Crypto Chronicles: Institutional Boost and Price Surges

Today's surge in Bitcoin's value is notable, as it has ascended by 5%, marked by a sudden and pronounced upward candle that propelled it to a peak not seen in two weeks—crossing the $28,000 threshold. This impressive surge follows a favorable judgment rendered by United States Court of Appeals Circuit Judge Neomi Rao in favor of the Grayscale Bitcoin Trust (GBTC) against the U.S. Securities and Exchange Commission (SEC).

This legal verdict further underscores the recent and increasing attention that institutional investors are directing towards Bitcoin (BTC). The financial world has observed a surge of interest from major players such as BlackRock and Fidelity Investments, both of which are set to receive responses regarding their proposals for Bitcoin spot exchange-traded funds (ETFs) on September 2nd.

Bitcoin's value according to TradingView data.

Bitcoin's value according to TradingView data.

Influx of institutional attention ignites a vigorous surge in the Bitcoin market

The traction gained from institutional interest has triggered a substantial upward momentum in Bitcoin, leading to a rally on August 29th. Judge Rao's decision effectively nullified the SEC's previous ruling that had denied the approval of the GBTC spot ETF based on concerns of fraudulent activities. Although this judgment doesn't explicitly grant approval to the spot ETF, it does acknowledge:

"The petition for review by Grayscale is accepted, and the Commission's order is voided, as per the court's opinion."

Judge Rao's action of overturning the SEC's denial of the Grayscale ETF also had a positive impact on the Grayscale ETF itself, with its discount approaching the highest levels of 2023, remaining below 25%.

Information about Grayscale's assets as reported by CoinGlass.

Historically, the SEC has rejected all proposals for a Bitcoin spot ETF, despite a plethora of applicants including major names like BlackRock, Fidelity, ARK by Cathie Wood, and 21Shares, which has submitted its application for approval thrice.

With assets under management exceeding $8.5 trillion, BlackRock stands as the globe's largest asset manager. Their plans involve using Coinbase for safekeeping the BTC within their trust, as per their submission to the SEC. As September arrives, the SEC is slated to make a series of determinations on various ETF applications.

Data on exchange-traded fund (ETF) movements sourced from Bloomberg.

Data on exchange-traded fund (ETF) movements sourced from Bloomberg.

Diminished availability of Bitcoin on exchanges

In tandem with the surge in Bitcoin's price on August 29th, there has been a noticeable decline in BTC supply on exchanges, reaching the lowest point since January 2018.

Bitcoin quantity held on exchanges, based on Glassnode as the source.

The market interprets this outflow from crypto exchanges as an optimistic signal, given that traders typically withdraw BTC for long-term self-custody during bullish periods.

Interestingly, data gleaned from blockchain activity indicates that exchanges have been steadily shedding Bitcoin since May 18, 2023. In essence, a significant cohort of Bitcoin investors is positioning themselves for a potential price rally, despite the extended bearish trend that has characterized 2023.

Changes in the net position of Bitcoin on exchanges, with Glassnode as the information source.

Changes in the net position of Bitcoin on exchanges, with Glassnode as the information source.

Bitcoin price might be driven higher by liquidation events

The ongoing exodus of Bitcoin from exchanges has led to diminished cushioning for liquidations, thereby contributing to heightened volatility. In the past 24 hours alone, shorts amounting to over $46.5 million in BTC have been forcibly closed, with the broader crypto market witnessing over $100 million in short liquidations.

Map illustrating Bitcoin liquidation intensity, sourced from CoinGlass.

Map illustrating Bitcoin liquidation intensity, sourced from CoinGlass.

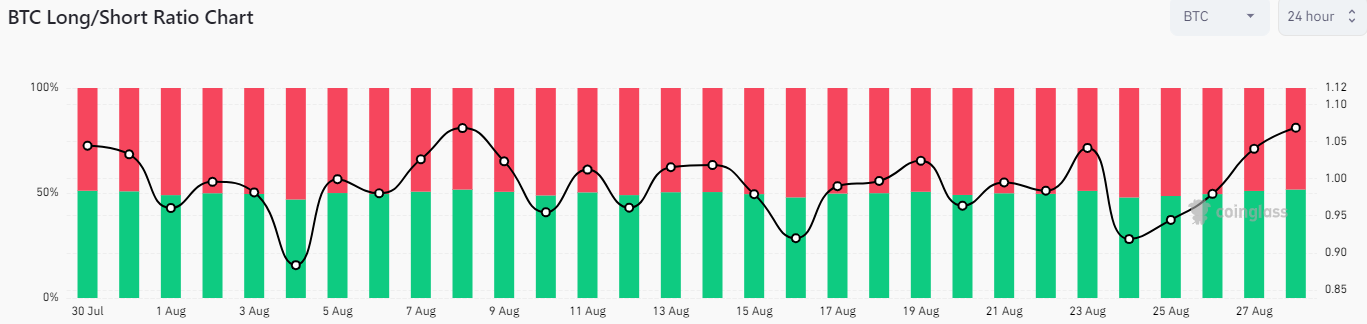

Despite the misfortune experienced by short-sellers, almost half (48%) of the futures market remains pessimistic about the Bitcoin price. With such a pronounced skew towards short positions, the prospect of a short squeeze is looming, which could drive the price of Bitcoin even higher.

Ratio of Bitcoin short positions to long positions, with CoinGlass as the information source.

Ratio of Bitcoin short positions to long positions, with CoinGlass as the information source.

While the immediate trajectory of the Bitcoin price has been infused with bullish sentiment following the Grayscale verdict and the occurrence of short liquidations, the Bitcoin Fear & Greed Index implies that the market remains predominantly fearful, exhibiting a decline of over 13 points compared to the prior month.

Index measuring Bitcoin market sentiment, sourced from Alternative.

Trending

Press Releases

Deep Dives