Crypto Momentum: Navigating Peaks and Patterns

Bitcoin BTC Price indicators experienced a slight downtick $37,033 hovered precariously close to $38,000 in the lead-up to the weekly close on Nov. 26, while traders cautiously fortified their positive outlook on BTC prices.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin buyers leave no space for bears to maneuver

In an intriguing turn of events, Bitcoin bulls adeptly navigated the intricacies of market dynamics, leaving the bears with little room for maneuver. According to data from TradingView, the cryptocurrency exhibited a relatively subdued weekend, with volatility lying dormant as the weekly close loomed on the horizon.

#Bitcoin Straightforward and slow weekend.

— Daan Crypto Trades (@DaanCrypto) November 26, 2023

Usually volume/volatility picks up a bit later today. https://t.co/joyKaqG68f pic.twitter.com/T9sXbJ2c6d

Despite recently achieving new highs over the past 18 months, discerning observers noted that the foremost cryptocurrency exhibited promising signals indicative of a sustained upward trajectory.

Credible Crypto, a well-regarded trader and analyst, underscored the resilience of buyers in skillfully absorbing any selling pressure emanating around local peaks. This resilience, combined with the persistently low open interest (OI) in derivative markets and an unwavering demand for spot transactions, potentially set the stage for the next upward surge.

Offering insights into market dynamics, Credible Crypto stated, "On the whole, I anticipate that potential price dips may prove to be even shallower than initially expected. This is primarily attributed to the limited OI, which fails to induce significant liquidations, coupled with the conspicuous demand we are witnessing at these levels." A snippet of a post on X (formerly Twitter) conveyed this sentiment.

"While there are conceivable liquidations above the $38k threshold and some below $37.5k, the overall volume of open positions remains relatively modest. Consequently, the anticipation is that substantial volatility in either direction will not manifest until a breakout occurs, unless there is a notable and unexpected shift in spot flows."

Bitcoin exchange market data chart. Source: Credible Crypto/X

Bitcoin exchange market data chart. Source: Credible Crypto/X

Credible Crypto concluded that, contrary to his earlier prognostication of a retracement to $36,900—a meager 2.1% decrease from the current spot price—such a correction might not materialize as envisaged.

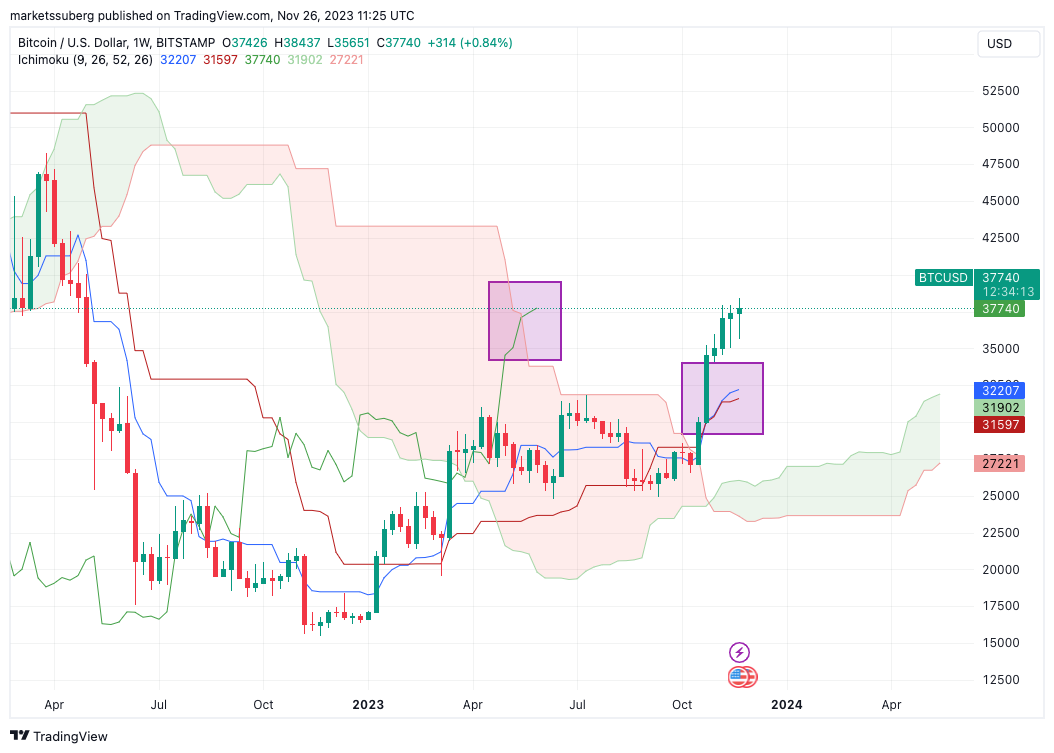

BTC price charts unveiled a noteworthy Ichimoku pattern

Equally buoyant about the immediate future was Titan of Crypto, a fellow market commentator with a penchant for detailed analysis.

In an examination leveraging the Ichimoku Cloud indicator, Titan of Crypto discerned a conspicuous breakout of its key components—a rarity in the context of the Bitcoin weekly chart. The lagging span of Ichimoku, Chikou—measured 26 weeks prior—asserted its dominance by positioning itself above the price and at the summit of the Kumo Cloud. Concurrently, Tenkan-sen and Kijun-sen displayed a reinvigorated upward trend, collectively painting a highly promising picture for the continuation of the prevailing uptrend, according to Titan of Crypto's thorough analysis.

Delving into the intricacies of recent price action, Titan of Crypto highlighted the significance of the last two weekly candles. "The wicks suggest that bulls are steadfastly pushing back," he summarized in a portion of the accompanying X commentary on Nov. 25.

With a palpable upward momentum, the next target in sight is $39.3k, as the cryptocurrency market braces itself for potential developments.

BTC/USD 1-week chart with Ichimoku Cloud features highlighted. Source: TradingView

BTC/USD 1-week chart with Ichimoku Cloud features highlighted. Source: TradingView

You might also like: Gilded Wisdom: Kiyosaki's Financial Frontier

Trending

Press Releases

Deep Dives