BTC Market Dynamics and Sentiment Analysis

Bitcoin, the well-known digital currency often referred to by its ticker BTC, has recently witnessed a noticeable dip in its value, now standing at approximately $27,085. Traders, in response to this decline, seem to be displaying behavior reminiscent of the bear market bottom experienced in 2022, as recent research suggests a prevailing sense of uncertainty within the market.

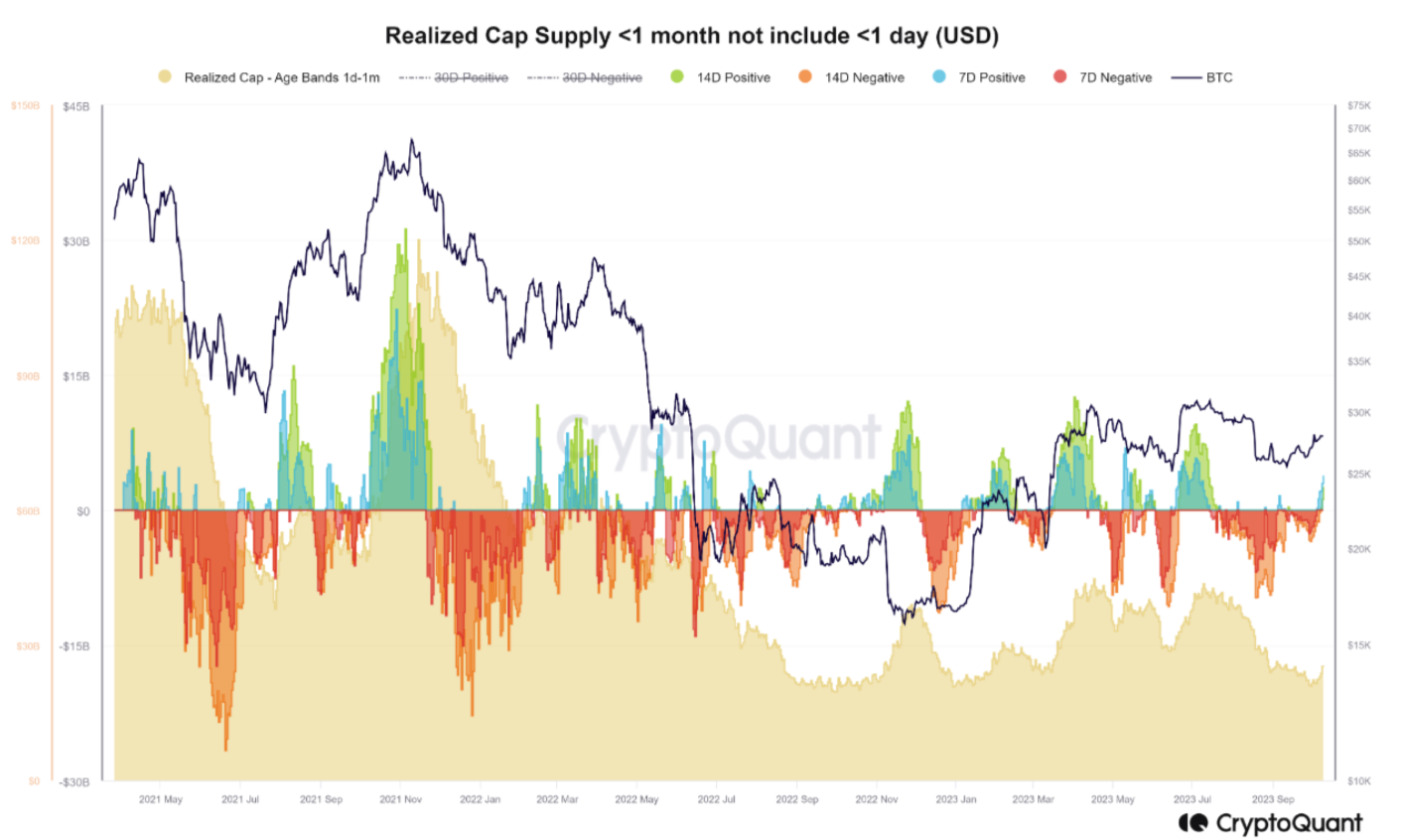

A market update by CryptoQuant on October 9 delved into this shift, highlighting a significant drop in the realized capitalization of the most active segment of BTC supply. The implications of this drop are being closely examined.

The realized capitalization of BTC supply that's just a month old completes a cycle

This year has been a year of heightened scrutiny for Bitcoin's more speculative investor cohorts. This scrutiny is particularly amplified as BTC price experiences a multitude of diverse scenarios and trends.

Presently, the spot price hovers around the aggregate cost basis for what is known as short-term holders (STHs). These are defined as entities holding a specific amount of BTC for a duration of 155 days or less.

Additionally, CryptoQuant has revealed a stark decline in the realized capitalization of coins that were last transacted between 24 hours and one month ago. This recent trend in the realized capitalization is a significant point of interest.

Realized cap, a metric representing the combined value in U.S. dollars of a specific group of Bitcoins used in various transactions, has seen a decline in the value of the cohort ranging from one-day to one-month (1D-1M). Analyzing this cohort is believed to provide valuable insights into the broader BTC price actions, according to CryptoQuant.

Contributor Binh Dang elaborated, stating, “In my opinion, this dataset effectively mirrors the fluctuations in Bitcoin's market price, showcasing recently acquired coins before they transition into long-term holdings or are actively traded in the short term.”

