Block's Resounding Success: Q3 Earnings Report Unveiled

On a crisp autumn day, Block, the Bitcoin-focused fintech company helmed by the visionary Jack Dorsey, made headlines by releasing its eagerly awaited Q3 earnings report on November 2. The report not only exceeded the expectations of industry analysts but also illuminated a path to a highly profitable quarter.

During this third quarter of 2023, Block saw its revenue soar to an impressive $5.62 billion, thanks in no small part to the stellar performance of its Cash App and Square divisions. This remarkable financial success was further highlighted by a $44 million windfall in profits from Block's Bitcoin holdings, now valued at a remarkable $34,260 per BTC unit, a significant increase driven by the recent surge in Bitcoin prices.

In a carefully crafted shareholder letter, Jack Dorsey, the maestro behind the Block symphony, provided valuable insights into the company's strategic direction and future plans, with a particular focus on Square's role in this grand vision. Among the key financial metrics shared, Dorsey revealed that Block had given the green light for a substantial $1 billion share repurchase program, aimed at offsetting any potential dilution arising from share-based compensation.

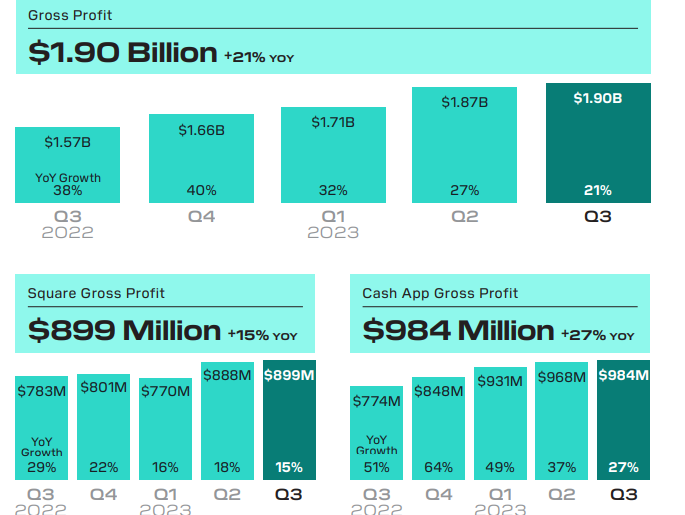

The financial achievements of the third quarter were truly remarkable. Block reported a gross profit of $1.90 billion, showcasing a robust 21% year-over-year growth. Cash App, the popular mobile payment service, contributed significantly with a gross profit of $984 million, marking a remarkable 27% increase year-over-year. Meanwhile, Square, the other financial pillar of Block, contributed a substantial gross profit of $899 million, exhibiting a commendable 15% year-over-year growth.

Block’ Q3 profits. Source: Block

Block’ Q3 profits. Source: Block

An intriguing facet of Block's earnings was the pivotal role that Bitcoin played, accounting for nearly 43% of the company's total revenue, reaching an impressive $5.6 billion. This impressive showing was bolstered by unwavering consumer demand and a climate of positive spending in the market.

Delving into Block's Bitcoin-related figures, we discover that the company raked in a noteworthy gross profit of $45 million, marking a commendable 22% year-on-year increase. This growth was attributed to the sale of $2.42 billion worth of BTC to eager customers via the Cash App platform, making up 2% of Bitcoin revenue. Block confidently asserted that the surge in BTC revenue was directly correlated to the rising market price of Bitcoin and the quantity of Bitcoin units sold to its valued customers.

In an equally reassuring development, Block proudly declared that it had not suffered any impairment losses on its Bitcoin holdings during the quarter, building on the previous quarter's success. As of September 30, 2023, the carrying value of Block's Bitcoin investments stood at $102 million, while their fair value, determined by observable market prices, reached an impressive $216 million, marking a substantial $114 million surplus over the carrying value, a testament to Block's strategic foresight and prudent financial management.

Read more about: Financial Fusion: Tether's Strategic Surge in Bitcoin Mining

Trending

Press Releases

Deep Dives