Bitcoin's Trajectory: A Glimpse into 2025

Bitcoin, the famed cryptocurrency denoted by BTC, has recently seen a dip, settling at the mark of $28,673. Yet, an array of analytical models enthusiastically suggest that its value is on the verge of a substantial upswing, potentially reaching a remarkable $128,000 or even exceeding this figure by the culmination of 2025.

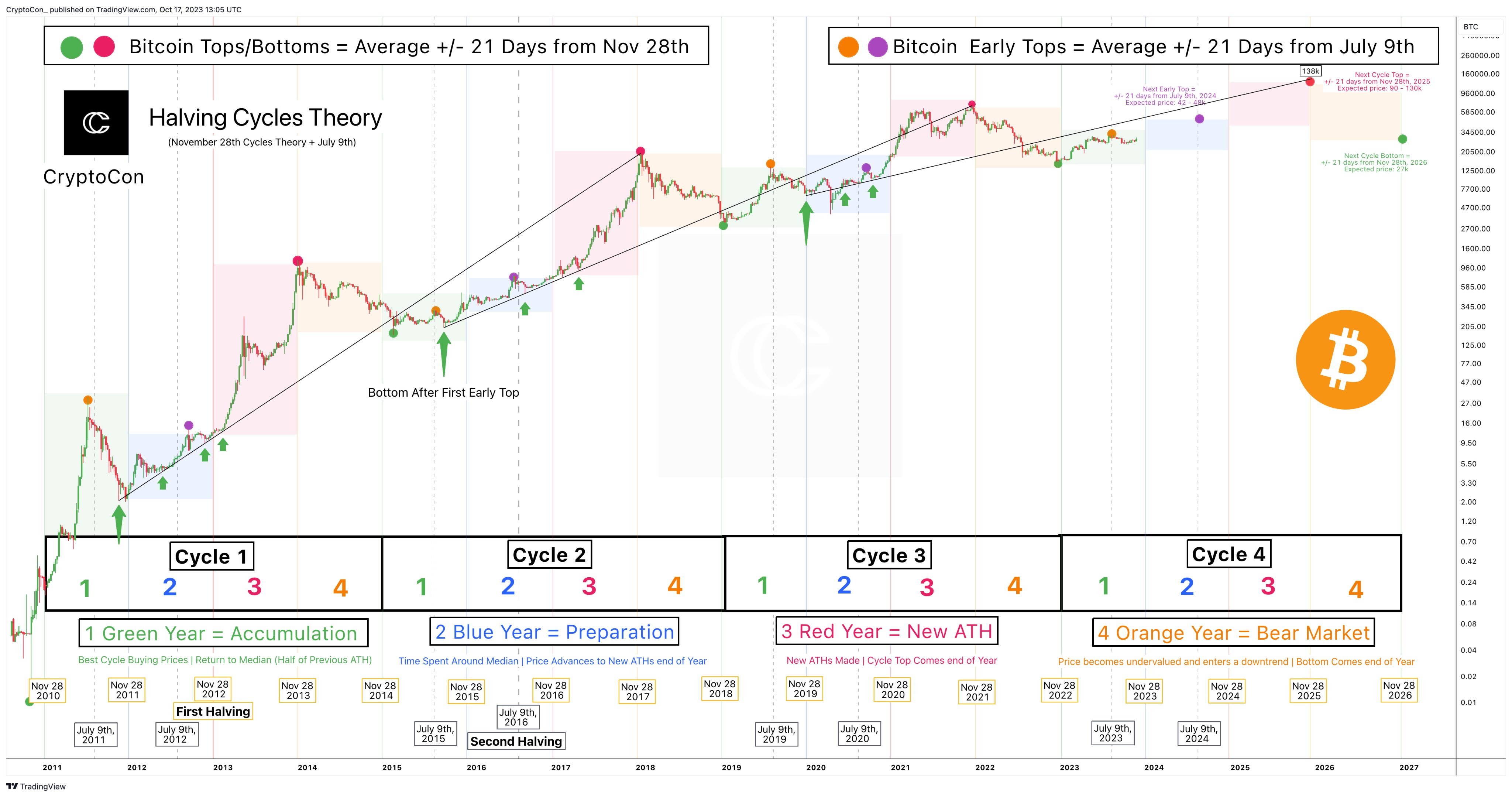

In the realm of crypto insights, a prominent trader and analyst named CryptoCon took to X (formerly known as Twitter) on October 17 to unveil his updated projections regarding BTC's price trajectory. Intriguingly, he confidently set a target of approximately $130,000 for the next two years, adding a sense of anticipation to the crypto landscape.

