Charting the Course: Historic Low in Crypto Trading Volume across the Americas

Top Stories

On September 7, 2023, the cryptocurrency landscape witnessed a flurry of noteworthy activity. In accordance with data from Crypto Insights, a leading digital asset information platform, there emerged a discernible dip in crypto spot trading, marking its lowest point since March 2019. This signals a period of sluggishness within the market. Over the course of August, spot trading volume on centralized exchanges saw a notable descent of 7.78%, totaling $475 billion. Concurrently, the volume of derivative transactions experienced a significant downturn of over 12%, culminating at $1.62 trillion, a figure not seen since 2021. Intriguingly, even substantial events like Grayscale's recent legal victory over the SEC failed to ignite substantial activity among traders. Crypto Insights keenly noted that "the reduced trading volume in spot transactions, coupled with the fluctuations in open interest data, indicate that speculation currently steers the market."

Mirae Asset Securities, a prominent figure in South Korean investment banking, has entered into a strategic partnership with the Polygon network to drive forward the tokenization of assets in the finance sector. Serving as a technical advisor, the Ethereum scaling network will collaborate with the $500 billion asset management powerhouse to establish the requisite infrastructure for the issuance, exchange, and distribution of tokenized securities. Tokenization involves representing tangible assets such as bonds, equities, and physical holdings as digital tokens, tradable on the blockchain. The underlying premise is that this approach will enhance the efficiency, transparency, and liquidity of transactions. Mirae now joins the ranks of institutions like Franklin Templeton in leading the way on tokenization initiatives on Polygon.

Cboe's BZX exchange has taken a significant stride by submitting the necessary documentation on Wednesday to list spot ether (ETH) ETFs from both Ark 21Shares and VanEck. In this endeavor, Coinbase will step in as the partner for sharing surveillance data for both products, mirroring its proposed role in a multitude of spot bitcoin (BTC) ETFs. Once the SEC acknowledges the submissions, it will have a 240-day period to reach a decision, a timeline it typically adheres to. Approval for either fund would mark the introduction of a spot ether ETF in the U.S., potentially paving the way for similar products linked to other cryptocurrencies. Nonetheless, the fate of ether ETF applications remains uncertain, as they may encounter the same pattern of ongoing evaluations and potential rejections by the SEC that has affected other cryptocurrency-related products.

Chart of the Day

Google Trends

Google Trends

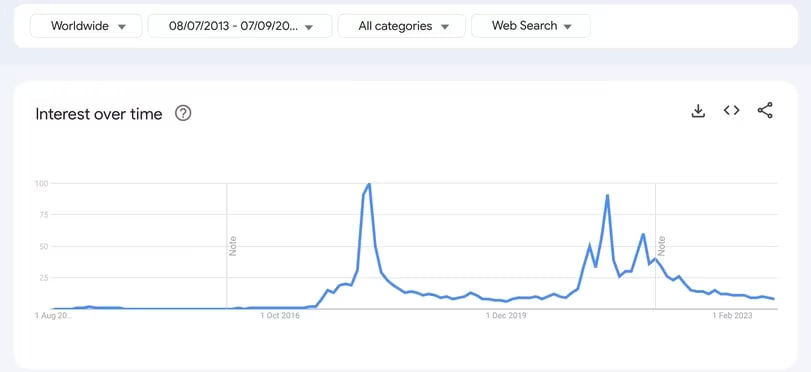

The graph illustrates the Google Trends data depicting the global search interest in "cryptocurrency" over the last decade.

This week, the figure dropped to eight, the lowest it's been in at least three years, indicating a diminishing overall interest in digital assets.

Google Trends is a commonly relied upon tool for assessing the public's or retail audience's interest in current trending subjects. Historically, low values have indicated the bottom of bear markets, whereas figures near 100 have signified the peak of bull markets.

Trending

Press Releases

Deep Dives