- Home

- Latest News

- CME Surpasses Binance: Wall Street's Rise Fueled by Bitcoin ETF Enthusiasm

CME Surpasses Binance: Wall Street's Rise Fueled by Bitcoin ETF Enthusiasm

CME Group has solidified its position as a leader in the bitcoin (BTC) futures exchange arena, displacing Binance from its long-standing top spot after two years. This shift underscores the increasing interest from institutional players in the realm of bitcoin, with CME's platform drawing significant attention from established traditional financial institutions.

As of Thursday, CME's open interest, a key metric gauging the number and value of active contracts, reached an impressive $4.07 billion in bitcoin futures positions. This represents a notable 24.7% share of the entire bitcoin futures market, according to insights from CoinGlass. In contrast, Binance held an open interest position of $3.8 billion.

Headquartered in Chicago, CME is a stalwart in traditional finance, specializing in financial, commodity, and agricultural futures and options. The timing of its ascent above Binance, a platform centered around cryptocurrencies, is particularly noteworthy. Major players on Wall Street, including BlackRock, are increasingly influencing the narrative around bitcoin and other cryptocurrencies. They are actively exploring avenues like introducing bitcoin and ether (ETH) exchange-traded funds (ETFs) to broaden the accessibility of crypto investments. The preference for highly regulated exchanges, such as CME, over platforms like Binance, which has encountered regulatory challenges in the U.S., reflects the changing dynamics of institutional engagement in the crypto market.

Tim McCourt, Global Head of Financial and OTC Products at CME Group, highlighted the growing institutional interest in their crypto suite, affirming,

"Market participants see CME Group as a trusted source for risk management."

The reshuffling of rankings coincided with a significant market event, characterized by a substantial reduction in leverage within the crypto market amid intense price fluctuations on Thursday. The aggregate open interest in bitcoin experienced a notable $2 billion decline from $12 billion, with Binance traders facing a disproportionate impact compared to their counterparts on the CME platform.

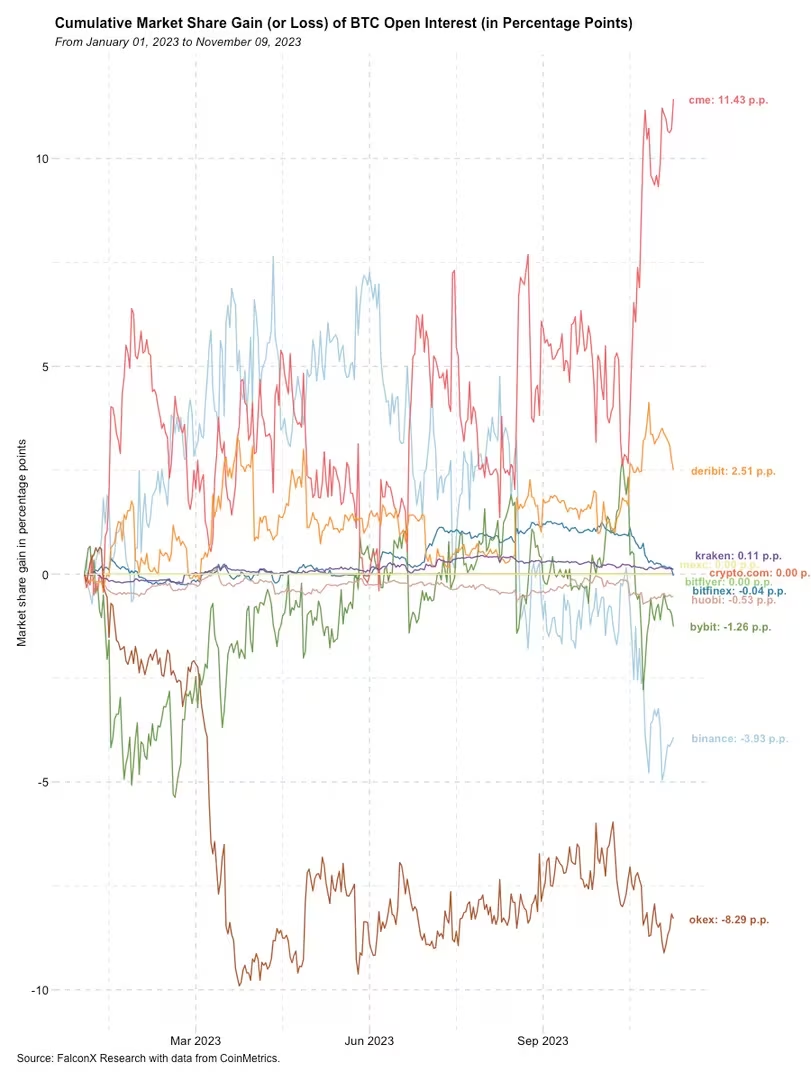

Exchanges' 2023 Cumulative Market Moves: Insights from FalconX

Exchanges' 2023 Cumulative Market Moves: Insights from FalconX

Bitcoin's price surged initially, reaching nearly $38,000, only to retrace sharply towards $36,000 following the revelation of a corporate entity named "iShares Ethereum Trust" being registered in Delaware. This development mirrored a previous occurrence before BlackRock submitted an application for a spot BTC exchange-traded fund (ETF) in June.

CME's gradual ascent throughout the year underscores the increasing demand from institutional market participants eager to engage in the trading of the premier and most established cryptocurrency. A 2020 study by Bitwise Asset Management emphasized the consistent and statistically significant leadership of the CME bitcoin futures market over the spot market.

David Lawant, Head of Research at the trading platform FalconX, remarked,

"Given that CME is a venue primarily utilized by large traditional financial institutions, it indicates the substantial interest from this audience in the crypto space."

While Binance did not offer a comment, CEO Changpeng Zhao highlighted the trend of U.S. institutions entering the crypto arena in a post on social media.

US institutions are moving into crypto. What about your country? pic.twitter.com/euNg4j42gg

— CZ ???? Binance (@cz_binance) November 10, 2023

Read More: BlackRock Ethereum Trust Formation Propels ETH Beyond $2K Mark

Trending

Press Releases

Deep Dives