Bitcoin's September Surge

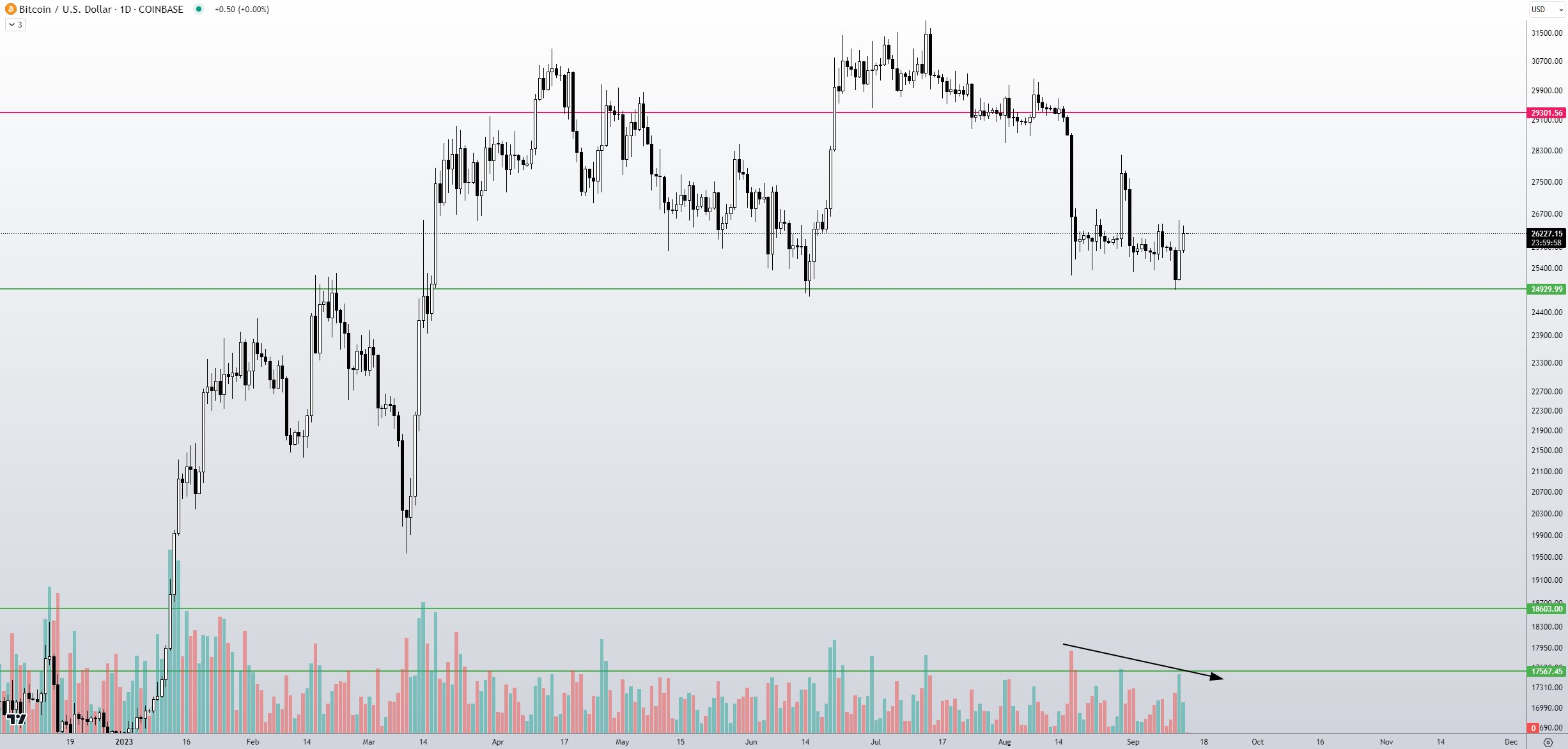

Bitcoin (BTC) has taken a notable dip, reaching the $26,279 mark, but it quickly rebounded to achieve fresh highs for September after the daily close on September 14th. This surge came amidst a backdrop of significant developments in both the macroeconomic landscape and the cryptocurrency industry.

BTC/USD 1-hour chart data as provided by TradingView

BTC/USD 1-hour chart data as provided by TradingView

Trader: There's a distinct vibe in the Bitcoin market

Traders have sensed a distinctive shift in the Bitcoin market sentiment. Even in the wake of a higher-than-expected United States Consumer Price Index (CPI) reading the previous day, Bitcoin managed to hold steady at the $26,000 level. Moreover, the news that the defunct exchange FTX had obtained legal approval for the liquidation of its remaining assets had no discernible impact on Bitcoin's resilient intraday performance.

