Crypto Claim Surge: FTX's Remarkable Resurgence

The prevailing data from Claims Market reveals an interesting development in the world of cryptocurrency exchanges, as it shows that FTX's current claim pricing has remarkably surged to a peak of 57%. This substantial increase in FTX's claim pricing can be primarily attributed to the intriguing evaluation of the worth of artificial intelligence (AI) enterprises in which the now-defunct crypto platform had previously made significant investments.

It's worth noting that creditors stake their claims as part of their strategic efforts to recover a portion of their investments when businesses encounter financial hardships or face the daunting specter of bankruptcy. These claims are often actively traded by investors, and their estimated recovery value tends to rise proportionally as the claim prices experience an upward trajectory. Essentially, as the pricing of a claim escalates, the potential for creditors to recover a larger sum also rises in tandem.

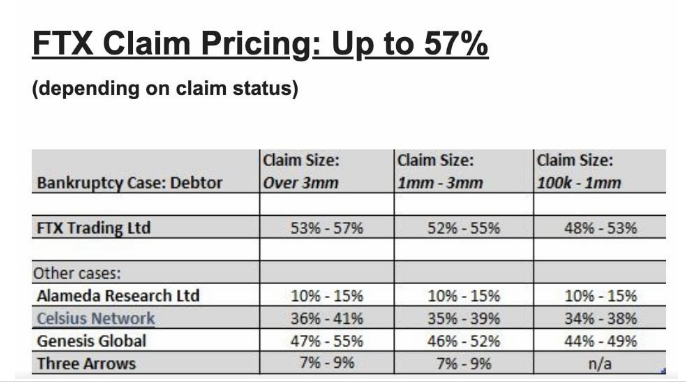

FTX claims. Source: Claims Market

FTX claims. Source: Claims Market

With the surge in the valuation of the AI companies that FTX had strategically invested in, the potential recovery amount from its ongoing bankruptcy proceedings has seen a substantial and noteworthy increase. It's essential to emphasize that a claim essentially represents a legal assertion of a specific monetary sum.

The claim percentage value signifies the proportion of the initial investment amount that is anticipated to be recovered from the platform. Notably, FTX's claim value has risen to the highest level, surpassing other bankrupt cryptocurrency firms by a significant margin. For instance, Celsius stands at 35–40%, Genesis at approximately 50%, Alameda at 10%, and Three Arrows Capital at a relatively modest 7–9%.

The recent surge in FTX's claims aligns with the recent conclusion of the public trial of the former FTX CEO, Sam Bankman-Fried, on November 2. In a rather dramatic turn of events, he was found guilty on all seven charges, and the eagerly anticipated sentencing is now scheduled to be announced in March 2024.

The FTX claims have undeniably captured the collective attention of the cryptocurrency community during the ongoing bankruptcy proceedings. Notably, the presiding judge had previously granted FTX the permission to sell nearly $3.4 billion worth of crypto assets in the market as a means to compensate the creditors. Given the current upward trajectory of cryptocurrency prices and the ever-increasing valuation of the companies nestled within FTX's diverse portfolio, creditors are now presented with a substantial and promising opportunity to recoup a significant portion of their previously lost investments from FTX.

You might also like: Unified Crypto Custody Settlement Network: BitGo Joins Forces with Copper

Trending

Press Releases

Deep Dives