Crypto Chronicles: BTC's Dance of Fate

Cryptocurrency Enigma: BTC Dramatic Downturn and Shifting Tides $25,956. Amidst the tumultuous rollercoaster ride that saw a staggering plunge to $26,000, a sweeping 90% of speculative traders now grapple with the harsh reality of losses, an unsettling narrative meticulously laid out by recent in-depth research.

Unveiling the poignant echoes of last week's seismic decline in BTC's value, the renowned analytics powerhouse Glassnode treats us to an insightful voyage through its latest weekly missive, aptly christened "The On-Chain Chronicle."

Vulnerability Amplified: Short-Term Holders Caught in Whirlwinds of BTC Price Fluctuations

In a curious dance where only 10% hold the spotlight, the precipitous dip in BTC/USD witnessed as the curtain fell on the week has reverberated throughout the market's collective psyche.

Against the backdrop of predictions threading BTC's valuation at the delicate $25,000 threshold, or perhaps threading even lower, the haze that enveloped a trading stage long accustomed to the languor of lateral movement has begun to dissipate.

Emerging at the heart of this transition is the tribe of short-term holders (STHs), the brave souls who dare to tread the speculative tightrope on the hodler spectrum.

Diving into the nitty-gritty, Glassnode extends a cordial invitation to the world of STHs—entities that cradle BTC for 155 days or less, a cohort juxtaposed against their patient siblings, the long-term holders (LTHs), lovingly dubbed the resolute "hodlers."

"With 2.56M BTC clutched tightly by STHs, a mere 300k BTC (11.7%) dare to bask in the glory of profitability," the research unveils, casting light on the unfolding drama.

Graph depicting gains and losses in Bitcoin's short-term holder supply. Image source: Glassnode.

Graph depicting gains and losses in Bitcoin's short-term holder supply. Image source: Glassnode.

However, the curtain has drawn on a new act—one that orchestrates a sweeping transformation in the financial terrain of these daring players. Once paradigms of BTC's trading gamut, STHs now find their bearings altered.

The symphony's crescendo emerges in the form of an aggregate break-even point, christened the "realized price," a tune currently resonating above the $28,500 mark.

Chart illustrating the cost basis (realized price) of Bitcoin for Short-Term Holders (STH) and Long-Term Holders (LTH). Image source: Glassnode.

Chart illustrating the cost basis (realized price) of Bitcoin for Short-Term Holders (STH) and Long-Term Holders (LTH). Image source: Glassnode.

The Plot Thickens: Deciphering Exchange Inflows and Their Dance with Profits and Losses

As the landscape of market movements evolves, Glassnode keenly directs our gaze toward the intricate web of exchange inflows and their dynamic interplay with the canvas of profits and losses.

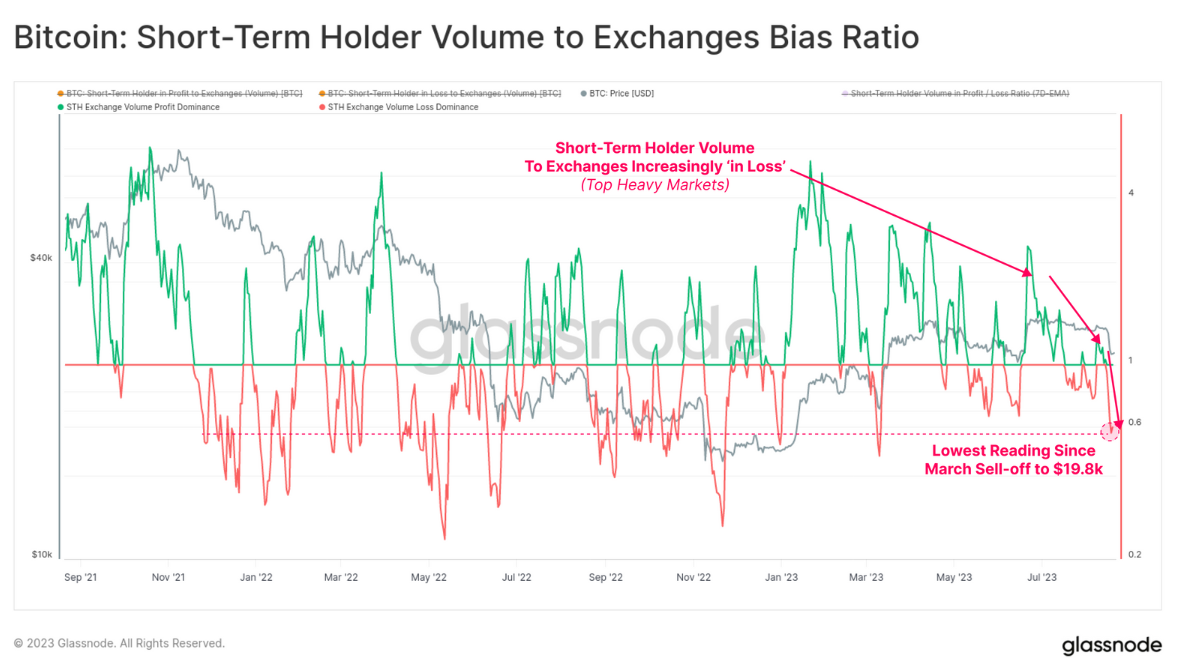

Against this backdrop, a prescient note resounds—a note of caution, as Glassnode dons the hat of the harbinger: "Amidst the crescendo of the 2023 rally, a delicate cadence of diminishing profit dominance emerges, a reflection of a growing clan of STHs gathering coins at an ascending cost echelon."

