Crypto Market Momentum Report

The cryptocurrency market is currently experiencing an upswing, with Bitcoin (BTC) sliding to $34,363, while Ether (ETH) dips to $1,825. Additionally, XRP (XRP) is down to $0.57, and Solana's SOL (SOL) has seen a decline to $31. Meanwhile, various alternative cryptocurrencies are rallying to rekindle the bullish momentum that is often associated with the phenomenon known as "Uptober." It's worth noting that cryptocurrencies are continuing their upward trajectory, contributing to the overall cryptocurrency market capitalization, which has now reached a noteworthy $1.15 trillion as of October 23. Concurrently, Bitcoin is flirting with the $31,000 price threshold.

Crypto total market. Source: TradingView

Crypto total market. Source: TradingView

Now, let's delve into three significant factors that are contributing to the ongoing rally in the cryptocurrency market.

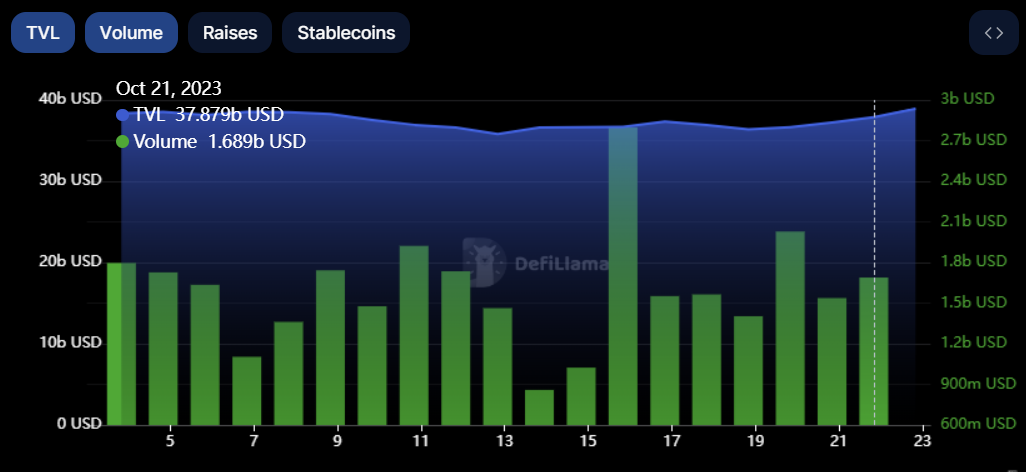

"Uptober" Persists with Notably High Trading Volumes

Historically, October has been dubbed "Uptober" due to the positive returns it brings to the cryptocurrency market. During a brief period spanning October 13 to 15, both Bitcoin and the overall crypto market experienced a substantial surge in trading volumes, catapulting from $1 billion to over $2.7 billion per day. Notably, the trading volume has consistently remained above the $1 billion threshold since October 13.

