BTC's Legal Victory Fuels Market Momentum

Bitcoin (BTC), often represented by its ticker symbol, has undergone a remarkable turnaround, with its value bouncing back to $27,409 after a recent dip. This intriguing shift unfolded on the 29th of August, propelled by intriguing news that Grayscale, a prominent digital asset management firm, had emerged victorious in a legal tussle against the regulatory authorities in the United States.

Bitcoin to US Dollar (BTC/USD) 24-hour chart data sourced from TradingView.

Bitcoin to US Dollar (BTC/USD) 24-hour chart data sourced from TradingView.

The SEC's decision to reject the Bitcoin ETF was deemed as "unpredictable and arbitrary"

The regulatory player in question is none other than the U.S. Securities and Exchange Commission (SEC), which found itself on the wrong side of a ruling from the United States Court of Appeals. The court deemed the SEC's rejection of Grayscale's application to establish a Bitcoin-based exchange-traded fund (ETF) as "arbitrary and capricious." This conclusion stemmed from the SEC's inability to provide a coherent explanation for its divergent treatment of financial products that were quite similar in nature. It's worth noting that these legal intricacies are detailed in a document circulating online, though its authenticity remains unverified.

The reverberations of this legal development were felt across the Bitcoin trading landscape, injecting a fresh gust of excitement into an otherwise stagnant environment that had been grappling with losses since mid-August. In response to the court's verdict, the BTC price swiftly surged by $1,700 against the US dollar in a mere half-hour, a dynamic captured by TradingView's data tracking.

This pivotal court decision now positions Grayscale among the contenders aiming to introduce the inaugural U.S.-based spot Bitcoin ETF. However, it's worth tempering the enthusiasm as the SEC's endorsement of such applications remains elusive. As of my current knowledge, the BTC/USD pairing hovered around $27,300, briefly spiking to $27,723 on Bitstamp.

