Crypto Resurgence: Navigating Bitcoin's Rally and Market Dynamics

Bitcoin, the renowned cryptocurrency with the ticker BTC, has undergone a fluctuation, ticking down to $38,287. Nevertheless, today's market scenario reflects a noteworthy rebound from the correction below $37,000 on November 28, soaring to an intra-day pinnacle of $38,274. Traders are currently exhibiting a decidedly bullish bias towards Bitcoin, a sentiment bolstered by the resolution of the Binance case. The prevailing belief in the market circles around the potential approval of a spot BTC exchange-traded fund (ETF), anticipated to usher in substantial cash inflows to Bitcoin, consequently propelling prices across the expansive crypto market.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Now, let's delve into the intricate factors contributing to the present surge in Bitcoin price.

Navigating the settling dust of the Binance situation

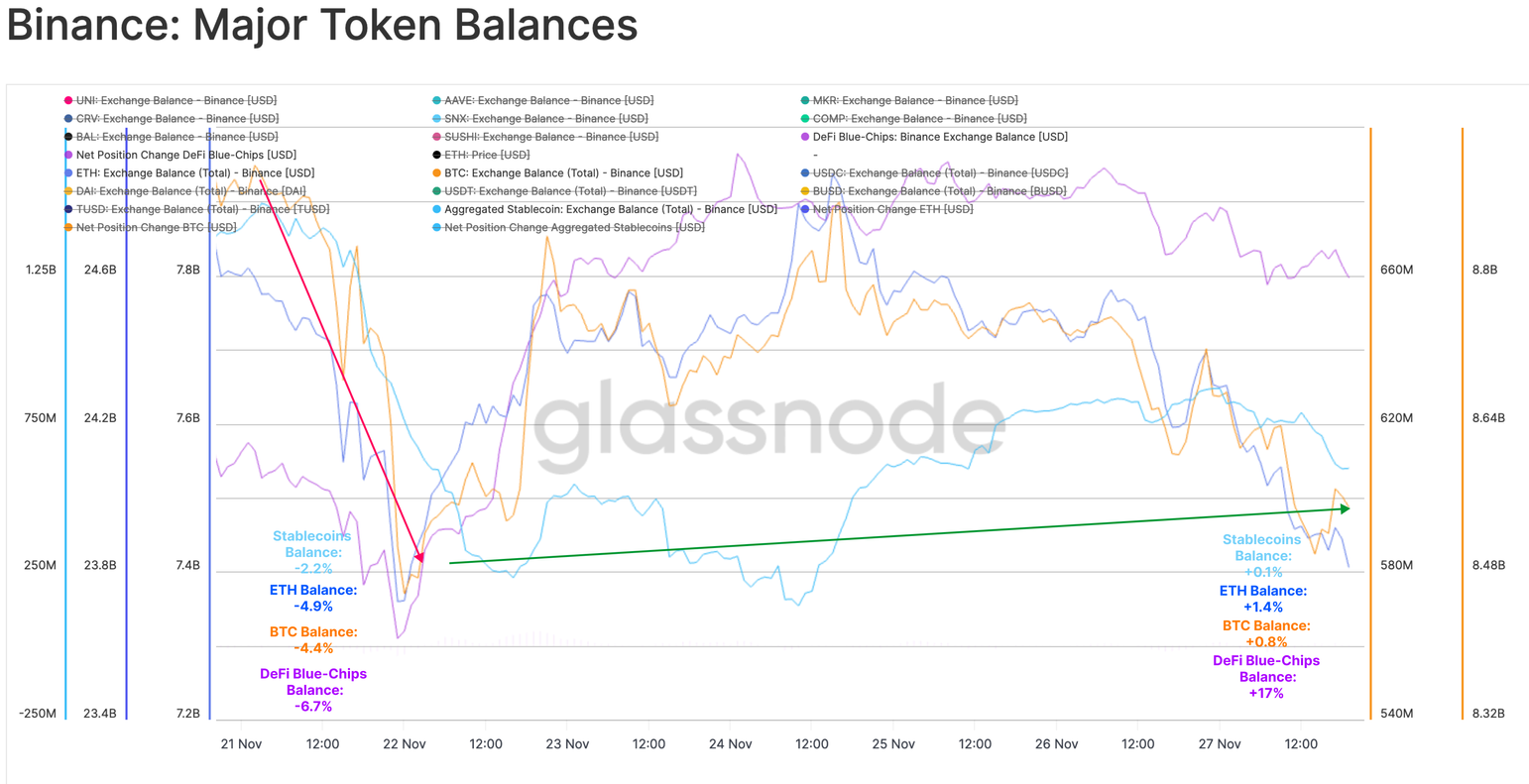

In the initial aftermath of Changpeng "CZ" Zhao's guilty plea and the Department of Justice's (DOJ) substantial $4.3 billion settlement with Binance, Bitcoin's price exhibited a mosaic of mixed signals. However, with the passage of time and some collective reflection, the market discerned that Binance did not undergo the feared mass exodus of funds, a stark contrast to the liquidity crisis experienced by FTX. Despite Binance's Bitcoin reserves initially taking a 