Crypto Conundrums: Unveiling the Enigma of Digital Assets

Bitcoin, often represented by its ticker symbol BTC, has experienced a notable decline in its market value, currently hovering at $34,477. This decline is particularly intriguing given its substantial market capitalization, exceeding a remarkable $7.2 billion. What's even more fascinating is the continued involvement of the United States government in the realm of Bitcoin, despite their mounting losses.

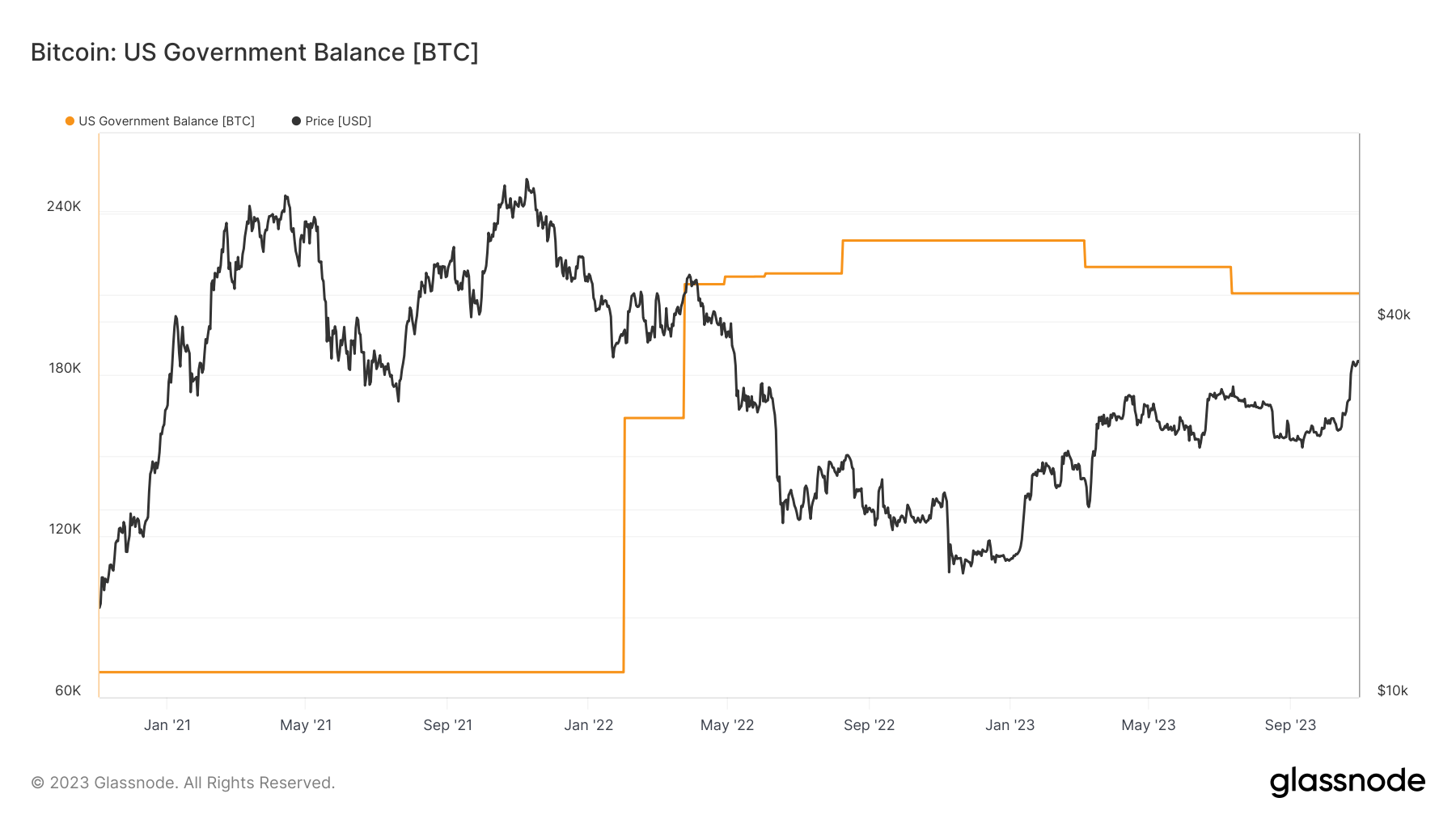

Newly released data from Glassnode, a renowned on-chain analytics firm, provides insights into the substantial Bitcoin holdings under the jurisdiction of the United States government. As of October 31, they have seized an impressive 210,429 BTC.

195,000 BTC were liquidated, resulting in a loss of $6.3 billion

It's worth noting that out of this considerable sum, a significant portion, specifically 195,000 BTC, has been divested, resulting in a substantial loss of approximately $6.3 billion.

The United States Department of Justice (DOJ) and the Internal Revenue Service (IRS) have unintentionally gained notoriety as some of the world's largest Bitcoin holders, thanks to their involvement in various legal proceedings. Surprisingly, only a fraction of the confiscated Bitcoin holdings has been returned to the market through auction.

Those fortunate enough to participate in these auctions have reaped substantial profits. An interesting twist of fate is that the DOJ, despite its prominent status, has demonstrated a tendency to sell its Bitcoin holdings prematurely.

According to statistics compiled by Jameson Lopp, a co-founder of Bitcoin custody firm Casa, the government's hasty sales have resulted in a colossal missed opportunity, totaling over $6 billion in potential gains from the sale of 195,092 BTC.

Largest national and corporate Bitcoin holdings (screenshot). Source: BitcoinTreasuries

Largest national and corporate Bitcoin holdings (screenshot). Source: BitcoinTreasuries

Remarkably, when it comes to Bitcoin ownership, the DOJ stands apart, overshadowing even the largest corporate BTC treasury, which is currently held by MicroStrategy with 158,245 BTC, valued at $5.43 billion, as reported by BitcoinTreasuries.

Substantial Bitcoin holdings

Interestingly, the size of the DOJ's Bitcoin holdings seems to expand in conjunction with announcements of confiscations. In early 2022, their Bitcoin inventory grew by nearly 100,000 BTC, valued at $3.6 billion at the time. This expansion can be attributed to legal actions against individuals involved in attempting to launder the proceeds of a major crypto exchange Bitfinex hack that occurred in 2016.

U.S. government BTC balance chart. Source: Glassnode

U.S. government BTC balance chart. Source: Glassnode

Meanwhile, billionaire Tim Draper, who had been a participant in the original BTC auctions, has recently criticized the U.S. government for its perceived hindrance of cryptocurrency growth. Draper, who had previously forecasted a $250,000 price for BTC in 2022, now laments that policy failures are stifling the potential of Silicon Valley's "golden goose." In a post from May, he passionately discusses how regulations are smothering innovation in the cryptocurrency space.

Read more about: CryptoMarket Pioneers: Unveiling the Future of Digital Finance

Trending

Press Releases

Deep Dives