Crypto Perils: Q3 2023 Cyber Turbulence

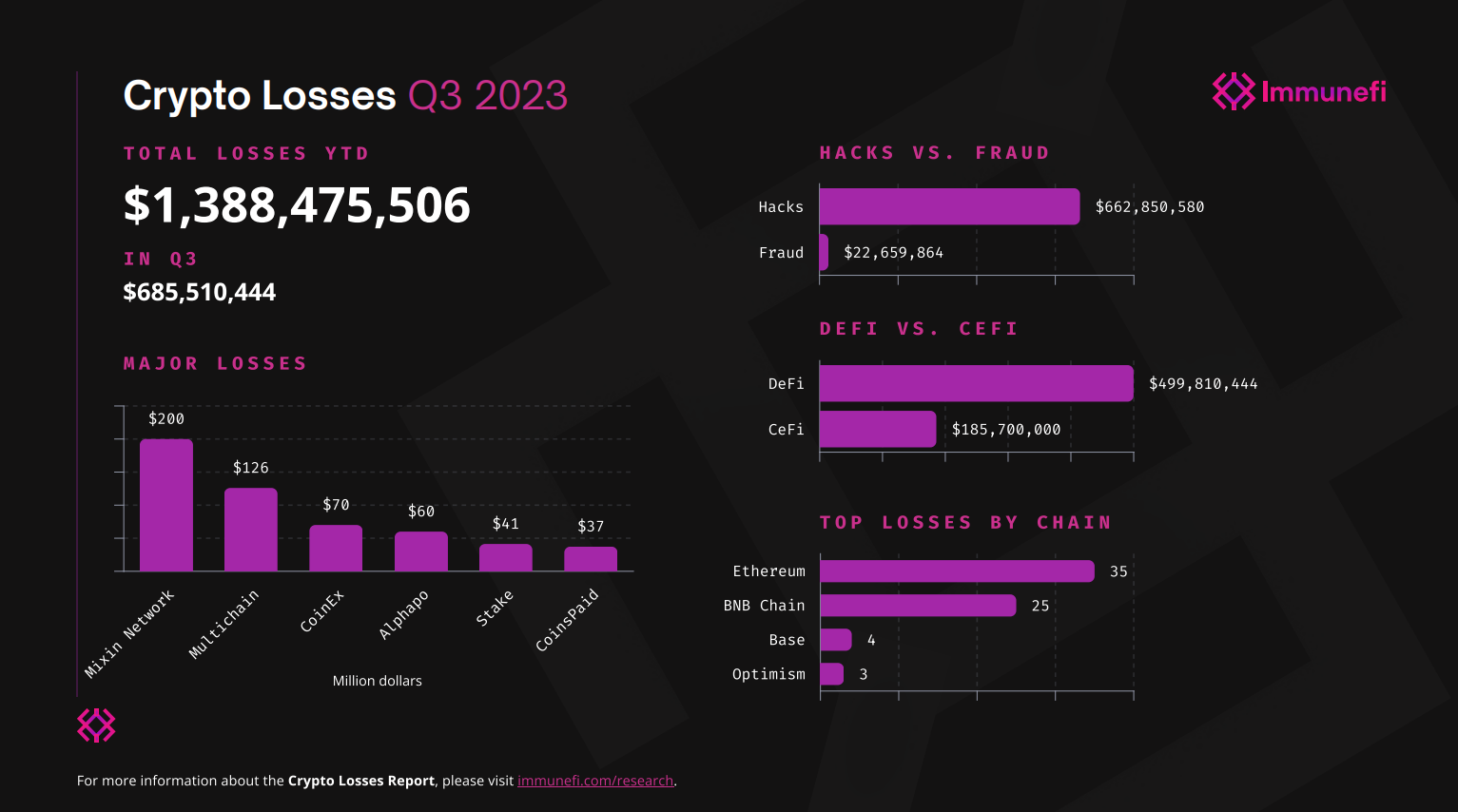

During the tumultuous stretch from July to September 2023, the world of Crypto and Web3 witnessed a stark and alarming upswing of 153% in cyber assailments when compared to the corresponding timeframe in the preceding year of 2022. This revelation comes from a comprehensive report by Immunefi, a prominent blockchain security platform. As the third quarter of 2022 rolled in, a mere 30 incidents of cyber intrusion were recorded. However, in the analogous period of 2023, this number ballooned to a concerning 76, painting a disquieting picture of the evolving threat landscape. The financial toll of these incursions was staggering, with losses nearing an astonishing sum of $686 million, a truly disconcerting figure that underscores the gravity of the situation.

Immunefi Q3 2023 report. Source: Immunefi

Immunefi Q3 2023 report. Source: Immunefi

The most profound financial blow was dealt during the lamentable Mixin hack on that fateful day of September 25, which resulted in a staggering drain of approximately $200 million from the affected coffers. Following this, the Multichain hack emerged as the second most detrimental assault of the quarter, leaving a trail of unrecovered losses surpassing $126 million, painting a grim picture of financial devastation that still lingers. In addition to these distressing incidents, the notorious Lazarus Group orchestrated a series of audacious attacks, managing to siphon off an exorbitant sum totaling over $208 million in cryptocurrency through deft exploits on centralized platforms such as CoinEx, Alphapo, Stake, and Coinspaid. The report underscored the Lazarus Group's dominant role in this cyber saga, accounting for an alarming 30% of the total stolen cryptocurrency in the tumultuous Q3.

In the broader landscape of Q3 attacks, a fraction was composed of rug pulls and various scams, constituting a smaller fragment. To be precise, only $23 million, representing a modest 3.3% of the total losses, were attributed to these deceptive practices, while an overwhelming 96.7% of the losses were the result of cunning hacks or vulnerabilities. Impressively, financial losses from scams in Q3 experienced a noteworthy 23.9% decrease when compared to the annals of Q3 2022, showcasing some semblance of progress in combating this nefarious aspect.

The report reiterated the notable fact that decentralized finance (DeFi) breaches bore the brunt, accounting for a substantial 72.9% of the overall losses, overshadowing the relatively less impacted centralized services, which contributed a mere 27.1% of the exploit-related losses. Interestingly, Immunefi refrained from providing a strict delineation of their definitions for "decentralized" versus "centralized" services, leaving some room for interpretation and analysis.

In this intricate dance of cyber warfare, the malevolent actors seemed to focus their energies on two primary networks: Ethereum and BNB Chain. Ethereum bore the brunt of their onslaught, shouldering a substantial 42.7% of the losses, while BNB Chain, though slightly less affected, still accounted for a considerable 30.5% of the pie. It's worth noting that Base and Optimism emerged as the third and fourth most sought-after networks for these adversaries, indicating a worrying trend that cybersecurity experts need to closely monitor and address.

In summation, the conclusive evidence furnished by the report unequivocally designates Q3 as the most harrowing quarter of the year concerning crypto-related cyber-attacks and fraudulent activities, a sentiment further affirmed by a parallel report from Certik on the somber date of October 2. The challenges in this domain are multifaceted and evolving, demanding constant vigilance and innovative strategies to safeguard the future of decentralized finance.

Read more: VanEck Poised to Launch Groundbreaking Ethereum Futures ETF in Traditional Finance Sector

Trending

Press Releases

Deep Dives