Bitcoin's Upward Journey: Factors at Play

Bitcoin (BTC) takes a dip to $27,048 on the tickers, but surprisingly, its value rallies by over 3% today, spurred by a sharp upward candle, reaching $27,300. This surge marks a one-week peak, manifesting a 4% gain for September.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Let's delve into the factors fueling this Bitcoin price surge.

Possibly, liquidations are propelling the surge in Bitcoin's price

Concurrently with the rally, the BTC supply on exchanges remains lower than the September 4 peak. Exchanges have witnessed a reduction of over 40,000 Bitcoins since that monthly high.

BTC balance on exchanges. Source: Coinglass

BTC balance on exchanges. Source: Coinglass

The market interprets the movement of coins out of crypto exchanges as a bullish sign, given that traders tend to withdraw their BTC for long-term self-custody.

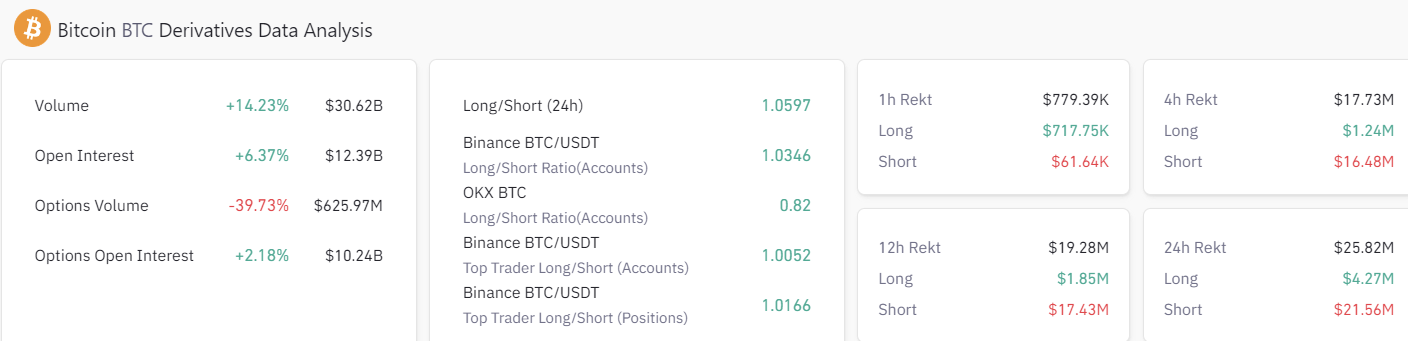

As Bitcoin continues to depart from exchanges, liquidations exert a notable influence on its price. In the past 24 hours alone, shorts worth a staggering $21.5 million BTC have been liquidated, with a substantial $17.4 million in shorts liquidated within a 12-hour span.