Crypto market volume. Source: DefiLlama

Crypto market volume. Source: DefiLlama

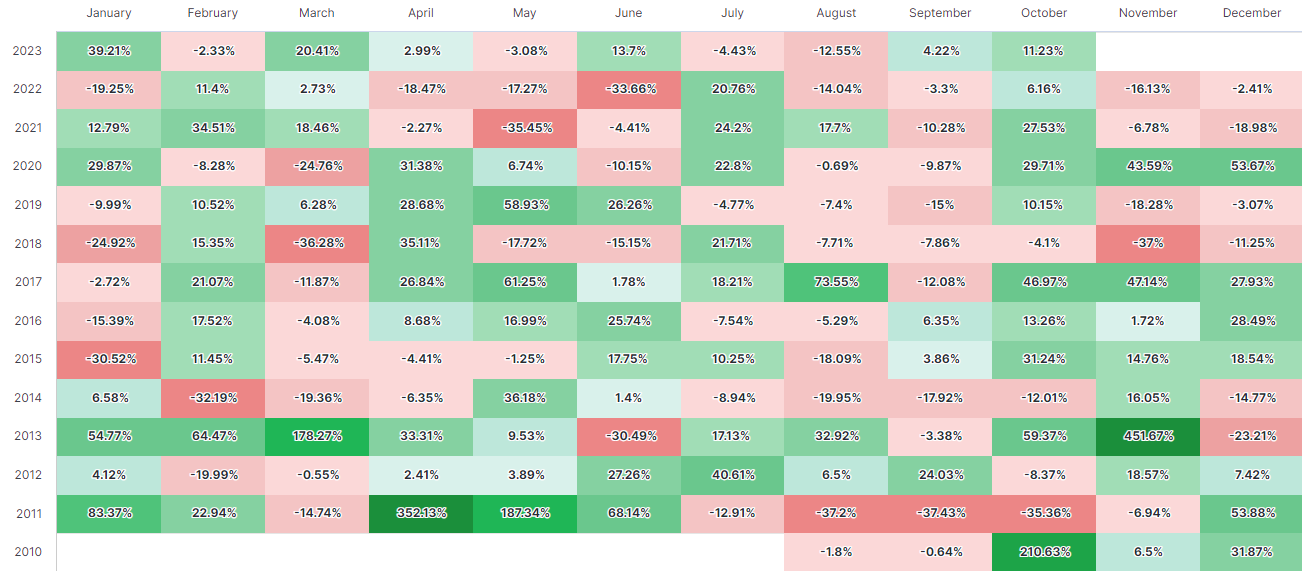

The surge in trading volume has spurred optimism, especially considering October's track record of delivering favorable returns for Bitcoin. In fact, October has statistically stood out as one of the most robust months for Bitcoin price gains, having already generated a significant return of 11.2% in 2023.

Bitcoin returns by month. Source: Newhedge

Bitcoin returns by month. Source: Newhedge

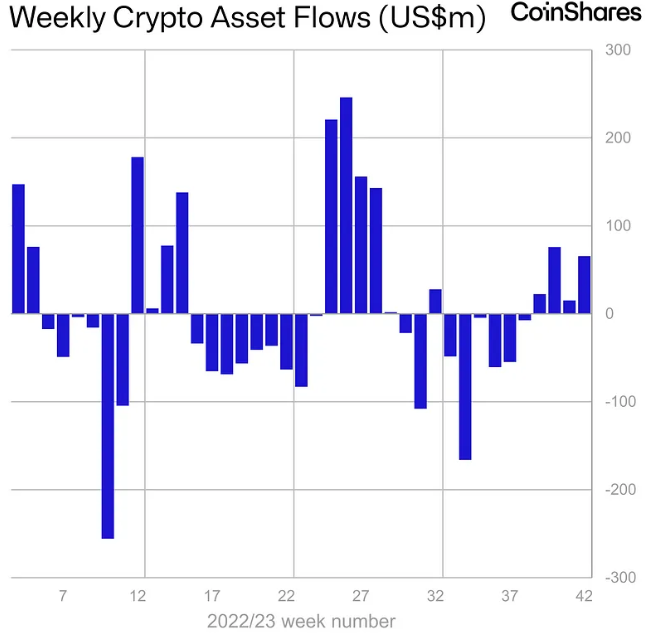

This robust October is complemented by an increase in inflows into the cryptocurrency market, with digital asset funds receiving positive investments for four consecutive weeks, amassing a total of $66 million by the 42nd week of 2023.

