Bitcoin's Trigger: Path to $1M

Bitcoin (BTC), the renowned cryptocurrency with the ticker BTC, has experienced a recent downturn in value, currently settling at $34,149. Nevertheless, it stands at a pivotal juncture, as highlighted by Arthur Hayes, the former CEO of BitMEX, in his extensive blog post titled "The Periphery," which was unveiled on October 24.

Escalating global conflicts leading to inflationary pressures that impact the values of both Bitcoin and gold

In his comprehensive analysis, Hayes accentuates that Bitcoin is already sending signals to the financial markets, providing glimpses of what the future may hold. He emphasizes the mounting risk of "global wartime inflation," a consequence of the United States' involvement in two ongoing conflicts, which are steadily pushing the world towards heightened global tensions. Hayes underscores the peculiar timing of these events, as the Federal Reserve of the United States wrestles with stubborn inflation and refrains from raising interest rates. This scenario is further compounded by the looming specter of a "bear steepener" in the economic landscape.

Hayes delves into the intricate interplay of financial institutions' hedging needs and the US military's borrowing requirements in the US Treasury market. If long-term US Treasury bonds cease to offer investors a safe haven, they will undoubtedly seek out alternative assets. Gold and, more prominently, Bitcoin emerge as attractive alternatives due to the deep-seated concerns regarding the potential ramifications of global wartime inflation.

The evidence supporting these claims is substantial, with BTC/USD experiencing a noteworthy 15% surge within the current week. This surge closely follows the address delivered by U.S. President Joe Biden, addressing the ongoing conflicts in Ukraine and Israel.

Hayes underscores his assertions by reiterating that "Immediately after President Biden's speech, Bitcoin, in tandem with gold, experienced a robust rally despite a significant sell-off in long-term US Treasuries." It is crucial to understand that this is not a mere speculative reaction to the potential approval of an exchange-traded fund (ETF). Instead, Bitcoin is astutely anticipating a future scenario characterized by rampant global inflation brought on by a world war.

Arthur Hayes has a well-established reputation for offering insights into the post-COVID-19 global economic landscape and the potential era of inflation that might ensue. He confidently predicts that these factors will ultimately propel Bitcoin to a staggering price tag of $1 million, a forecast that has recently gained substantial traction on social media platforms. This prediction hinges on the concept of yield curve control (YCC), a strategy already being implemented in Japan to manage economic conditions.

The bond vigilantes are yelling “down with the dollar.”

— Arthur Hayes (@CryptoHayes) October 23, 2023

Look out for my spicy essay “The Periphery” dropping this week where I discuss the Hamas vs. Israel war, the US Treasury market, and $BTC.

YCC = $1mm $BTC is in full effect.

Yachtzee!!! pic.twitter.com/1ABcW1esaf

The blog post concludes by suggesting that when yields become excessively high, the Federal Reserve will need to acknowledge that the US Treasury market does not truly operate as a free market. Instead, it will be subject to regulation, allowing for the fixing of interest rates at levels that align with political expediency. This realization will serve as the catalyst for a robust bull market in Bitcoin and the broader cryptocurrency sphere, ultimately prompting a shift away from short-term US Treasury bills and toward cryptocurrency investments.

Dalio cautions about decisions that come with a substantial price tag

Moreover, billionaire investor Ray Dalio, the esteemed founder of Bridgewater Associates, the world's largest hedge fund, has recently sounded the alarm about a potential "World War III." He estimates the likelihood of such a catastrophic event at 50% and underscores the need for global leaders to exercise restraint. He astutely points out that alliances formed during times of conflict can be notably costly and may inadvertently draw non-participating countries into the conflict, potentially escalating local wars into global conflagrations.

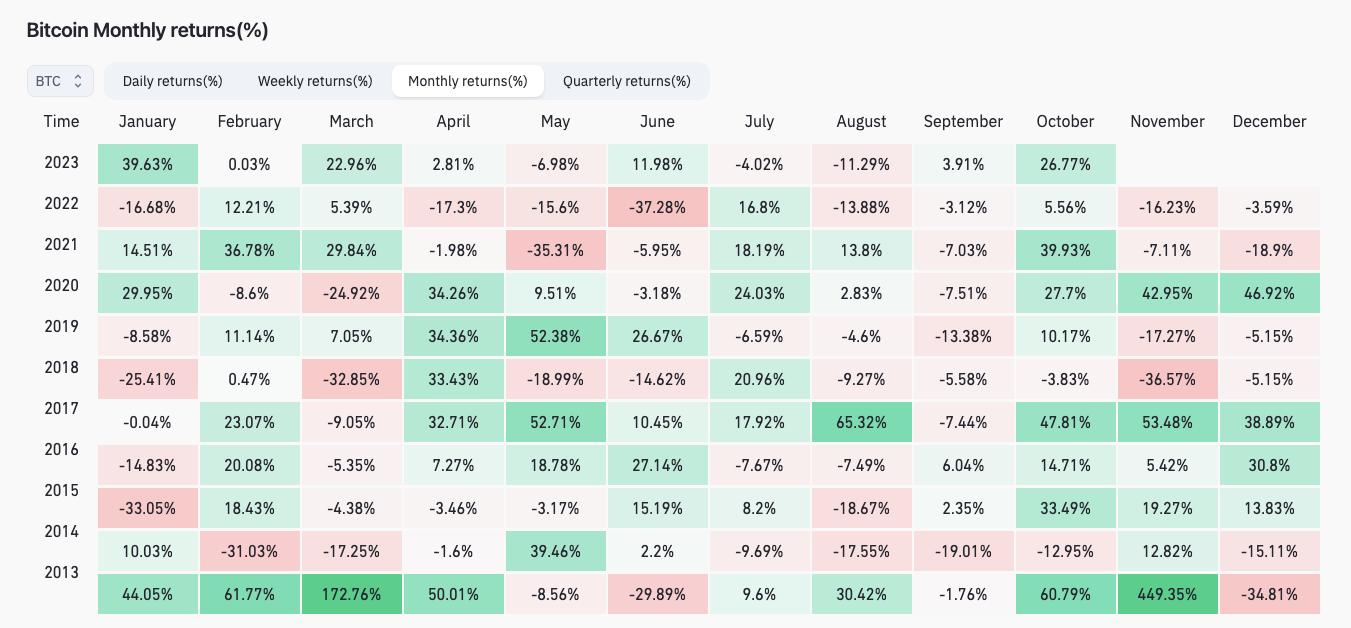

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

In this backdrop, the cryptocurrency market has also been abuzz with expectations surrounding the approval of an exchange-traded fund (ETF). These factors, combined with other market dynamics, have contributed to Bitcoin's notable price surge of 27% in October, resulting in remarkable year-to-date growth exceeding 100%, as reported by the data compiled by CoinGlass.

Read more about: Financial Disclosure Fine: BlackRock's Penalty

Trending

Press Releases

Deep Dives