Cambridge BTC Energy Gauge: Refreshed Insights

The brilliant minds steering the ship of the widely recognized Cambridge Bitcoin Electricity Consumption Index (CBECI) have taken a considerable leap by orchestrating a methodological makeover. This transformative endeavor is the first major alteration the Index has seen since its inception in 2019, a move intended to elevate its precision and reliability to unprecedented heights.

Emerging onto the scene in the midsummer of 2019, the CBECI was conceived with a noble mission at its core - to serve as a beacon of data-driven insights into the energy-intensive realm of Bitcoin mining and its intricate dance with the environment.

In an exclusive conversation, the trailblazing researcher Alexander Neumueller elaborated on the pivotal role of the Index. He artfully described how it not only aspires to cast a discerning light on the quantum of electricity the Bitcoin network consumes but also strives to encapsulate this intricate data in a form that's as accessible as a morning newspaper for the man on the street.

Central to this methodological facelift is a laser-like focus on the latest advancements in Bitcoin mining hardware and the ever-shifting sands of hash rate dynamics. It's a deliberate effort to ensure that the CBECI remains a faithful mirror of the evolving landscape. The researchers embarked on a voyage of discovery into the enigma of hash rate spikes that have graced recent times, driven primarily by the entry of more robust mining equipment that left their predecessors trailing in their computational wake.

Neumueller and his intellectual comrades acknowledged the scarcity of comprehensive hardware data, acknowledging this gap as a formidable challenge to the exactitude of assessing the types and the extent of hardware harnessed by miners.

This challenge catalyzed the birth of a methodology that ingeniously conjures a daily hardware distribution, a digital oracle that draws from the real-world ballet of hardware performance and power consumption. Neumueller's sagacity shone as he highlighted that the foundation of the former CBECI methodology leaned on the assumption that all profitable hardware models unveiled within the last lustrum played an equal role in shaping the network's hash rate.

However, this seemingly straightforward assumption birthed an unforeseen quirk - an abundance of older mining hardware representation that overshadowed their newer counterparts, particularly during epochs of exceptionally prolific mining. The researchers, the enlightened voyagers they are, thus deduced the imperative for an evolution in the CBECI methodology.

Neumueller then unfolded the narrative of his team's rigorous cross-referencing of hash rate crescendos with import data from the United States - a mirror reflecting the influx of Bitcoin mining hardware. This narrative seamlessly intertwined with publicly available sales data from the mining hardware titan Canaan, weaving a rich tapestry of insights.

CBECI examined U.S. Bitcoin mining equipment import records (on the left) and approximated computational capability based on the import data (on the right). By utilizing hash rate (measured in TH/s) and manufacturer-stated gross weight, researchers evenly considered models like Canaan's Avalon A1246, Avalon A1266, Avalon A1346, and Avalon A1366 in their analysis.

CBECI examined U.S. Bitcoin mining equipment import records (on the left) and approximated computational capability based on the import data (on the right). By utilizing hash rate (measured in TH/s) and manufacturer-stated gross weight, researchers evenly considered models like Canaan's Avalon A1246, Avalon A1266, Avalon A1346, and Avalon A1366 in their analysis.

This meticulous analysis, akin to a symphony of interconnected variables, served as a crucible to scrutinize the hypothesis that the rise in network hash rate was the handiwork of newer mining hardware. Neumueller lent gravitas to this assertion, stating, "If Canaan's sales data indeed echoes the industry's sentiment, it reinforces our premise."

The discourse around Bitcoin unfurls like a tapestry with contrasting threads - critics warn that the cryptocurrency "jeopardizes environmental headway and could amplify climate change," whereas proponents extol the mining industry's potential as a climate change mitigator and harbinger of societal prosperity.

"Yet, the intricacies of this realm and the scarcity of comprehensive information often hover under the radar, leaving crevices for cherry-picked data and skewed viewpoints."

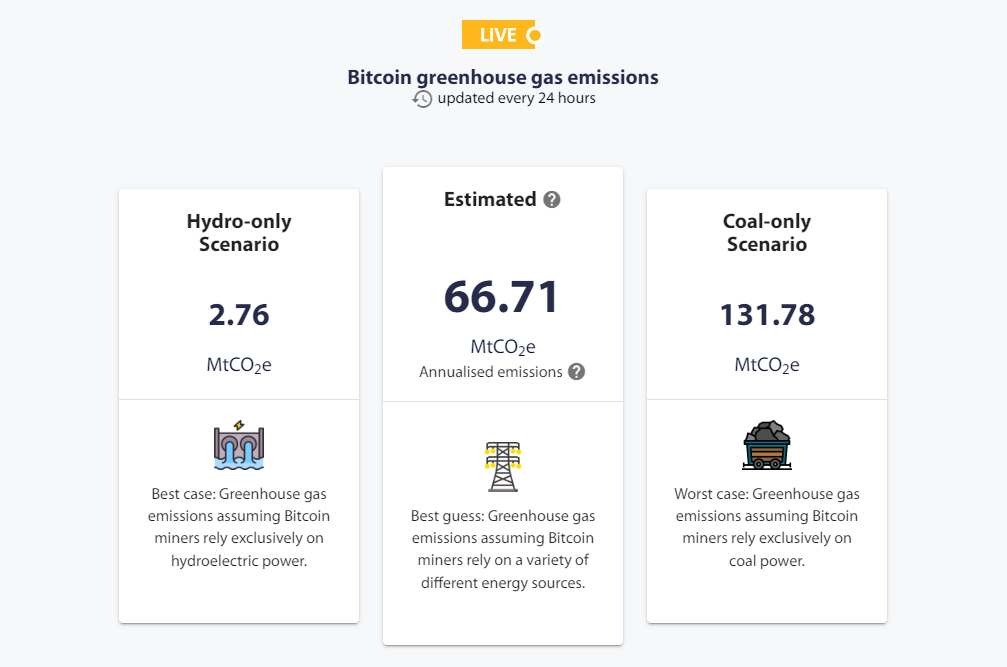

The CBECI unfurls like an elaborate mosaic, replete with an array of intricate data points and visually captivating insights. It presents a palette ranging from evaluating Bitcoin network power consumption to painting a vibrant cartography of the geographic distribution of Bitcoin's mining hash rate, culminating in an index quantifying greenhouse gas emissions.

Both the CBECI and the greenhouse gas emissions indexes present a triumvirate of estimates for each sector, conjuring a theoretical spectrum for these specific metrics.

Trending

Press Releases

Deep Dives