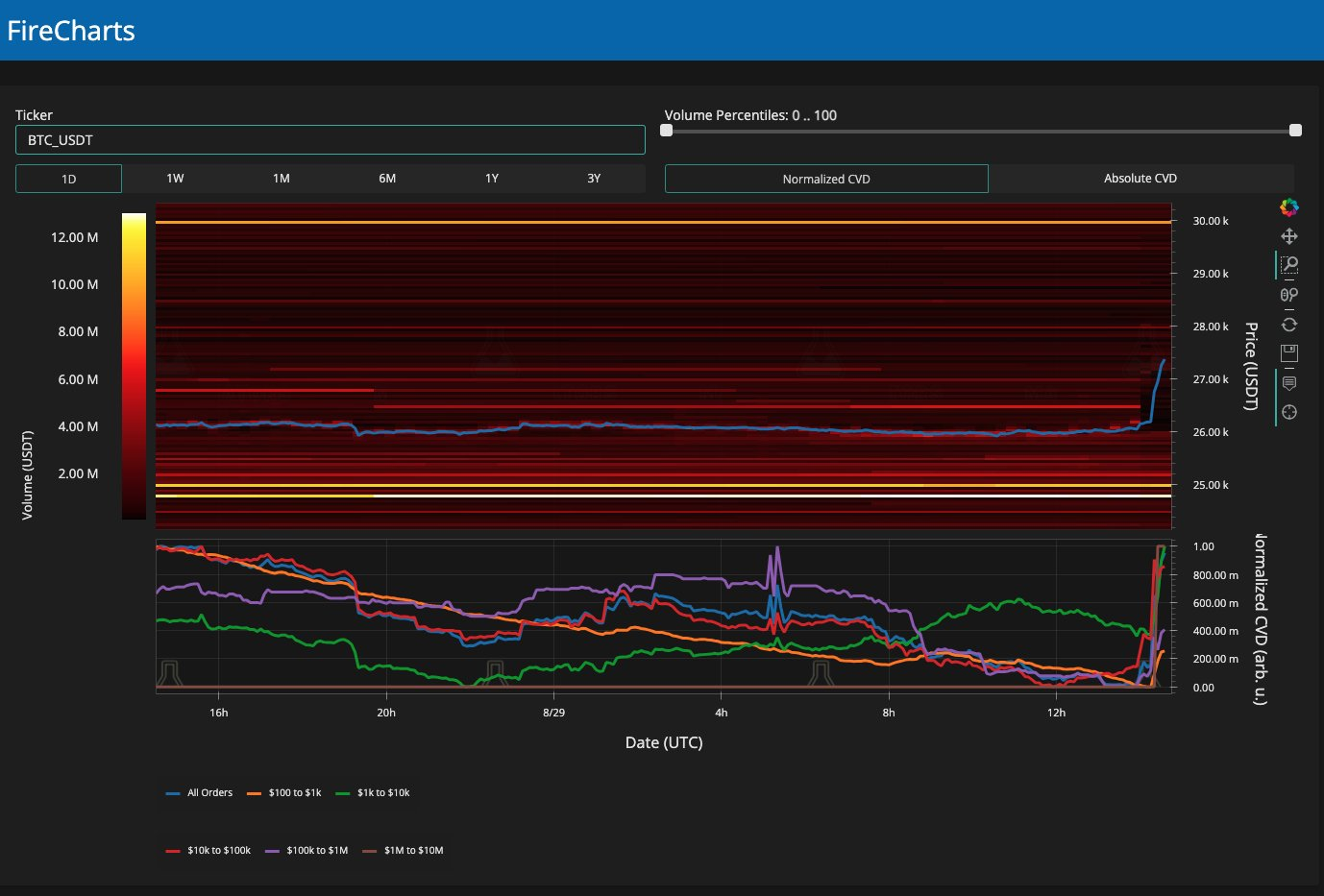

Insights gleaned from the Binance BTC/USD order book, graciously shared by monitoring resource Material Indicators on X (formerly known as Twitter), shed light on a surge in buying activity across all order categories. This occurrence was particularly noteworthy in the context of a market plagued by a notable lack of liquidity.

Bitcoin to US Dollar (BTC/USD) order book information sourced from Binance, provided by Material Indicators/X

Bitcoin to US Dollar (BTC/USD) order book information sourced from Binance, provided by Material Indicators/X

Intriguingly, an analysis published just before the Grayscale announcement acknowledged the presence of limited upward liquidity, hinting at potential prospects for revisiting the $30s territory. However, the prevailing sentiment in the market remained tinged with caution, stemming from concerns over the potential implications if Bitcoin were to experience further drops.

Analyst identifies BTC price as a potential trigger for a "bull cycle"

Adding a layer of speculation to the unfolding narrative, Michaël van de Poppe, the visionary founder and CEO of trading firm Eight, mused that this court decision might serve as a catalyst propelling the ongoing bull cycle forward. Sharing this perspective with his followers on X through a dedicated video update, he even ventured to suggest that this ruling could potentially cast a favorable light on the ETF application of BlackRock, a financial giant boasting the mantle of the world's largest asset manager.

Grayscale's protracted legal skirmish with the SEC, centering around the metamorphosis of their existing Bitcoin investment vehicle, the Grayscale Bitcoin Trust (GBTC), into an ETF, has finally borne fruit. CEO Michael Sonnenshein took to X to express heartfelt gratitude to the stalwart supporters and investors. He reassured them of the company's commitment to a thorough legal review in light of the court's opinion. Against this backdrop, the share price of GBTC experienced an impressive surge of over 17%, reaching a commendable $20.60 on the 29th of August.

Chart depicting Grayscale Bitcoin Trust (GBTC) performance over a 24-hour period, sourced from TradingView

Chart depicting Grayscale Bitcoin Trust (GBTC) performance over a 24-hour period, sourced from TradingView

Trending

Press Releases

Deep Dives