The plot finds its climax this week as the most striking orchestration of losses unfolds since the dramatic market descent witnessed in March, the descent that saw numbers waltzing down to the tune of $19.8k. This crescendo weaves a tale of a significant swath of the STH ensemble submerged beneath the waves of negative holdings, their response mechanisms amplifying in harmony with the tumultuous price fluctuations.

Screenshot displaying the chart depicting the ratio of Bitcoin's Short-Term Holder (STH) volume directed towards exchanges. Source: Glassnode.

Screenshot displaying the chart depicting the ratio of Bitcoin's Short-Term Holder (STH) volume directed towards exchanges. Source: Glassnode.

Veteran Hodlers: Silent Sentinels Amidst the Tempest

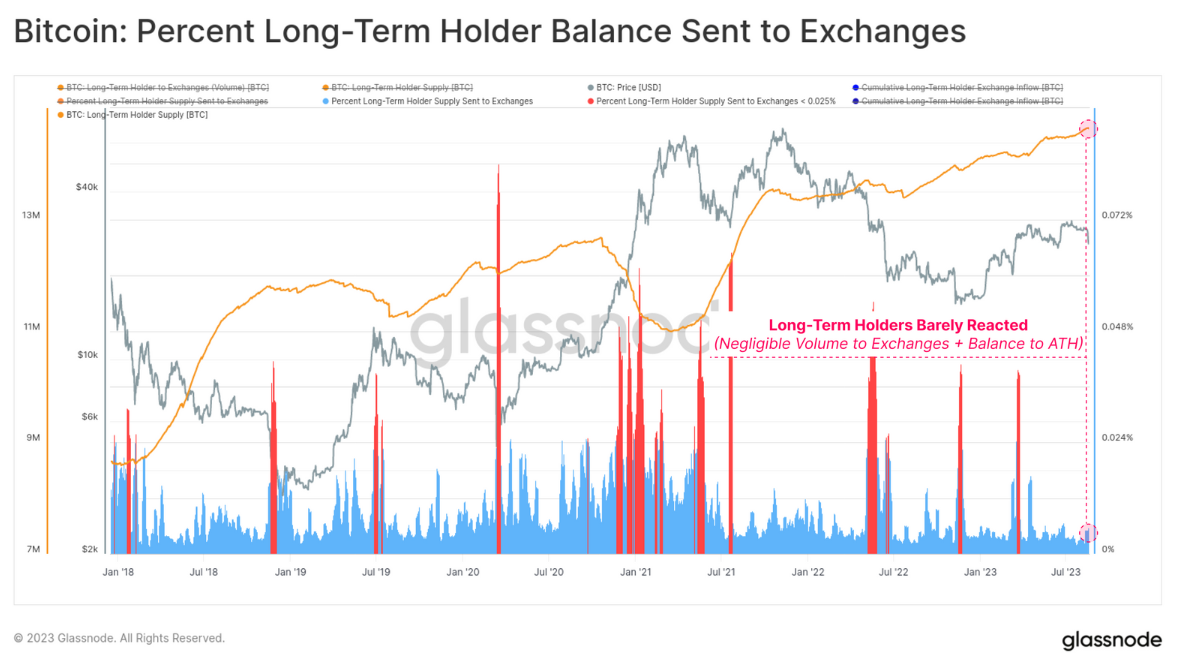

In a narrative twist as contrasting as light against shadow, long-term holders (LTHs) remain enigmatic entities, their response to the retreat below the $26,000 precipice barely leaving a ripple.

"In the poignant theater of Long-Term Holders (LTHs), the stage remains virtually untouched by the turmoil," Glassnode proclaims with an air of certainty.

"No crescendo of volume directed toward exchanges; their grand balance gracefully ascends to a symphonic crescendo, an apex previously unreached."

In an exquisite visual, a supplementary graph charts the measured flow of LTH inflows into exchanges—an undulating rhythm resembling the whisper of a gentle breeze against the tumultuous storm.

Conclusion: A Tale of Two Tribes

As the curtains fall on this dramatic saga, "The On-Chain Chronicle" unfurls its closing chapter.

"Long-Term Holders remain steadfast and unswayed, a living testament to resilience in the face of market tribulations—a script they've performed with graceful consistency during the opera of bear markets."

"Conversely, Short-Term Holders emerge as the protagonists of intrigue, their narrative punctuated by the weighty burden of 88.3% of their holdings (2.26M BTC) nestled within the caverns of unrealized losses. This tale takes a more ominous turn, accentuated by an upsurge of realized losses cascading into exchanges from the STH enclave, alongside the erosion of crucial technical moving average support—herein lies the crux of the conundrum, casting the bulls into the shadows."

Snapshot displaying the graph visualizing the proportion of Bitcoin's Long-Term Holder (LTH) balance transmitted to exchanges. Source: Glassnode.

Trending

Press Releases

Deep Dives