Coinbase Advanced: Unveiling the Future of Cryptocurrency Trading

Coinbase Advanced, the latest offering from the well-established Coinbase platform, has made significant strides by introducing regulated cryptocurrency futures contracts to retail traders in the United States. This innovative development comes after its subsidiary, Coinbase Financial Markets (CFM), successfully obtained the necessary approval to operate as a Futures Commission Merchant (FCM) entity just four months ago, marking a noteworthy milestone in the ever-evolving world of cryptocurrency trading.

On August 17, CFM received a green light from the National Futures Association (NFA), a highly regarded self-regulatory organization designated by the Commodity Futures Trading Commission. This regulatory approval paved the way for CFM to establish itself as an FCM, thus opening new horizons for traders looking to venture into the dynamic realm of cryptocurrency futures.

The significance of this achievement cannot be overstated, as it underscores the maturation of the cryptocurrency market and the increasing regulatory recognition it has gained. The embrace of regulatory compliance positions Coinbase Advanced as a responsible and secure platform for traders in the United States.

As part of this groundbreaking development, CFM has made a significant revelation. Coinbase Advanced customers in the United States can now actively participate in trading nano-sized futures contracts, a concept that epitomizes accessibility and inclusivity. These contracts are designed to be incredibly accessible, representing a mere 1/100th of the size of 1 Bitcoin (BTC), which is currently valued at $35,318, and 1/10th of the size of 1 Ether (ETH), currently valued at $1,831. Andrew Sears, the CEO of CFM, emphasized the significance of these contracts, stating, "These contracts have the unique advantage of demanding lower initial capital requirements, making them an exceptionally affordable investment option for a broader range of retail customers."

The introduction of the nano-Ether contract is poised to transform risk management, margin trading, and speculative activities related to the price of Ether, further enhancing the versatility and appeal of Coinbase Advanced. Similarly, the nano-Bitcoin contract empowers users to engage in speculation regarding the future price of BTC, offering a novel way to participate in the ever-evolving cryptocurrency market.

In addition to providing regulated, leveraged, and cash-settled cryptocurrency futures, users will have the added benefit of accessing a comprehensive library of educational content through Coinbase Learn. This educational component is designed to empower traders with valuable insights and knowledge, further enhancing their trading experience. It's a clear commitment to fostering a well-informed and savvy community of traders.

To further democratize access to these exciting opportunities, U.S. residents with an active Coinbase account for spot trading are eligible to create an FCM futures account. This inclusivity is at the heart of Coinbase's mission to make cryptocurrency trading more accessible to a wider audience and reflects their commitment to promoting financial literacy and empowerment.

These innovative services have already been successfully launched on the web platform, and efforts are underway to ensure mobile device compatibility, ensuring traders can access these opportunities seamlessly across various devices. This commitment to providing accessibility through multiple channels demonstrates Coinbase's dedication to meeting the diverse needs of its user base.

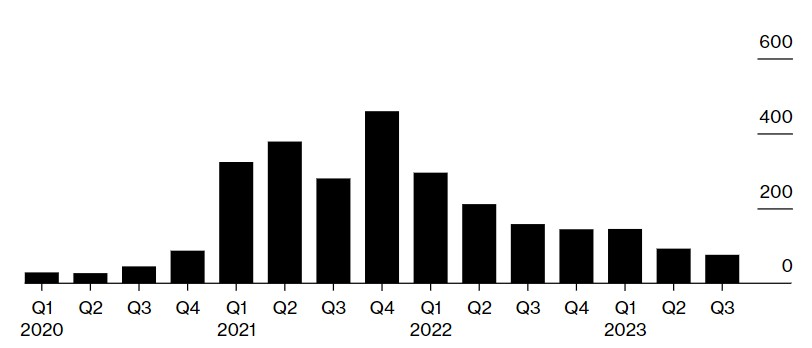

Coinbase's decision to enter the cryptocurrency futures market is not only timely but also strategic. The exchange has observed a decline in spot trading volume in 2023 compared to the previous year. Data from digital asset analytics provider CCData indicates that Coinbase's spot trading volume decreased by 52% in Q3 2023, amounting to approximately $76 billion. However, this drop in spot trading volume has not deterred Coinbase's progress. In fact, the exchange has managed to gain market share in the last quarter, positioning itself strategically as cryptocurrency exchange Binance faced increased regulatory scrutiny.

Crypto exchange Coinbase spot trading volume in billions of dollars. Source: Bloomberg

Crypto exchange Coinbase spot trading volume in billions of dollars. Source: Bloomberg

In conclusion, Coinbase's foray into the world of cryptocurrency futures is a testament to its commitment to innovation and adapting to the changing landscape of the cryptocurrency market. This new venture promises to bring exciting opportunities and accessibility to traders, all while maintaining a strong focus on compliance, education, and responsible trading practices. As Coinbase continues to evolve and grow, it is poised to play a prominent and influential role in the future of cryptocurrency trading, setting the stage for an exciting era in the world of digital assets.

You might also like: Echoes of Cryptocurrency: A Parliamentary Tribute and Regulatory Reflection

Trending

Press Releases

Deep Dives