Bitcoin's Wall Street Premiere: A Tale of Tears and $83M Liquidations

The debut of Bitcoin exchange-traded funds (ETFs) in the United States marked a significant milestone, with trading volumes reaching an impressive $4.6 billion on the first day. Contrary to the initial expectations of a sell-the-news scenario, the introduction of these ETFs had a profound impact on both long and short Bitcoin futures bets, totaling a substantial $80 million. However, the rapid and unpredictable movement of prices posed challenges for futures speculators navigating the heightened market volatility.

As ETF trading commenced, Bitcoin prices surged briefly, surpassing the $49,000 mark and sparking a wave of bullish sentiment and leveraged bets. This surge extended to other major cryptocurrencies, such as ether (ETH) and Solana's SOL, which experienced substantial increases of up to 10% within a few hours.

Despite the initial optimism, Bitcoin's trajectory took a reversal, dampening the enthusiasm among investors. Observers linked the considerable trading volumes, reaching into the hundreds of millions, to the Grayscale Bitcoin ETF. However, speculations arose that a significant portion of the activity was driven by sellers.

Re what all these dollars flying around means. For the 10 fresh ETFs volume = buying btc today. Clear cut. But, GBTC volume prob ALL selling and maybe $BITO has some too so likely a lot offsetting going on. Just my take tho, not 100%, we'll know more when flows hit tonight

— Eric Balchunas (@EricBalchunas) January 11, 2024

Consequently, prices retraced to as low as $45,700, revisiting levels observed before the ETFs became tradable. Since late Thursday, Bitcoin has struggled to surpass the $47,000 mark.

The Grayscale Bitcoin ETF, an uplisting of the now-defunct Bitcoin trust product, played a role in the turbulent dynamics of the market. This product, holding spot Bitcoin in each share, had consistently traded at a discount to its holdings-to-share value throughout 2023.

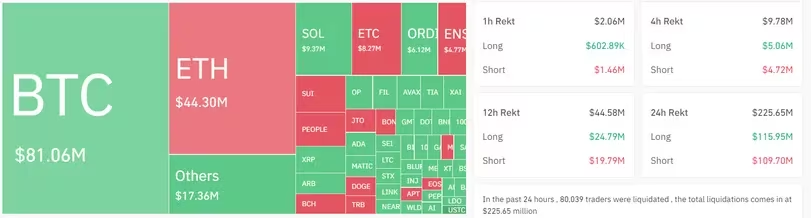

The resultant price whipsawing triggered substantial liquidations for both long and short Bitcoin futures traders, totaling a noteworthy $83 million. The impact reverberated across various platforms, with Binance facing the highest exposure.

Coinglass Chronicles: Unraveling Bitcoin and Major Cryptocurrency Futures Liquidations

Coinglass Chronicles: Unraveling Bitcoin and Major Cryptocurrency Futures Liquidations

The downward movement in Bitcoin initiated a domino effect, affecting other futures products and resulting in over $230 million in liquidation losses. Notably, this occurred despite the overall market maintaining a relatively flat performance over the past 24 hours.

In this context, liquidation refers to the forceful closure of a trader's leveraged position by an exchange due to a partial or total loss of the initial margin. Traders encountered difficulties meeting the margin requirements, leading to the closure of leveraged positions when there were insufficient funds to sustain the trades.

Read More: Grayscale's Milestone: Launching the Inaugural Spot Bitcoin ETF for Trading

Trending

Press Releases

Deep Dives