Several predictions for BTC prices align towards $130,000 in 2025

There's a noteworthy convergence in the forecasts stemming from multiple sources, all pointing toward Bitcoin's value surging to the $130,000 milestone in the year 2025. Interestingly, within the Bitcoin community, there's a divergence of opinions regarding how the price of BTC will respond to the forthcoming block subsidy halving scheduled for the following year. Nevertheless, CryptoCon maintains an unwavering optimistic stance concerning Bitcoin's long-term journey.

Embarking on a meticulous reassessment of various models tracking Bitcoin price cycles and their peaks and troughs, the insightful analyst underscored the growing magnetism of the $130,000 range. "My recent extensive study of Bitcoin cycle tops consistently revolves around a price point of approximately 130k," he succinctly encapsulated.

In tandem with this analysis, an accompanying chart vividly illustrated the concept of "early" peaks in each price cycle, juxtaposed with the actual cycle peak signaling a new all-time high. CryptoCon elucidated that these early peaks tend to manifest roughly three weeks before or after July 9. Following this pattern, the new all-time highs manifest approximately three weeks prior or subsequent to November 28—an intriguing pattern that held true in the previous month as well.

The timing of these events is artfully derived from plotting straightforward diagonal trendlines that originate from the first early peak. The X post continued, further adding to the intrigue, "Following this methodology, we have accurately pinpointed the price of the last two cycle tops. Extrapolating from this trend from the previous cycle, it strongly suggests a price hovering around the 138k mark."

"I'm certainly prepared for the possibility of witnessing lower prices; however, the alignment of various indicators and trends irresistibly points to the 130k mark for Bitcoin during this cycle!" the post emphasized, enhancing the sense of anticipation.

BTC price model data. Source: CryptoCon/X

BTC price model data. Source: CryptoCon/X

Drawing from the timeline suggested by the models, it's anticipated that 2025 will mark the year of the next cycle peak, nearly doubling the record set in the preceding cycle during 2021.

"The past indicates a preference for a bearish trend"

In the realm of cryptocurrency dynamics, historical trends often serve as guiding lights. Notably, the four-year halving cycles are a significant aspect that many well-respected Bitcoin market commentators consider.

Among these discerning observers is the esteemed trader and analyst, Rekt Capital, who consistently underscores the potential for encountering new local lows in the year 2023 before the bull market regains its full vigor.

#BTC

— Rekt Capital (@rektcapital) October 6, 2023

5 Phases of The Bitcoin Halving

1. Pre-Halving period

If a deeper retrace is going to occur, it will likely be over the next 140 days or so (orange)

In fact, $BTC retraced -24% in 2015 and -38% in 2019 at this same point in the cycle (i.e. ~200 days before the Halving)… pic.twitter.com/r1dAWBJXyw

In previous discussions, he cautioned that the highs witnessed at $32,000 earlier in the current year might form a double-top structure, potentially igniting a protracted downturn in BTC prices.

"Reflecting on this very juncture in the cycle (approximately 180 days before the Halving)... BTC retraced by -25% during the cycle of 2015/2016 and even more markedly by -38% during the cycle of 2019," read one of his recent posts on X, adding a historical perspective to the ongoing analysis.

"The lingering question remains: will historical patterns repeat themselves, or will the year 2023 herald an entirely distinctive trajectory? While my macro perspective remains fundamentally bullish, it's essential to acknowledge that historical trends tend to favor a bearish sentiment."

Rekt Capital further emphasized that any potential new lows should be viewed as strategic opportunities for prudent re-accumulation, imparting a sense of tactical wisdom to the analysis.

You might also like: GBTC Discount at Nearly 2-Year Low After SEC's ETF Appeal Deadline Passes

Trending

Press Releases

Deep Dives