As of the time of this writing, the BTC/USD pair is trading around $26,300, marking a 5.5% increase from its September lows. A prominent trader known as Crypto Tony expressed optimism, stating, "As we approach the upper range levels, once we break through, we can consider establishing a secure long position."

Annotated BTC/USD chart sourced from Crypto Tony's X platform

Annotated BTC/USD chart sourced from Crypto Tony's X platform

Another trader, Daan Crypto Trades, highlighted a shift in the overall dynamics of the Bitcoin market compared to the weakness observed during the monthly close. He observed that this week, the market feels different, with dips being swiftly bought up, and the price consistently reaching new highs while leaving lows untouched. He also noted increased strength in spot bids compared to recent weeks and cautiously expressed optimism.

Further analysis suggests that a potential long-term price breakout for BTC could occur if U.S. regulators approve a Bitcoin spot price exchange-traded fund (ETF) in the coming months. However, trader Skew issued a word of caution, pointing to on-chain volume likely cooling down after a "relief rally." The analysis indicates that the daily structure appears favorable, but with decreasing volume, a relief rally may be in the cards before any significant downward movement. BTC/USD is still holding the crucial $25,000 support level.

Annotated BTC/USD chart, including volume data, sourced from Skew's X platform

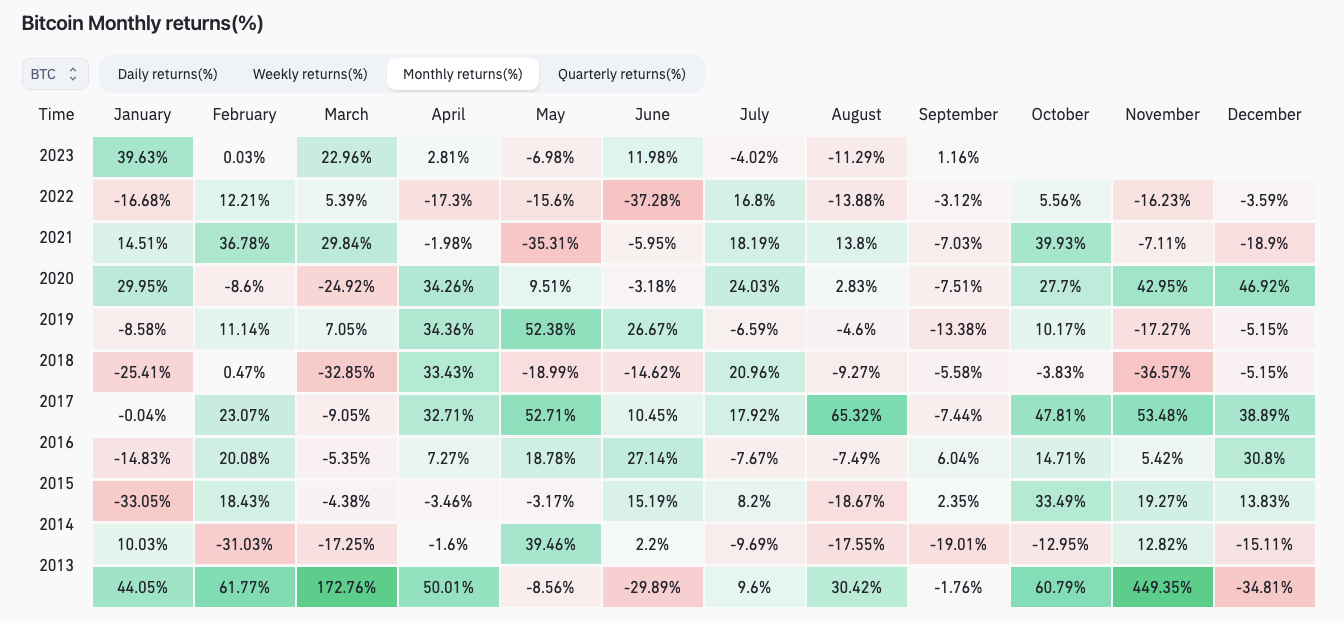

Is this the first September in seven years with positive gains?

Despite the recent dip, Bitcoin has shown resilience and is up 1.15% month-to-date, potentially on track for its best September performance in several years. According to data from CoinGlass, the last time BTC/USD posted gains in September was in 2016, which remains its best September performance on record at 6.35%. In contrast, two years prior, Bitcoin had its worst "red" September, with a loss of 19%. In 2022, Bitcoin experienced a 3.1% dip in September but rebounded with a 5.6% increase in October, which is colloquially referred to as "Uptober" by bullish traders.

A screenshot of the monthly returns chart for BTC/USD, sourced from CoinGlass

A screenshot of the monthly returns chart for BTC/USD, sourced from CoinGlass

Trending

Press Releases

Deep Dives