Bitcoin liquidation data. Source: Coinglass

Bitcoin liquidation data. Source: Coinglass

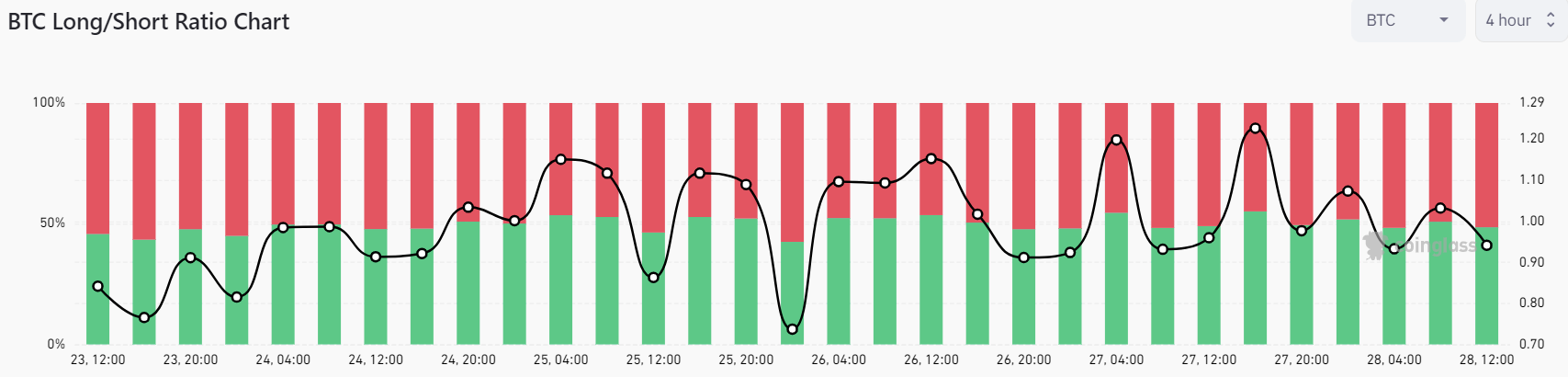

Despite the losses incurred by short-sellers, 51.5% of the futures market remains bearish on Bitcoin. With this persistent skewed short ratio, a potential opportunity for a short-squeeze may arise, potentially driving the price even higher.

Bitcoin short vs. long ratio. Source: Coinglass

Bitcoin short vs. long ratio. Source: Coinglass

Institutional interest in Bitcoin strengthens investor confidence

Following the U.S. Court of Appeals Circuit Judge Neomi Rao siding with Grayscale Bitcoin Trust (GBTC) in its case against the U.S. Securities and Exchange Commission (SEC) on August 29, numerous major institutions have applied for ETFs. Despite this ruling, Gary Gensler has stood firm, refraining from categorizing Bitcoin as a commodity while testifying to Congress on September 27, reiterating that BTC is not a security.

Recent growth in institutional interest towards Bitcoin is evident from companies like BlackRock and Fidelity Investments. Both institutions, although experiencing delays in BTC spot ETF approvals on September 2, witnessed a filing by the $1.5 trillion asset manager Franklin Templeton with the SEC for a spot Bitcoin ETF on September 12.

To date, the SEC has declined approval for a spot Bitcoin ETF, despite multiple applicants, including BlackRock, Fidelity, Cathie Wood’s ARK, and 21Shares, which has applied for approval three times.

BlackRock stands as the world’s largest asset manager, overseeing assets exceeding $8.5 trillion. According to the SEC filing, the firm intends to utilize Coinbase for custodying the BTC in the trust.

The SEC had set an October 16 deadline for deciding on the next round of ETFs but chose to postpone this deadline preemptively on September 25, ahead of Gensler’s testimony.

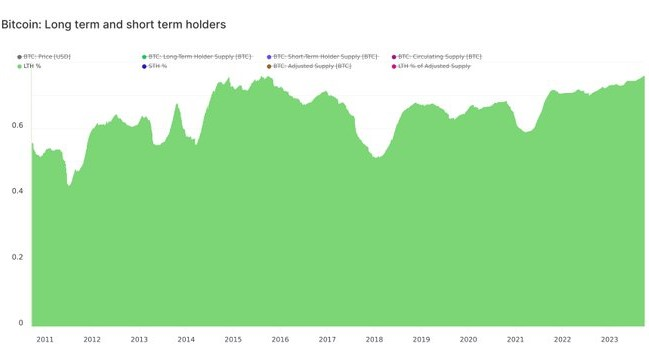

The percentage of Bitcoin held by long-term investors reaches a record peak

The metric for long-term Bitcoin holders has soared to an all-time high, reaching 76.1% of the total outstanding BTC supply on September 28.

Bitcoin long-term holders. Source: Glassnode

Bitcoin long-term holders. Source: Glassnode

While Bitcoin exhibits bullish momentum today, the Bitcoin Fear & Greed Index indicates that the market remains largely fearful, despite a 7-point increase compared to the previous month.

Bitcoin Fear & Greed Index. Source: Alternative.me

Bitcoin Fear & Greed Index. Source: Alternative.me

You might also like: BTC ETF Delays: Regulatory Outlook

Trending

Press Releases

Deep Dives