Blockchain Bulletin: Unraveling the Cryptoverse

Crypto exchange-traded products (ETPs) have recently witnessed a surge in investor interest, marking their most substantial weekly influx in over a year, as reported on October 30 by the asset management platform CoinShares. It's important to note that this increase in interest occurred against a backdrop of market dynamics and speculative fervor that have kept the crypto world abuzz.

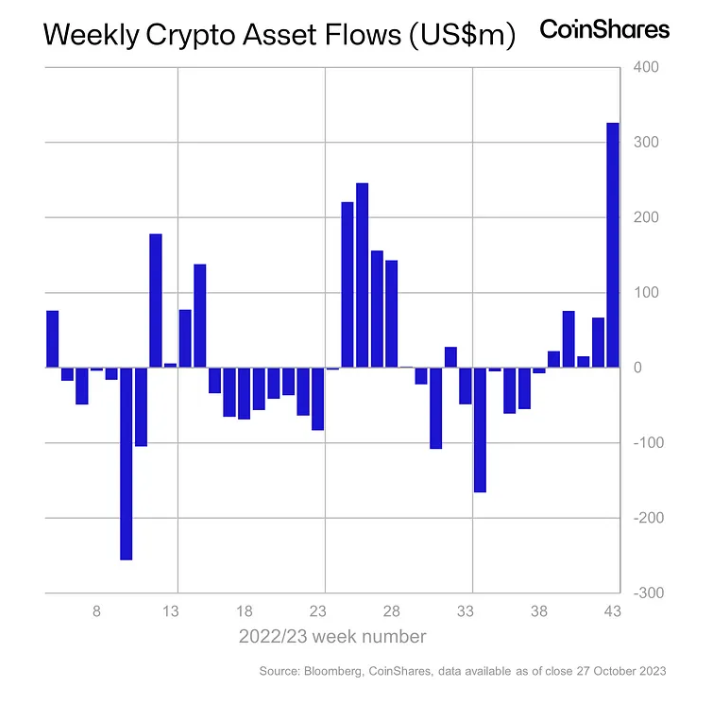

During the week ending on October 27, a staggering $326 million flooded into these ETPs, leaving the previous week's meager $66 million inflow in the dust. This substantial influx certainly raises eyebrows and piques curiosity, especially when considering the volatile nature of the crypto market.

???? Digital asset investment products saw inflows of US$326m, the largest single week of inflows since July 2022!

— CoinShares (@CoinSharesCo) October 30, 2023

???? These numbers are due to what we believe was rising optimism from investors that the US SEC is poised to approve a spot-based Bitcoin ETF in the US.

– #Bitcoin –… pic.twitter.com/AbgsgjcaOz

To provide a bit of context, ETPs are essentially investment vehicles that offer a unique way to gain exposure to the price movements of various assets. In the realm of crypto ETPs, they typically mirror the values of high-market-cap cryptocurrencies, the most notable being Bitcoin, which is currently dancing around

$34,412, and Ether, valued at approximately $1,800. Investors seem to favor the convenience and security of accessing crypto price movements through these ETPs, rather than the hassle of managing the assets themselves. This preference may also be driven by the ease with which ETP shares can be managed within traditional brokerage accounts.

Delving further into the mechanics, an ETP experiences an "inflow" when its price surges ahead of its underlying asset. This prompts the ETP to acquire more of the asset, a situation often interpreted as a bullish indicator for the underlying asset. Conversely, an "outflow" scenario unfolds when the ETP needs to divest its assets due to declining note or share values relative to their target, a signal generally viewed with caution as it may indicate a bearish trend.

The data from CoinShares' report presents an intriguing narrative: the weekly inflows for the week ending on October 27 were not just significant but also the highest they've been since July 2022. Yes, that's approximately 15 months ago. The week in question also marked the fifth consecutive week of ETP inflows, suggesting that this trend has been steadily gaining momentum.

Weekly crypto fund flows in 2023 as of Oct. 27. Source: CoinShares

Weekly crypto fund flows in 2023 as of Oct. 27. Source: CoinShares

Now, what might be fueling this remarkable surge in investor interest? One potential explanation, as pointed out by CoinShares, could be the mounting optimism among investors regarding the possible approval of a spot-based Bitcoin ETF in the United States by the U.S. Securities and Exchange Commission (SEC). If this anticipation materializes into reality, it could indeed lead to increased inflows into U.S.-based funds, serving as a testament to the power of regulatory decisions on market sentiment.

Despite the apparent enthusiasm, it's essential to keep things in perspective. While this week's increase in inflows was indeed significant, CoinShares noted that it only ranked as the 21st largest on record. Furthermore, the lion's share of these considerable weekly inflows found its way into Bitcoin ETPs, representing a whopping 90% of the total. This substantial allocation to Bitcoin suggests a strong bullish sentiment around the pioneer cryptocurrency.

Not to be overlooked, Solana's SOL token, currently valued at $39, also joined in the rally, enjoying an inflow of $24 million. However, not all crypto assets were so fortunate. Ether funds, for instance, experienced a reverse flow, with $6 million worth of outflows, highlighting that investor sentiment can indeed vary across the crypto landscape.

In the backdrop of these developments, it's worth noting that despite multiple applications being filed over the years, the SEC has yet to grant approval for a spot Bitcoin ETP. Recent efforts by Van Eck, who amended their application on October 19, and Hashdex, who engaged in discussions with the SEC on October 25, underscore the persistent efforts to navigate the regulatory landscape for crypto ETPs. The journey towards regulatory approval continues, and the crypto market remains a space filled with both promise and challenges.

You might also like: Crypto Currents: Navigating the Digital Financial Landscape

Trending

Press Releases

Deep Dives