Digital asset fund inflows by week. Source: CoinShares

Digital asset fund inflows by week. Source: CoinShares

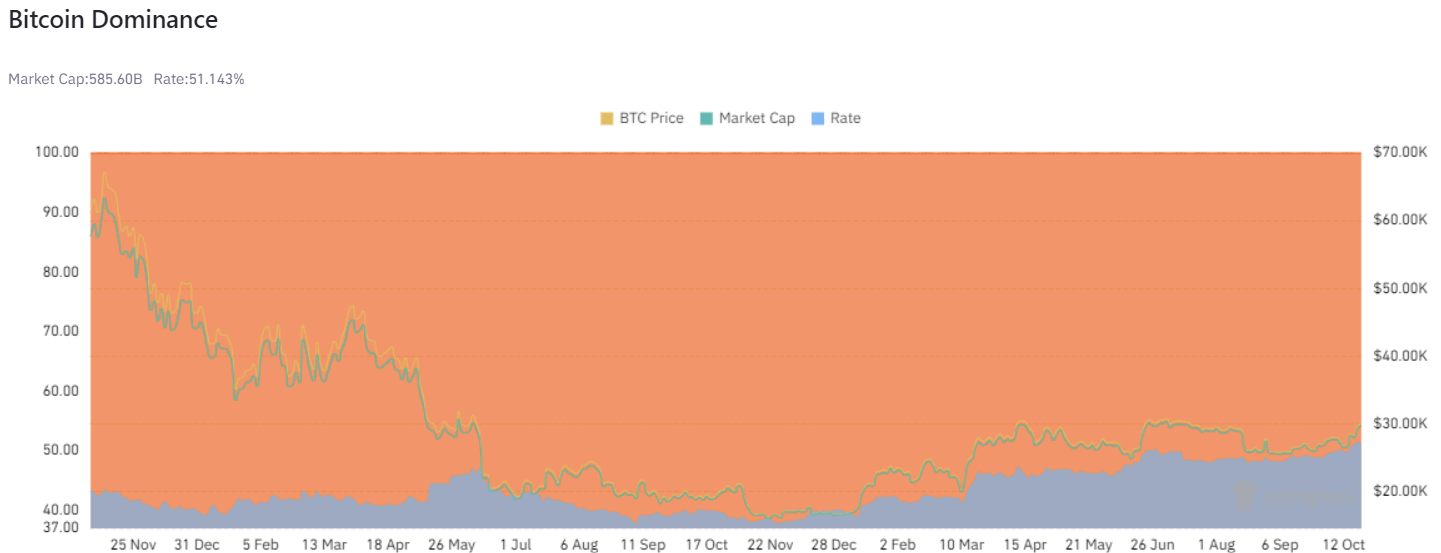

Bitcoin's Dominance Maintains Its Position

Bitcoin is regaining its dominance in the cryptocurrency market ahead of the scheduled supply halving in April 2024. This marks the first time since June 28 that Bitcoin's market cap constitutes more than 50% of the entire cryptocurrency market. As of October 23, Bitcoin's dominance stands solidly above the 51% threshold.

Bitcoin dominance versus crypto market. Source: Coinglass

Bitcoin dominance versus crypto market. Source: Coinglass

Traditionally, when Bitcoin's dominance plateaus, there is a renewed interest in alternative coins and other cryptocurrencies. This increased dominance aligns with models suggesting that Bitcoin has the potential to reach an impressive $130,000 following the 2024 BTC halving event. Nevertheless, analysts emphasize that Bitcoin must surpass the $31,000 mark to avert a bearish fractal pattern identified by technical experts.

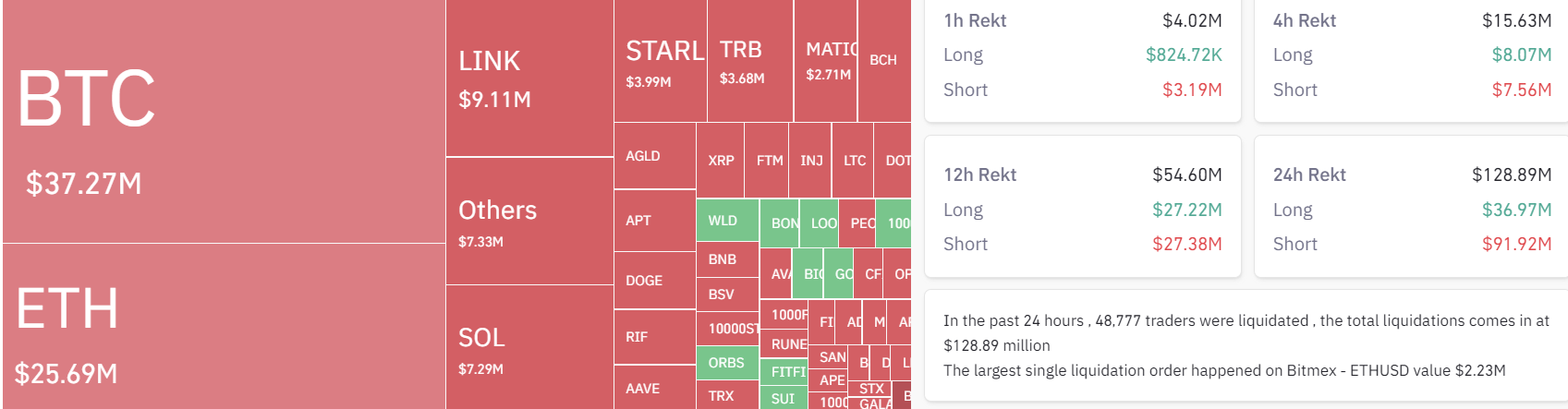

Liquidation of Short Positions Sweeps Across the Crypto Market

The ongoing rally in the cryptocurrency market has triggered a series of liquidations of short positions, resulting in a cumulative liquidation exceeding $91 million within a 24-hour window. Leading the way are Bitcoin short positions, accounting for a total of $37.3 million in shorts wiped out. Notably, the largest single liquidation occurred within an Ether short position, totaling $2.23 million in a single transaction on the BitMEX exchange.

