Crypto Market's Turnaround Watch

The recent downturn in the cryptocurrency market appears to be showing signs of a potential turnaround, based on emerging insights from JPMorgan. Their latest research indicates that the completion of most long-position liquidations might be on the horizon, introducing a glimmer of optimism amid the turbulence.

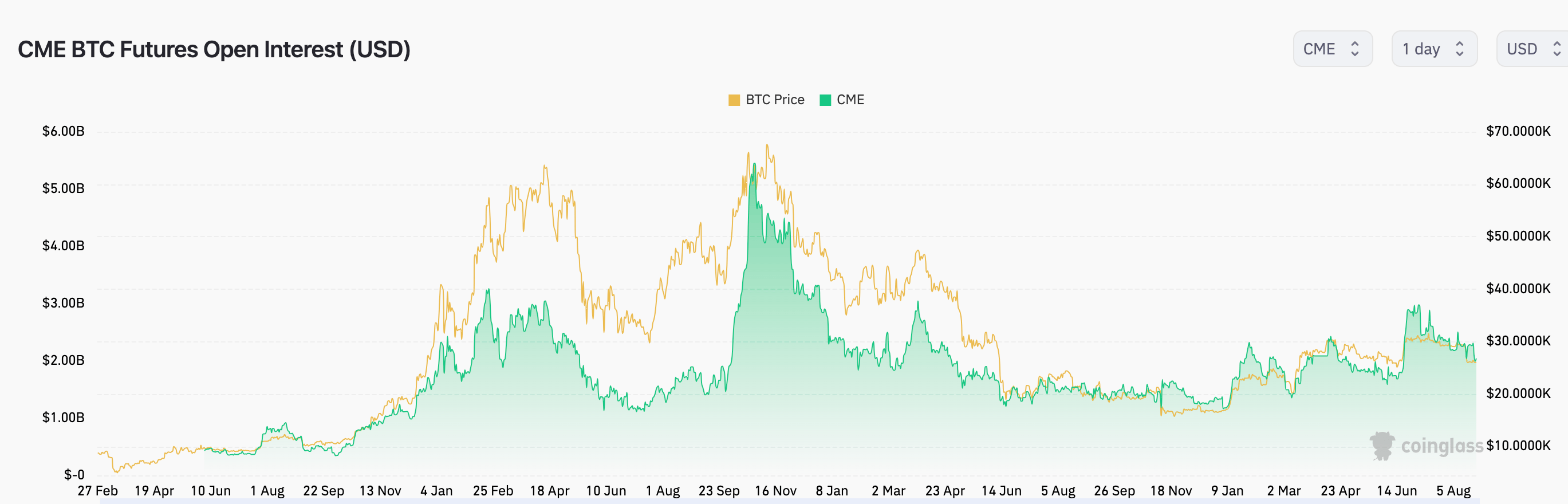

Highlighted in a Bloomberg report, JPMorgan's analysts speculate that the phase of significant liquidations is now mostly in the rearview mirror. This speculation is grounded in an analysis of open interest data related to Bitcoin futures contracts on the Chicago Mercantile Exchange (CME), suggesting a potential easing of the prevailing selling pressure. Open interest, which acts as a barometer of market sentiment and the intensity of price movements, is now hinting at a possible change in direction.

The dwindling open interest figures for Bitcoin have triggered experts to postulate a potential softening of the ongoing price trajectory. Consequently, there is a growing sentiment that the cryptocurrency landscape might see limited downside in the immediate future.

Open interest data for BTC futures on CME. Reference: CoinGlass.

Open interest data for BTC futures on CME. Reference: CoinGlass.

Recent weeks witnessed a dip in cryptocurrency valuations, largely due to diminishing enthusiasm concerning regulatory changes in the United States, a point underscored in the report. As of August 26th, Bitcoin's trading price hovers near $26,000, reflecting an 11.27% dip over the preceding month.

The preceding months had seen a bullish trend for Bitcoin, propelled by various favorable catalysts. Notably, a series of applications for the inaugural U.S. exchange-traded funds (ETFs) linked to Bitcoin's spot price garnered attention. Noteworthy industry players such as BlackRock, Fidelity, ARK Investments, 21Shares, alongside several other asset management entities, were part of the queue awaiting regulatory green lights.

In a parallel development, Ripple Labs secured a partial victory in their legal tussle with the United States Securities and Exchange Commission (SEC), providing additional wind to the crypto sails. However, this positivity appears to be tapering, in line with the analysis. The waning optimism can be attributed to the anticipation surrounding decisions about Bitcoin ETFs and the unfolding of the SEC's Ripple-related proceedings, reintroducing an air of uncertainty.

The analysis also spotlights how this situation has contributed to a "fresh wave of legal ambiguity" surrounding crypto markets, rendering them sensitive to forthcoming dynamics. Beyond these factors, external variables such as the ascending U.S. real yields and apprehensions regarding China's economic growth have collectively contributed to the cryptocurrency market's recent cooling trend.

Trending

Press Releases

Deep Dives