- Home

- Cryptocurrency

- Crypto Market Cap Hits 2-Month Low as Bitcoin and Ether Slide: Causes and Prospects

Crypto Market Cap Hits 2-Month Low as Bitcoin and Ether Slide: Causes and Prospects

Crypto Market Capitalization Hits Two-Month Low as Bitcoin and Ether Slide

The cryptocurrency market experienced a 1.3% decline in its capitalization on August 17th, marking its lowest point in the past two months. Notably, Bitcoin (BTC), the dominant player in the market accounting for 50% of the total capitalization, dropped by 1.4% and is now at risk of slipping below the $28,000 mark. Ether (ETH), another prominent cryptocurrency, also faced a 1.6% decrease in its value.

Comparison of Cryptocurrency Market Capitalization with Daily Performance of BTC/USD and ETH/USD

Comparison of Cryptocurrency Market Capitalization with Daily Performance of BTC/USD and ETH/USD

This downtrend in the crypto market has been persistent since mid-July, which coincides with the strengthening of the U.S. dollar index (DXY) during the same period.

This decline has been parallel to the upward trajectory of U.S. bond yields. On August 17th, the yield on the benchmark 10-year U.S. Treasury note surged to 4.31%, marking its highest level since October 2022. This trend suggests a shift in investor preference towards safer assets, leading them to move away from non-yielding digital currencies like Bitcoin.

Chart Depicting Daily Performance of BTC/USD Alongside U.S. 10-Year Treasury Note Yield. Source: TradingView

Chart Depicting Daily Performance of BTC/USD Alongside U.S. 10-Year Treasury Note Yield. Source: TradingView

The surge in yields closely followed the release of the Federal Open Market Committee's (FOMC) minutes from their July meeting, which reaffirmed a hawkish stance. Notably, a significant portion of Federal Reserve officials expressed concerns about sustained inflation even without further interest rate hikes, heightening expectations of an additional rate increase in September.

In historical context, the prospect of higher interest rates has traditionally been unfavorable for the cryptocurrency market. This likely contributed to the downward movement observed on August 17th.

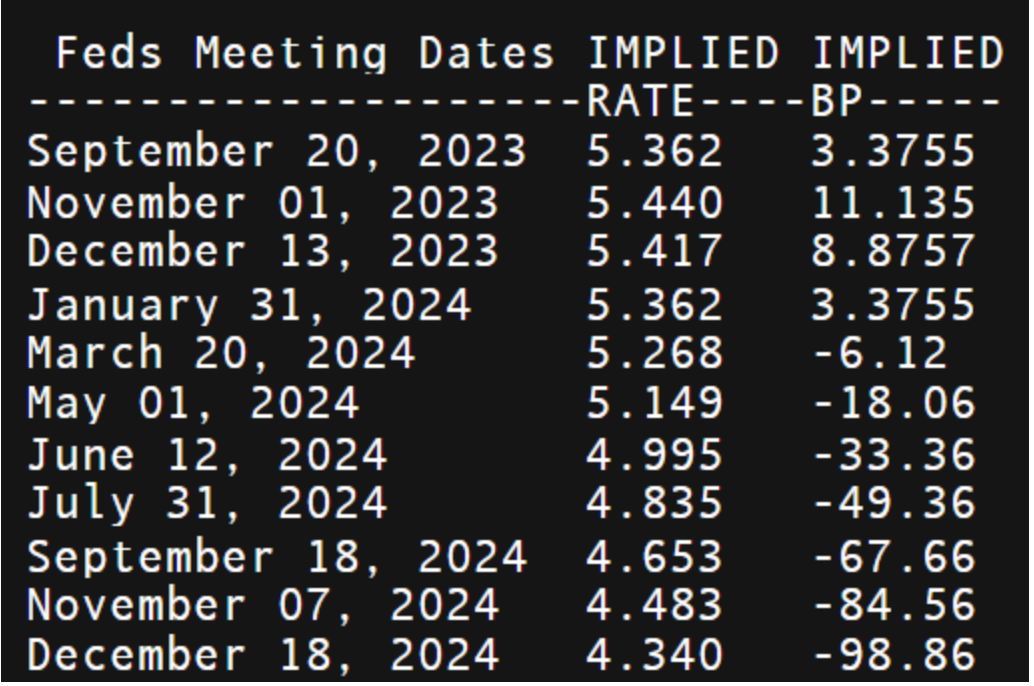

However, it's worth noting that implied Fed funds futures rates indicate the possibility of the first rate cuts occurring around May-June 2024, as depicted in the provided data. Until then, it's anticipated that the Fed rates will remain within the existing range of 5.25-5.50%.

Anticipating a Potential Reversal

The current state of the crypto market suggests that it is nearing oversold conditions, with its daily relative strength index (RSI) at 33.75. This value is only slightly above the typical threshold, implying the possibility of the market stabilizing or even rebounding in the near future.

Chart Showing Daily Performance of Cryptocurrency Market Capitalization. Source: TradingView

Chart Showing Daily Performance of Cryptocurrency Market Capitalization. Source: TradingView

Furthermore, the market is undergoing a test of its 200-day exponential moving average (200-day EMA), represented by the blue curve, which is acting as a support at approximately $1.098 trillion. If this support level holds, it could serve as a foundation for a rebound towards $1.166 trillion, indicating a potential increase of over 3% from current levels.

Conversely, the bears are striving to drive the market below the ascending trendline support situated around $1.053 trillion, representing a decline of approximately 4% from the current levels.

Trending

Press Releases

Deep Dives