Crypto Surge: Unraveling the Inflow Dynamics

Bitcoin, often represented by the symbol BTC, experienced a modest downturn, settling at $37,032. However, amidst this fluctuation, exchange-traded products (ETPs) witnessed a substantial upswing, registering a noteworthy $312 million in inflows for the week concluding on Nov. 24. This surge contributed to a cumulative year-to-date influx of approximately $1.5 billion, according to the insightful analysis by CoinShares. Intriguingly, the weekly inflows for all cryptocurrencies collectively reached $346 million, maintaining a commendable nine-week streak of positive net flows.

???? New record of inflows with US$346m this week, the highest total observed in the past 9 weeks of inflows.

— CoinShares (@CoinSharesCo) November 27, 2023

– #Bitcoin –

???? $BTC: US$312m inflows (year-to-date inflows US$1.5bn)

???? Short Bitcoin: US$0.9m outflows

???? ETP volumes as a percentage of total spot Bitcoin volumes… pic.twitter.com/gMUPzTy0q4

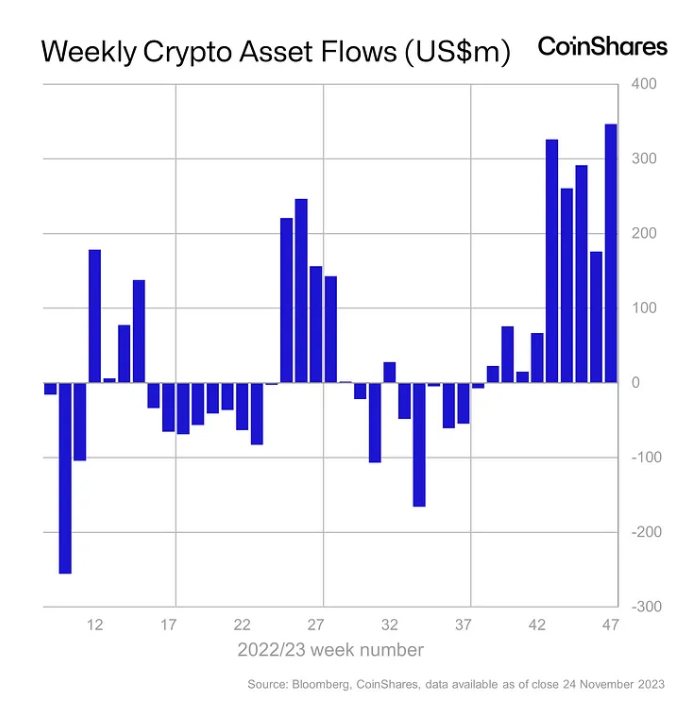

The landscape of crypto ETPs underwent a noteworthy transformation before Sept. 25, marked by several weeks of outflows, as highlighted in the comprehensive report. However, a turning point emerged in the week of Sept. 25–29, as the sector embarked on a trajectory of consistent weekly inflows, gradually escalating in magnitude. Notably, the week concluding on Nov. 24 emerged as the zenith of this nine-week period in terms of inflow volume.

Weekly crypto asset flows for the 47 weeks ending Nov. 24. Source: Coinshares

Weekly crypto asset flows for the 47 weeks ending Nov. 24. Source: Coinshares

Drawing attention to the specifics, CoinShares underscored that the lion's share of the weekly inflows originated from Canadian and German ETPs, commanding an impressive 87% of the total. In contrast, inflows from the United States remained relatively subdued, amounting to a modest $30 million.

Looking at the bigger picture, the collective assets managed by crypto funds have now reached a substantial $45.4 billion, marking a notable peak in the last 18 months.

In a thought-provoking exploration, CoinShares ventured to speculate that the recent surge in inflows might be intricately linked to a growing sense of optimism surrounding the potential approval of a U.S. spot Bitcoin ETF. Notably, on Nov. 22, BlackRock engaged in constructive discussions with the U.S. Securities and Exchange Commission, earnestly striving to propel progress towards this pivotal objective. Concurrently, Grayscale tactfully navigated a meeting with the SEC, sharing analogous aspirations on this intriguing financial horizon.

Read more about: Crypto Exodus: Wallet of Satoshi Bids Farewell to the U.S.

Trending

Press Releases

Deep Dives