Bitcoin's Rollercoaster Ride: Unraveling the Short Squeeze Saga

Bitcoin, often symbolized as BTC, recently underwent a significant price downturn, sliding to the value of $35,359. This price fluctuation unfolded against the backdrop of Bitcoin's characteristic price volatility, particularly noticeable on November 7th when the daily close witnessed what is informally referred to as a "short squeeze," pushing the market closer to the elusive $36,000 threshold.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin reaches a pivotal price level triggered by a short squeeze

The short squeeze that influenced Bitcoin's price trajectory can be attributed to the heightened open interest (OI) observed across various cryptocurrency exchanges. In a prior report, it was emphasized that the collective open interest had exceeded a remarkable $15 billion, leading to expectations of heightened market turbulence. This burgeoning open interest raised concerns about a potential downtrend in Bitcoin's price, though the precise market direction remained cloaked in uncertainty.

As the events transpired, it became evident that short sellers found themselves in a challenging position as Bitcoin swiftly surged to just shy of $35,900. Remarkably, this outcome was anticipated by astute traders such as Skew, who had presciently forecasted that momentum would gather pace if Bitcoin's price revisited the $34,800 mark. This foresight proved to be accurate, as the market dynamics unfolded in alignment with Skew's predictions.

Skew aptly remarked, "Open interest continues to accumulate, and it is becoming increasingly evident that short positions are a significant component of this open interest surge. $34,800 appears to be a pivotal price level for triggering a short squeeze."

Yup there was a significant rise in OI overnight- it seems to be more of the same- shorts aping into passive bids here at the local lows.

— CrediBULL Crypto (@CredibleCrypto) November 7, 2023

We have a big rise in OI, perp takers net selling, funding decreasing, and limit bids being filled. A recipe for a nice squeeze up. https://t.co/IgwSR5dIo9 pic.twitter.com/F82fmNnw7F

In the realm of on-chain monitoring, Material Indicators reiterated a previous forecast that Bitcoin was unlikely to breach the $36,000 threshold within the week. The source's proprietary trading indicators suggested that while certainties are rare in the volatile cryptocurrency market, surpassing the $36,000 mark before the week's end appeared improbable, based on prevailing trend signals.

Meanwhile, another trader known as Daan Crypto Trades noticed an interesting transformation in the composition of derivatives trading. He astutely pointed out that traders on the renowned cryptocurrency exchange, Binance, exhibited a greater inclination toward bearish positions compared to their counterparts on Bybit. Nevertheless, he underscored that the occurrence of a "long squeeze" remained uncertain.

