Crypto Odyssey: Peaks and Puzzles

Bitcoin, often represented by the acronym BTC, finds itself in a curious dance around the $37,000 mark, a milestone that has eluded its grasp for the past 18 months. The current valuation, resting at $36,305, hints at a potential breakthrough, but the air is thick with skepticism among traders, casting a shadow over BTC's recent price performance.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

The movement in BTC's price doesn't seem to be in line with expectations

In a fascinating turn of events, Bitcoin, driven by overnight gains, is ambitiously challenging resistance levels on its journey toward the coveted $40,000 threshold. The month of November has been surprisingly generous, offering a 6.6% boost, building on the momentum from a remarkable 30% surge in October. Yet, as the cryptocurrency flexes its muscles, some market participants can't help but raise an eyebrow at the unfolding narrative.

According to data gleaned from TradingView, BTC/USD flirted with the $37,000 figure before the opening bell on Wall Street, introducing an element of uncertainty into the equation. Material Indicators, a vigilant on-chain monitoring resource, sheds light on a potential hitch in the upward trajectory – a lack of robust trading volume support at the current altitude.

In a post shared on X (formerly Twitter), Material Indicators points to a shifting landscape of support, now tethered at $33,000, while resistance at $40,000 has gracefully stepped into the $42,000 realm. The intricacies of this tussle are vividly portrayed in a BTC/USDT order book liquidity chart from Binance, leaving Material Indicators with a nagging feeling that something might be amiss.

A noticeable concern emerges as the price of BTC appreciates amidst dwindling trading volume – a classic red flag that experienced market watchers can't ignore. Material Indicators issues a cautious call to observe closely, acknowledging the peculiar dynamics at play this time around.

BTC/USDT order book data for Binance. Source: Material Indicators/X

BTC/USDT order book data for Binance. Source: Material Indicators/X

Adding to the intrigue, popular trader Skew unveils a tale of whale selling pressure, with the crosshairs set on the psychologically significant $40,000 level. This twist in the plot adds a layer of complexity to the unfolding drama.

$BTC

— Skew Δ (@52kskew) November 9, 2023

bear whale aka gigantic seller has been selling into price for past few days

they're dumping again here

$38K - $40K is probably where they get carried out of the market

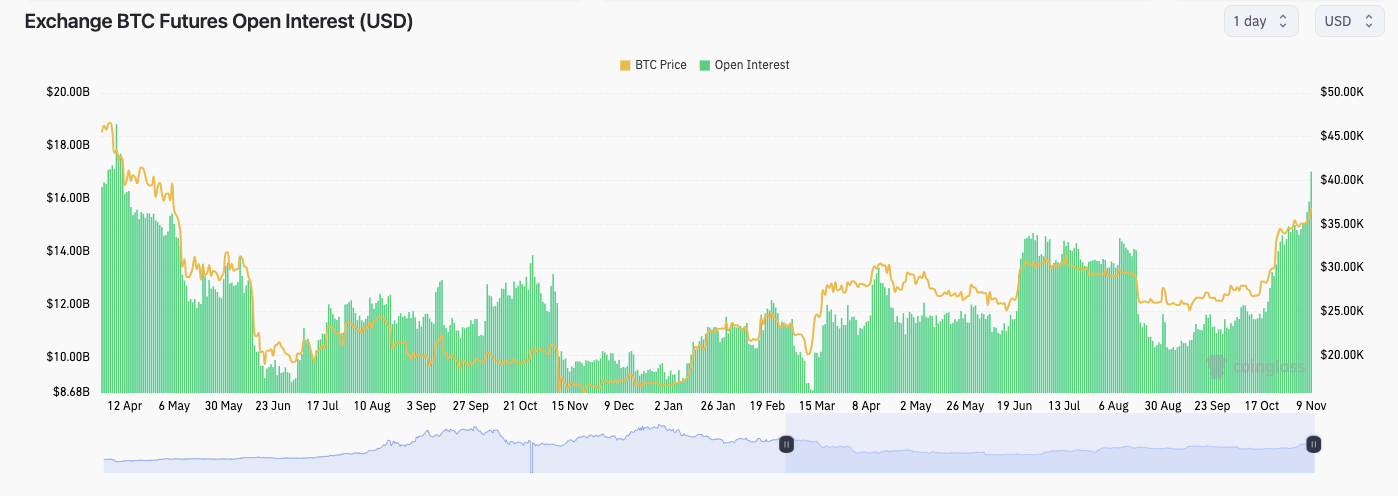

Open interest approaches its highest level in seven months

On a different front, financial commentator Tedtalksmacro introduces a subplot involving increasing open interest (OI), a recurring theme in recent upward surges. CoinGlass data reveals that total Bitcoin futures OI has surpassed $17 billion, reaching heights not seen since mid-April. Tedtalksmacro, however, urges caution, highlighting how the market tends to play a cat-and-mouse game with OI impulses during bearish phases.

Market heating up again.

— tedtalksmacro (@tedtalksmacro) November 9, 2023

~15k BTC in open interest added in the past 10 hours.

That's about $525MM USD worth... the vibes are slowly returning. pic.twitter.com/aSMbZxrySO

As we navigate this intricate narrative, Tedtalksmacro leaves us with a tantalizing notion – a true bull market might unveil itself when the market, undeterred by OI fluctuations, forges ahead on a relentless upward trajectory. The evolving dynamics present a captivating spectacle, inviting observers to remain vigilant in the unfolding chapters of Bitcoin's journey.

Bitcoin exchange futures open interest (screenshot). Source: CoinGlass

Bitcoin exchange futures open interest (screenshot). Source: CoinGlass

Trending

Press Releases

Deep Dives