Reflecting on historical data, during the late months of 2022 when BTC/USD faced a significant dip to two-year lows, the realized cap of the 1D-1M cohort fell below the $20 billion mark. Conversely, during a peak Bitcoin period in July, just shy of $32,000, the realized cap more than doubled, reaching approximately $44 billion.

Binh emphasized that this figure has now regressed back to levels reminiscent of the bear market, albeit showing slight signs of recovery, hovering in the proximity of the $20 billion mark.

“The present changes in this data (highlighted in blue and green) reveal an inconsistent recovery, partly influenced by the overall market sentiment, encompassing macroeconomic and geopolitical concerns,” Binh continued, offering insights alongside an illustrative chart.

Bitcoin realized cap supply data (screenshot). Source: CryptoQuant

Bitcoin realized cap supply data (screenshot). Source: CryptoQuant

Newcomers to Bitcoin should not anticipate a repeat of Q1 profit levels

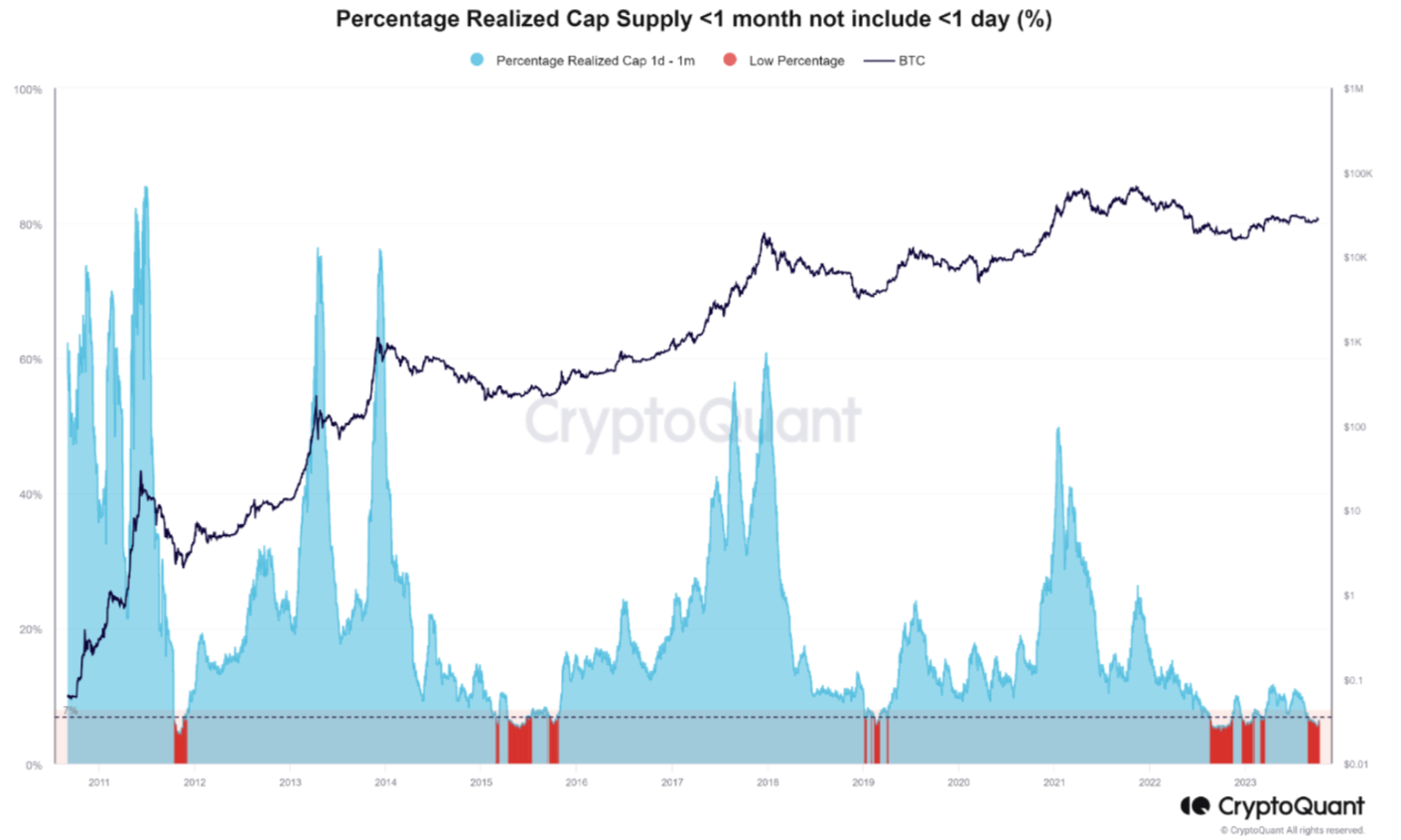

Since September 2022, a significant floor has been established for the 1D-1M group at $20 billion. However, it's important to temper expectations, as a robust bounce back to previous highs may not be on the immediate horizon.

Banh emphasized, “The market is likely to retain its uncertain nature if these data do not exhibit substantial and positive trends leading up to the end of the year.”

“Predicting the volatility remains a challenge; therefore, newcomers to the market should not expect continual and substantial price surges akin to those witnessed in the first half of this year.”

Similarly, an examination of the percentage of the aggregate realized cap accounted for by 1D-1M coins reveals intriguing insights into market trends.

Bitcoin 1D-1M cohort realized cap % chart (screenshot). Source: CryptoQuant

Bitcoin 1D-1M cohort realized cap % chart (screenshot). Source: CryptoQuant

Read more: Bitcoin's Bold Trajectory: Hayes' Insights

Trending

Press Releases

Deep Dives