Bitcoin's Surge to $41K Fueled by Weekend Short Liquidations Exceeding $200M

Over the past 24 hours, the collective market capitalization of cryptocurrencies has witnessed a 3% surge, attaining levels not seen since April 2022. Both Bitcoin (BTC) and Ether (ETH) exhibited a 4% increase during this timeframe, propelled by growing optimism regarding the potential approval of a spot exchange-traded fund (ETF) in the United States. Furthermore, the surge in gold prices has further contributed to this positive momentum.

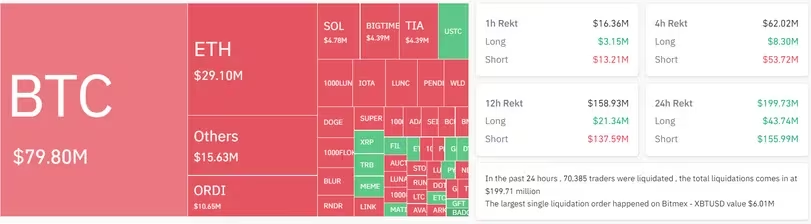

BTC exceeded the $41,000 milestone early on Monday, marking a year-to-date gain of an impressive 152%. According to data from CoinGlass, crypto exchanges liquidated around $220 million worth of perpetual futures positions over the weekend, with bullish long positions accounting for almost 85% of this total.

Market Momentum Unveiled: Coinglass Insights into Cryptocurrency Futures Liquidations

Market Momentum Unveiled: Coinglass Insights into Cryptocurrency Futures Liquidations

Simultaneously, more than $120 million worth of Bitcoin shorts, representing bets against price increases, were liquidated since Friday. Concurrently, on Monday, there was a 6% increase in open interest, signaling that traders were increasing leveraged positions to take advantage of anticipated market volatility.

In a significant development, analysts at Coinanlyze informed Bitsday that open interest on the BitMEX exchange experienced a 90% surge within a few hours, escalating from $200 million to $420 million on Saturday. This spike implies that a major player initiated substantial bets on the platform.

$BTC open interest on @BitMEX skyrocketed . +90% in a single day! pic.twitter.com/kKeBqeVQxV

— Coinalyze (@coinalyzetool) December 2, 2023

The term "liquidation" denotes the forced closure of a trader's leveraged position by an exchange due to a partial or total loss of the trader's initial margin. It happens when a trader fails to meet the margin requirements for a leveraged position, lacking sufficient funds to maintain the trade.

Large-scale liquidations can serve as indicators of potential local highs or lows in a significant price movement, providing valuable insights for traders to strategically position themselves. This data is particularly valuable for traders as it signifies the effective reduction of leverage from popular futures products, serving as a short-term indicator of a decrease in price volatility.

Read More: Crypto Projections: BTC's Resilience & $100K Vision

Trending

Press Releases

Deep Dives