Bitcoin liquidations. Source: Coinglass

Bitcoin liquidations. Source: Coinglass

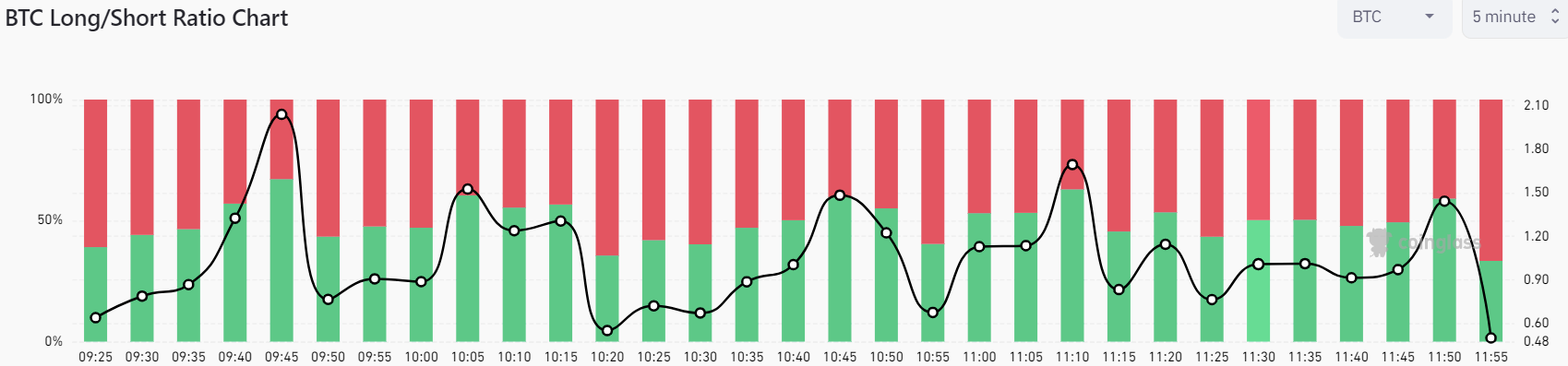

Despite this recent streak of short position liquidations, it's important to note that 66% of the futures market continues to maintain a bearish stance. This skewed short ratio potentially sets the stage for a short squeeze, which could drive further upward price movement.

Bitcoin short vs. long ratio. Source: Coinglass

Bitcoin short vs. long ratio. Source: Coinglass

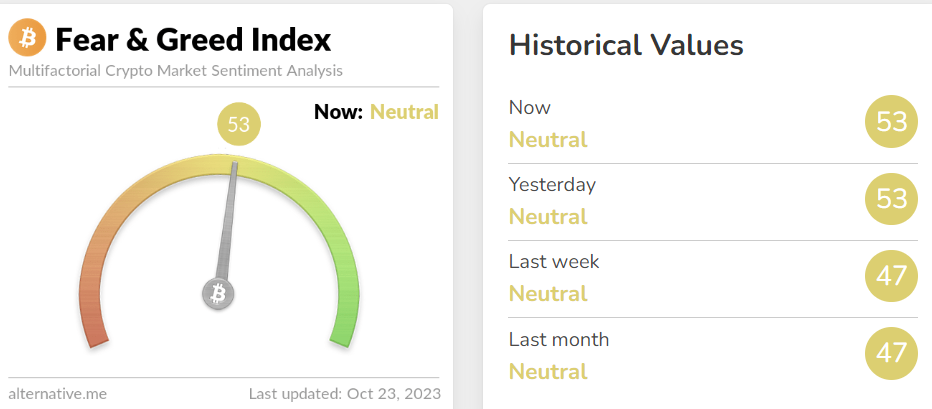

While Bitcoin and alternative cryptocurrencies still face looming risk factors that could influence their prices, the increasing interest from institutional investors is positively impacting market sentiment. Notably, the Bitcoin Fear & Greed Index reflects this improved sentiment, registering a six-point increase over the past month.

Bitcoin Fear & Greed Index. Source: Alternative.me

Bitcoin Fear & Greed Index. Source: Alternative.me

In conclusion, cryptocurrency markets are poised to continue experiencing price fluctuations. While the positive price action in October provides a short-term boost to crypto prices, the market's response to new regulatory actions or economic downturns will ultimately determine the direction it takes.

Read more: Blockchain ETF Boost: BlackRock's Key Move

Trending

Press Releases

Deep Dives