17% dip from their all-time high, recent data indicates a nearly 1% uptick in BTC inflows. In contrast, FTX's BTC reserves plummeted by a staggering 99.9% in November 2022, an incident from which it never fully recovered.

Binance major token balances. Source: Glassnode

Binance major token balances. Source: Glassnode

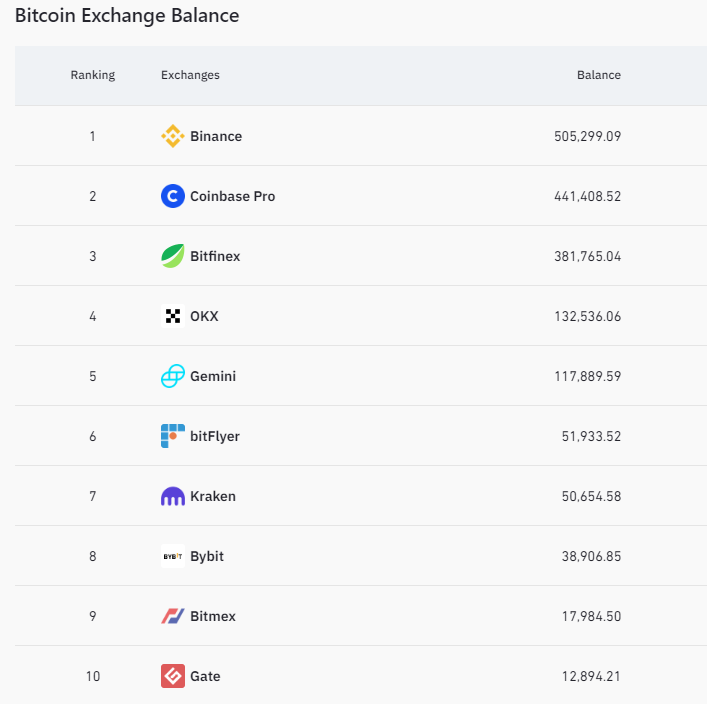

Although Binance's current Bitcoin reserves mark their lowest since 2017, the exchange still proudly holds the lion's share of BTC compared to other centralized exchanges.

Bitcoin exchange balances. Source: Coinglass

Bitcoin exchange balances. Source: Coinglass

Markus Levin, co-founder of XYO Network, astutely observes that the sustained uptrend in Bitcoin and the broader digital asset market reveals a clear pattern of robust accumulation. The anticipated pullbacks for BTC, contrary to expectations, are not as pronounced, signaling a notable phase of strength.

Potential approval of a spot BTC ETF injects positivity into market sentiment

Against the backdrop of various macroeconomic challenges, Bitcoin's price resilience persists, boasting a significant year-to-date gain of 130.5%, coupled with an observable spike in volatility. Noteworthy voices in the analyst community posit that the Binance and DOJ settlement sets a favorable precedent for the green light on a spot Bitcoin ETF, drawing parallels to a historical instance involving Arthur Hayes and BitMEX.

