Bullish Bitcoin: Chart Chronicles and Miner Insights

Bitcoin has experienced a notably bullish trend in recent months, successfully surpassing multiple resistance levels. However, scrutinizing the concluding patterns of the preceding daily candles prompts an examination of the sustainability of this bullish momentum.

Exploring Bitcoin's Price Trends on the Daily Chart

An analysis of the daily chart reveals a breakthrough beyond the resistance levels at $37,500 and $40,000 since the onset of November. Despite this, there are indications of a slowdown in the market, with a bearish tone emerging early in the current week.

The $40,000 level is currently undergoing scrutiny, and a breach might precipitate a potential descent towards the $37,500 range and possibly even the more distant 200-day moving average at approximately $31,000. The Relative Strength Index has also emitted a distinct bearish signal by descending below the overbought territory.

Nevertheless, Bitcoin's value has initiated a recovery in recent hours, introducing an element of intrigue regarding the extent of this rebound.

Source: TradingView

Source: TradingView

Analysis of the 4-Hour Chart

A closer inspection of the 4-hour timeframe vividly illustrates a recent correction in the price trajectory. Following weeks of bullish momentum, the market has crafted a double-top pattern just shy of the $45,000 threshold, subsequently retracing to the $40,000 zone.

However, Bitcoin's price appears to be gearing up for a resurgence from this juncture, potentially aiming for the $45,000 range shortly. Conversely, a breach of the $40,000 support level could trigger a descent towards the $38,000 area and possibly lower in the ensuing weeks.

Source: TradingView

Source: TradingView

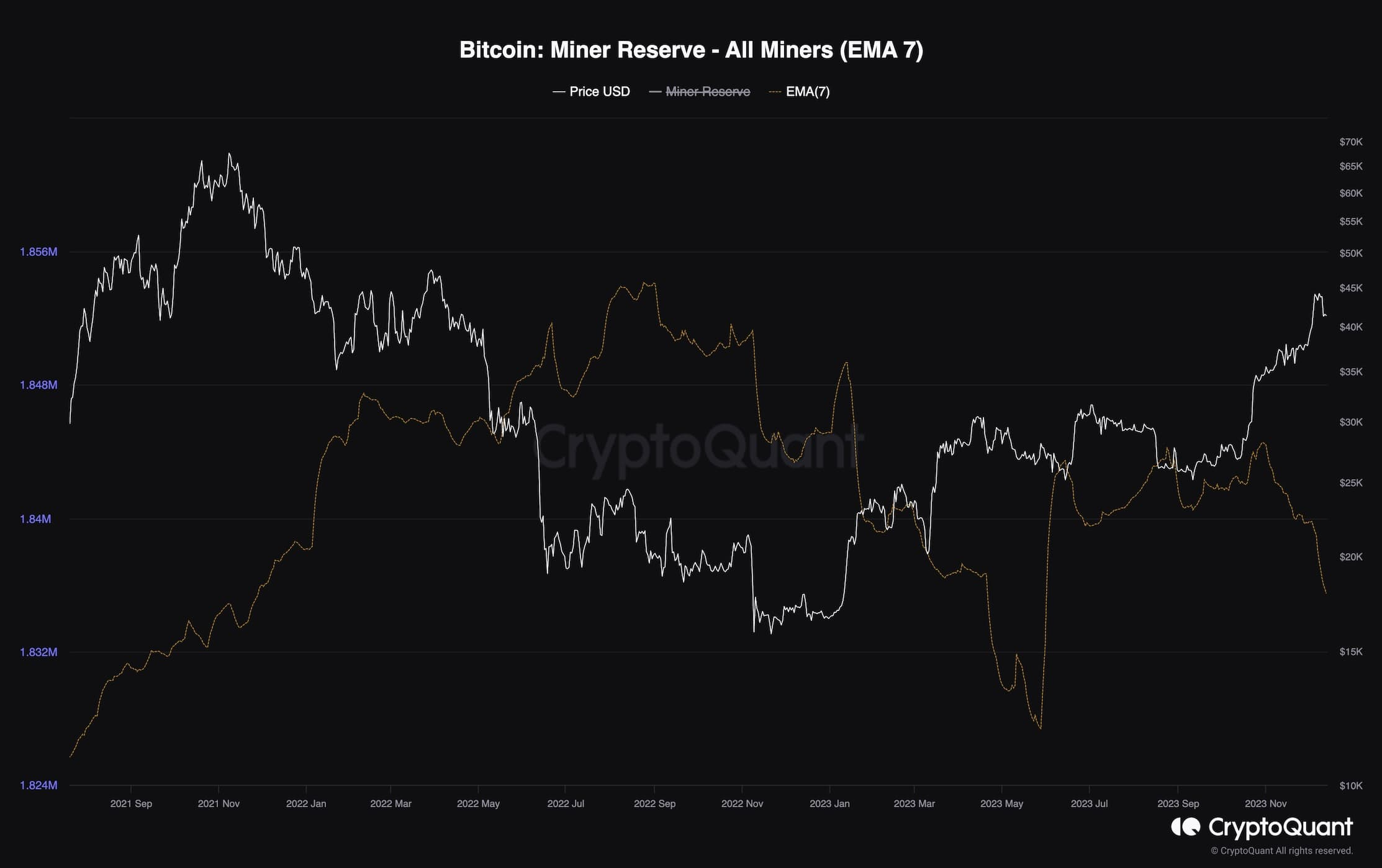

Bitcoin Miner Reserve (EMA 7)

Bitcoin's value has experienced a swift ascent in recent months following a bottom in the $17,000 range. Amidst speculation about whether BTC is poised for a new all-time high, scrutinizing miners' behavior offers valuable insights.

The chart illustrates the 7-day exponential moving average of the miner reserve metric, measuring the quantity of BTC stored in miners' wallets. An increase implies accumulation by miners, while declines signal pessimism as miners unload their Bitcoin.

Observing the chart, the metric has been swiftly decreasing after the price surpassed the $35,000 mark. This trend suggests that miners may anticipate a short-term price decline and consider Bitcoin to be currently overvalued.

Source: CryptoQuant

Source: CryptoQuant

Trending

Press Releases

Deep Dives