Bitcoin's Rollercoaster: The Financial Turbulence of November 2nd

Bitcoin (BTC) experienced a significant downturn, dipping below the $35,000 mark on November 2, coinciding with the opening of Wall Street trading. This price decline raised concerns among analysts who had been warning about the excessive heat in the derivatives market.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin reverses its previous gains following the Federal Reserve's actions

In response to these market dynamics, Bitcoin started to reverse its recent gains made in the wake of the Federal Reserve's latest announcements. TradingView's data illustrated a declining BTC price as it retraced ground gained during the previous night.

Before this drop, Bitcoin had achieved impressive new highs, reaching $35,968 on Bitstamp, marking its highest point in the last 18 months. These highs were largely attributed to the optimism generated by Jerome Powell, the chair of the United States Federal Reserve, who hinted in a speech that interest rate hikes might be put on hold.

It's worth noting that during the most recent Federal Open Market Committee (FOMC) meeting on November 1, the Federal Reserve chose to maintain the current interest rates. The accompanying press release emphasized strong economic expansion in the third quarter, a sound and resilient banking system, and low unemployment rates. However, persistently elevated inflation and the uncertain impact of tighter financial conditions on the economy remained key concerns.

As Bitcoin approached and subsequently dipped below $35,000, this price level emerged as a pivotal support threshold for market participants. Simultaneously, the range just above $34,500 was identified as an "ideal" target for establishing a local low.

#Bitcoin breaks out and reaches a new yearly high.

— Michaël van de Poppe (@CryptoMichNL) November 1, 2023

Not a massive breakout, but as long as we stay above $34.8K, the next target is $36.5-37K.#Altcoins to follow after. pic.twitter.com/3aCKwvoGXq

However, despite the recent highs, Bitcoin's value receded by over $1,000, generating unease among traders, with particular attention focused on the overheated derivatives markets. Charles Edwards, the founder of Capriole Investments, underscored the excessively high activity in all Bitcoin derivatives markets.

Furthermore, Skew, a renowned trader, emphasized the role of the spot markets in preserving the strength of BTC's price when derivative markets become overheated.

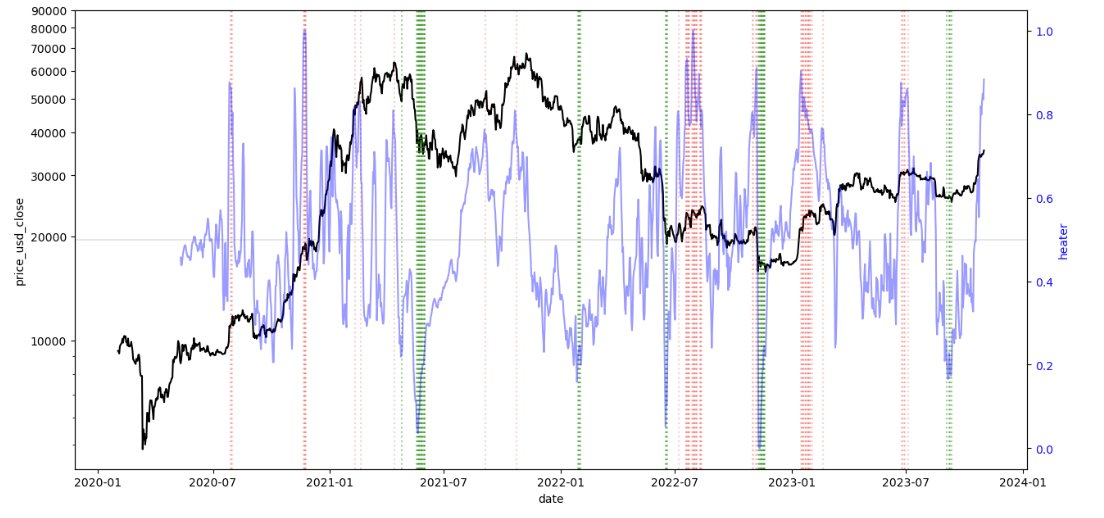

Bitcoin derivatives "heating" metric. Source: Charles Edwards/X

Bitcoin derivatives "heating" metric. Source: Charles Edwards/X

In the backdrop of these developments, several analyses have cautioned traders about liquidity risks and the potential for sudden support level disappearances.

The analysis raises concerns about sudden liquidity disruptions or 'rug pulls'

Material Indicators, a monitoring resource, advised traders to exercise caution in the current Bitcoin trading environment. For instance, the BTC/USDT order book on Binance, one of the largest global exchanges, showed support levels at approximately $34,000 and $33,500 at the time of analysis, yet traders were advised to remain vigilant, as these levels were considered susceptible to abrupt fluctuations, sometimes likened to a "rug pull."

#FireCharts shows #BTC liquidity is once again moving around the order book.

— Material Indicators (@MI_Algos) November 2, 2023

When blocks of liquidity are moving like this caution is warranted, because this kind of movement often leads to rug pulls.

You can mitigate the risk of getting rugged by waiting for buying to resume… pic.twitter.com/UCFNpiIoUe

You might also like: Cryptocurrency Chronicles: South Korea's Rise to Global Prominence

Trending

Press Releases

Deep Dives