Expanding on this positive sentiment, some discern the Binance settlement as a symbolic turning point for the entire crypto market, perhaps heralding the end of the Wild West era. Although Bitcoin market sentiment might slightly dip below last month's levels, it firmly maintains its ground in the realm of greed, indicative of sustained strength.

Fear & Greed Index. Source: Alternative.me

Fear & Greed Index. Source: Alternative.me

Capriole, a distinguished Bitcoin hedge fund, underscores the influence of heightened sentiment on price dynamics. They observe a high-timeframe technical bias favoring a range high of $58,000, while on daily timeframes, the near-term Wyckoff target hovers at $42-45,000.

Bitcoin price with Wyckoff model. Source: Capriole

Bitcoin price with Wyckoff model. Source: Capriole

Despite a flurry of spot Bitcoin ETF amendments in mid-October, the United States Securities and Exchange Commission (SEC) remains in a holding pattern, deferring the approval decision to January 10. Reports circulating suggest that an ETF approval could potentially unlock a staggering $600 billion in new demand. CryptoQuant analysts take it a step further, projecting that such an approval could catalyze a monumental $1 trillion surge in Bitcoin's market capitalization.

In a forward-looking perspective, Galaxy Digital ventures into forecasting a substantial 74% price uptick within the first year following the launch of a spot BTC ETF.

Record weekly inflows as year-to-date total surpasses $1.5 billion

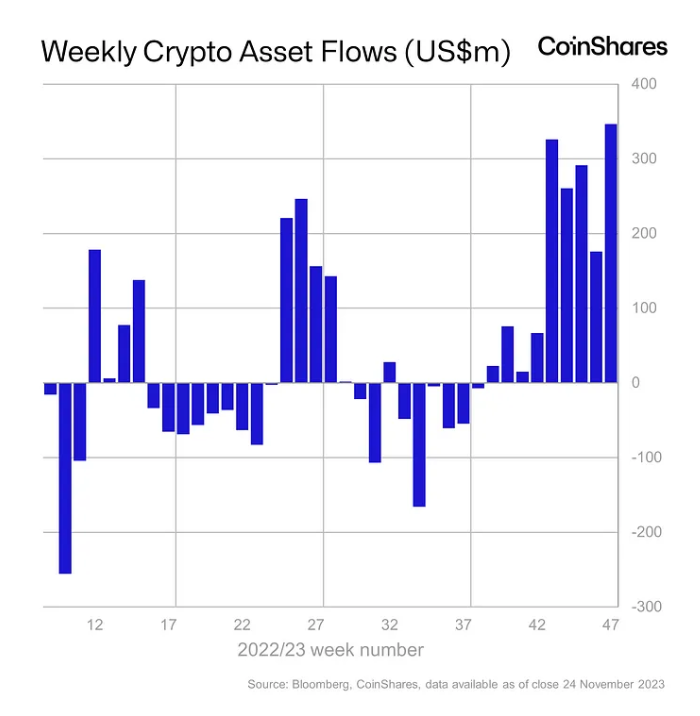

While some investors linger in anticipation of increased liquidity from approved ETFs, institutional players have already commenced deploying substantial funds into Bitcoin and the broader crypto landscape. According to data from CoinShares, institutional investors have injected an impressive sum exceeding $1.5 billion into various crypto products over the past year, with a significant portion, surpassing $1.5 billion, flowing directly into Bitcoin.

Crypto asset institutional investor inflow. Source: CoinShares

Crypto asset institutional investor inflow. Source: CoinShares

In the most recent week, a notable $311 million of institutional inflow specifically targeted Bitcoin. The total weekly inflows into crypto products by institutional investors, amounting to $346 million, stand as the highest since the vibrant market activity observed in November 2021.

Read more about: CryptoETF Watch: SEC Inquiry Unveiled

Trending

Press Releases

Deep Dives