet to as low as $25,000 on the Binance crypto exchange.

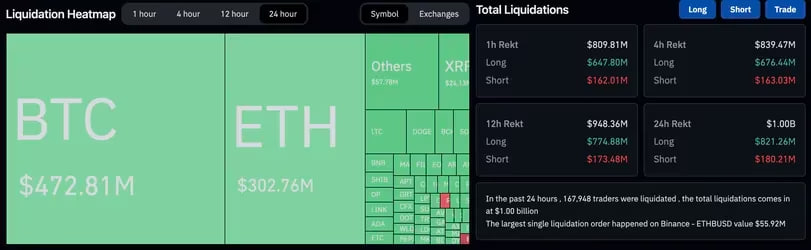

Traders within the cryptocurrency realm faced substantial losses, totaling approximately $1 billion in liquidations over the past 24 hours, according to data from Coinglass. This downturn marked one of the most severe sell-offs of the year, leading to Bitcoin's price sinking to a two-month nadir.

Bitcoin, the pioneer and largest cryptocurrency, saw a 7% drop, settling around $26,900. Earlier in the day, it had dipped close to $25,000, a point it hadn't touched since June.

As the markets plunged, roughly $821 million worth of long positions, reflecting trades betting on price increases, were wiped out during the swift exit period, as indicated by CoinGlass data. Among these, Bitcoin (BTC) traders bore the brunt of the losses, accounting for $472 million in long liquidations, followed by Ethereum (ETH) at $302 million.

The level of Bitcoin liquidations observed on this single day was the most significant since June 2022, as indicated by data from Coinalyze, which coincided with the time when the leading cryptocurrency's price plummeted to $17,000. Liquidations recorded within the past 24 hours (Coinglass)

Liquidations recorded within the past 24 hours (Coinglass)

These liquidations occurred simultaneously with cryptocurrency prices plummeting during the U.S. afternoon hours on Thursday, transforming this month's gradual downtrend into a market turmoil. This turbulence coincided with concerns surrounding weakening foreign currencies, economic uncertainties in China, and bond yields surging to multi-year highs. Major cryptocurrencies such as BTC and ETH experienced nearly double-digit losses, reaching their lowest points since early summer.

Liquidations transpire when an exchange closes a leveraged trading position due to the partial or complete loss of the trader's initial margin investment. This happens when the trader either fails to meet the margin requirements or lacks sufficient funds to maintain the trade open. When asset values plummet, this situation can trigger a chain reaction of liquidations, amplifying losses and contributing to the decline in prices.

Trending

Press Releases

Deep Dives

Русский

Русский