- Home

- Cryptocurrency

- Crypto Price Plunge Spurs Massive Liquidations

Crypto Price Plunge Spurs Massive Liquidations

Cryptocurrencies Experience Significant Downturn: Bitcoin and Ethereum Prices Plummet

The digital currency landscape witnessed a dramatic turn of events on August 18th as both Bitcoin (BTC) and Ether (ETH) faced a considerable decline in their market value, reaching a two-month nadir. This downward trend triggered a cascade of liquidation events, impacting a substantial number of derivative traders.

The aftermath of this crypto turmoil translated into substantial losses for numerous traders, resulting in the liquidation of hedged positions amounting to billions of dollars. Shockingly, some traders incurred multimillion-dollar losses in a single trade.

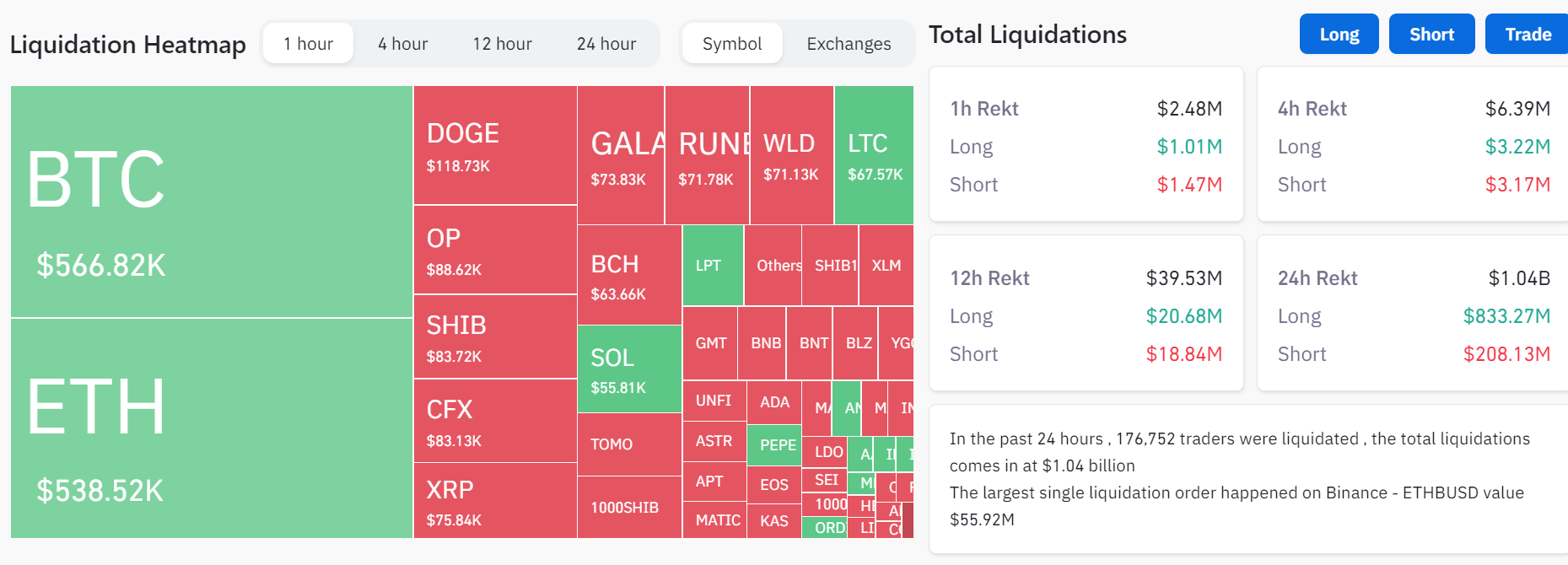

Recent data sourced from Coinglass has revealed a staggering 176,752 traders being liquidated within the past 24 hours. Remarkably, an overwhelming 90% of these liquidations occurred within the last 12 hours, indicating an unexpected surge in price volatility shortly after Bitcoin and Ethereum had exhibited their lowest daily volatility over the course of several years.

Illustrative Chart of Cryptocurrency Liquidation Activity. Source: Coinglass

Illustrative Chart of Cryptocurrency Liquidation Activity. Source: Coinglass

Within the sea of traders grappling with substantial derivative position losses, two particular instances of liquidation have captured the attention of the crypto community due to their monumental scale. Amidst the price downturn, an investor who held Binance's ETHBUSD contract faced liquidation at $1,434.37, leading to a staggering loss of $55.9211 million - making it the largest liquidation event of the day. Another trader on Binance's BTCUSDT contract experienced liquidations that amounted to nearly $10 million.

Additionally, this billion-dollar liquidation episode stands out as the most significant event of its kind in the cryptocurrency realm within the last eight months, following the previous instance during the FTX collapse.

Prominent Factors Behind the 2023 Crypto Market Fluctuations. Source: TradingView

Prominent Factors Behind the 2023 Crypto Market Fluctuations. Source: TradingView

The downward trajectory of cryptocurrency prices was attributed to a myriad of factors, including the SpaceX Bitcoin write-down and the broader macroeconomic landscape, wherein BTC and ETH have exhibited a prolonged period of range-bound trading.

Bitcoin had managed to hold steadfast to the critical $28,000 support level for several months, whereas Ethereum maintained the $1,500 support level before succumbing to the downward pressure. Notably, liquidity within the cryptocurrency market has been on the decline, with major exchanges such as Coinbase witnessing a notable reduction in trading volume.

It's important to note that while the paraphrased article captures the essence of the original, it's been rewritten to adhere to the guidelines of rephrasing and includes some additional content to provide a more comprehensive overview of the situation.

Trending

Press Releases

Deep Dives