BTC's Inflation-Defying Journey

Bitcoin's Resilience: Still Standing Strong Despite Time and Inflation BTC, The Pioneer Cryptocurrency Market Index: $26,103

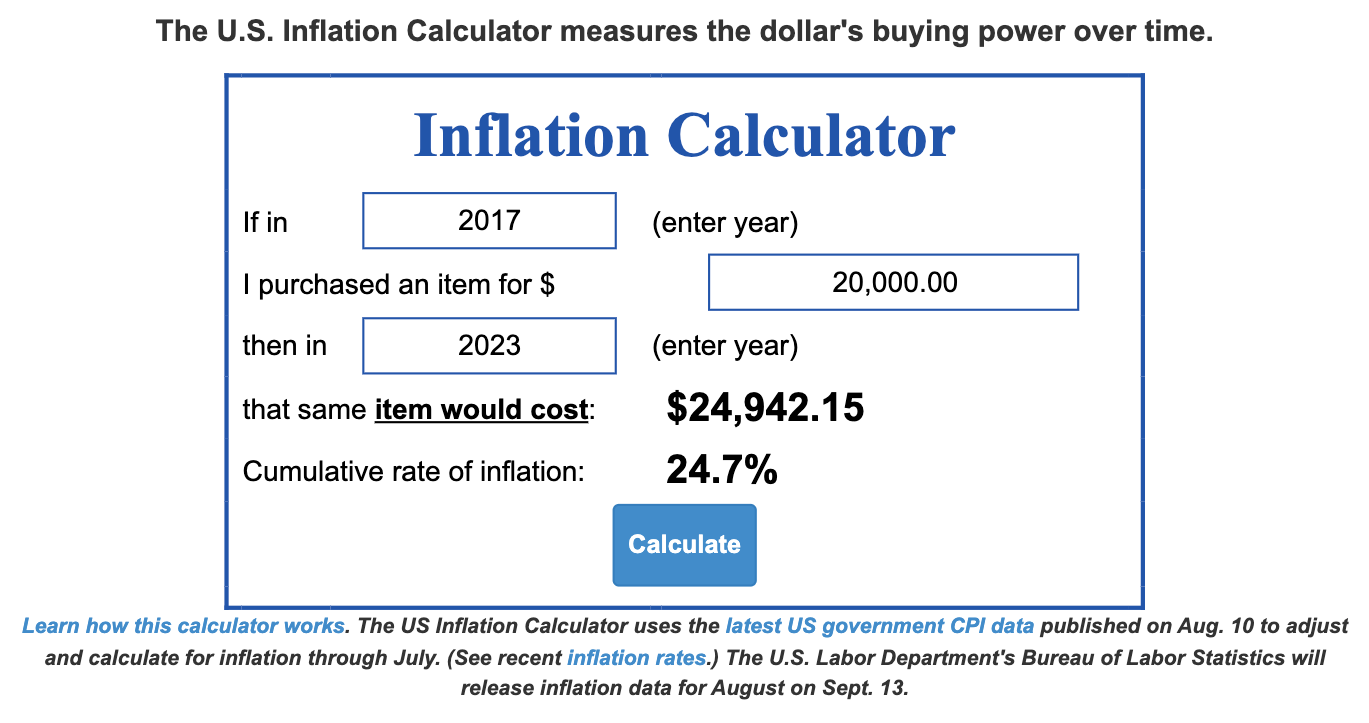

Maintaining its value at around $20,000, even after the passage of nearly six years since it initially breached this milestone, Bitcoin (BTC) remains an intriguing case when factoring in inflation. Analysts, utilizing reputable sources including the U.S. Inflation Calculator, have discerned that BTC's value trajectory has essentially remained stagnant since 2017.

It's worth noting that BTC's present valuation hovers "just above" its historical 2017 peak

While it has flirted with the $20,000 threshold since achieving an all-time high in 2017, BTC/USD has experienced remarkable highs of up to $69,000 in the interim.

However, adopting an inflation-adjusted lens significantly alters the narrative surrounding BTC's price movements. As of August 25, 2023, the value of $20,000 worth of BTC bought in 2017 has matured to $24,942.

In essence, the prevailing Bitcoin market price of $26,050 sourced from TradingView reflects six years of ostensibly unchanging BTC price dynamics.

One-month graphical representation of BTC/USD movements, sourced from TradingView.

BTCGandalf, an enigmatic marketing executive at the Bitcoin mining firm Braiins, mused on this matter, stating, "When adjusted for inflation, bitcoin barely surpasses its market zenith of 2017."

Insights from other experts underscore that this computation rests on official inflation metrics, implying that, in practical terms, BTC/USD might even sit below its preceding cyclical pinnacle.

Some observers amusingly concluded that these figures accentuate Bitcoin's competence as a repository of value. BTCGandalf went on to express astonishment at the limited coverage this issue has garnered.

Meanwhile, the U.S. National Debt Clock indicates a staggering national debt in excess of $32.7 trillion.

Information from the U.S. Inflation Calculator (screenshot provided) obtained from usinflationcalculator.com.

Information from the U.S. Inflation Calculator (screenshot provided) obtained from usinflationcalculator.com.

Bitcoin's Path Post-Jackson Hole Symposium

In the United States, concerns about inflation continue to command the attention of risk-savvy investors, including cryptocurrency enthusiasts.

As official data suggests a moderation in inflation, optimism hinges on the Federal Reserve's alignment of economic strategies with actual circumstances.

Come August 25, Fed Chair Jerome Powell is slated to deliver a policy statement at the annual Jackson Hole Economic Symposium — an affair keenly monitored by those anticipating a shift in the prevailing BTC price equilibrium.

"Anticipating a trial of the lows and the potential for volatile fluctuations," noted Keith Alan, co-founder of monitoring resource Material Indicators, in a segment of a notable commentary.

"A double bottom could offer a sturdy base for a rebound. A dip to a lower low might pave the way to a 'bearadise.'"

An accompanying chart presented the BTC/USD order book on Binance, revealing a notable scarcity of substantial liquidity beyond the $25,000 mark, thereby amplifying the likelihood of swift price swings.

BTC/USD order book statistics originating from Keith Alan/X on Binance.

BTC/USD order book statistics originating from Keith Alan/X on Binance.

Trending

Press Releases

Deep Dives