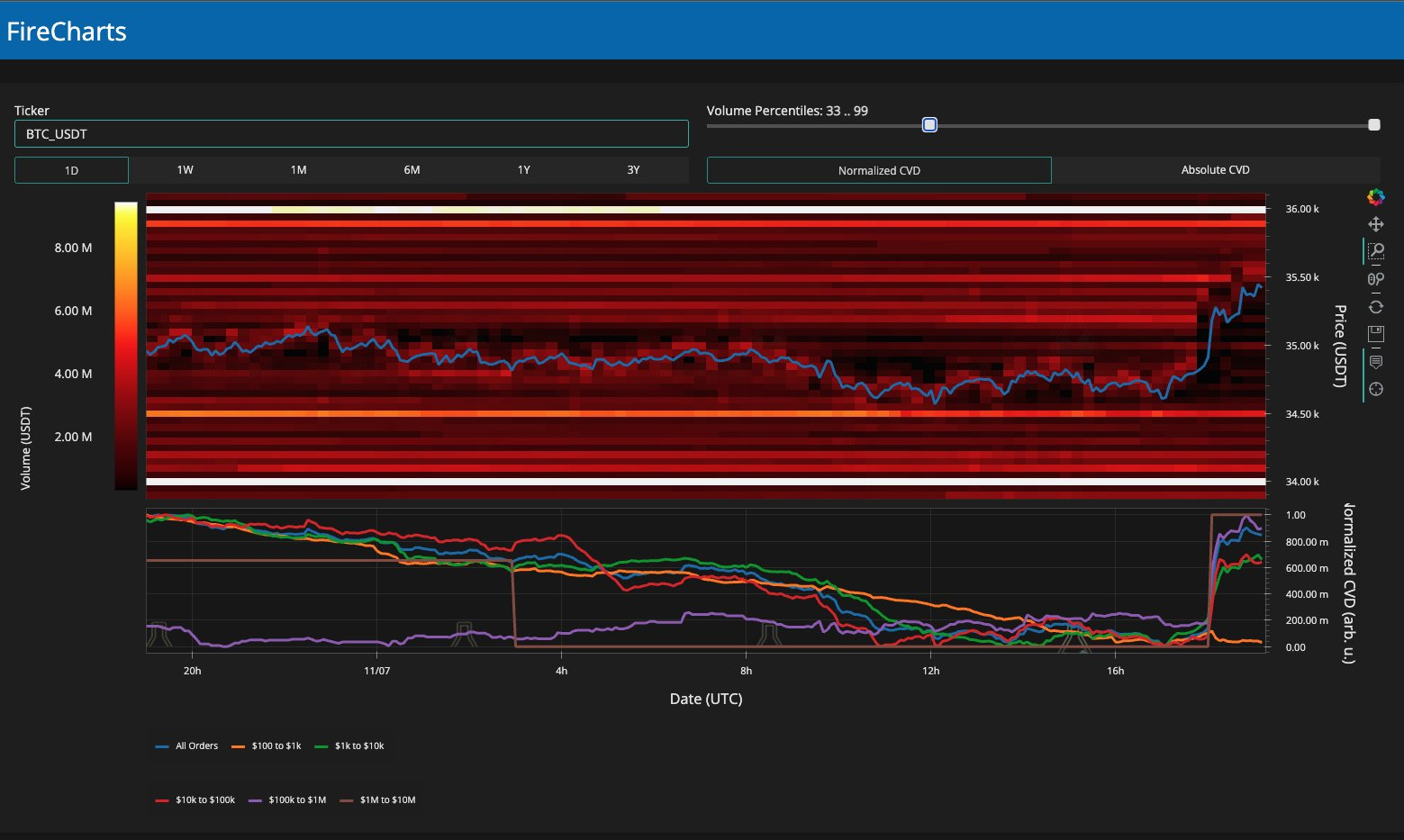

BTC/USDT order book data for Binance as of Nov. 7. Source: Material Indicators/X

BTC/USDT order book data for Binance as of Nov. 7. Source: Material Indicators/X

Daan Crypto Trades elucidated, "Bybit's perpetual contracts consistently reflected a more bullish sentiment in contrast to Binance. Bybit traders predominantly leaned towards long positions, whereas Binance traders were favoring short positions during this period."

An insightful chart comparing BTC/USDT perpetual swap pairs between these two exchanges highlighted that Binance was trading at a lower level following the occurrence of the short squeeze. The implications of this disparity were intriguing, and the outcome remained uncertain. Nevertheless, it was unmistakable that Bybit traders exhibited a more optimistic outlook regarding Bitcoin's future compared to their counterparts on Binance.

Binance vs. Bybit Bitcoin perpetual swaps chart. Source: Daan Crypto Trades/X

Binance vs. Bybit Bitcoin perpetual swaps chart. Source: Daan Crypto Trades/X

The substantial Bitcoin futures open interest purge is yet to manifest

Notably, it is essential to recognize that the substantial flush of Bitcoin futures open interest had not yet fully materialized, as indicated by the financial commentator Tedtalksmacro.

BTC shorts obliterated.

— tedtalksmacro (@tedtalksmacro) November 7, 2023

All of the OI built up earlier today ~$350MM USD, wiped in minutes. https://t.co/E8Ev1lsBWe pic.twitter.com/tHU25fTUt0

The repercussions of the short squeeze were particularly conspicuous on Binance, where short open interest had notably dissipated. As of November 8th, Bitcoin was trading at $35,300, with the total open interest still surpassing the $15 billion mark, according to data from the on-chain monitoring resource CoinGlass.

Bitcoin futures open interest chart (screenshot). Source: CoinGlass

Bitcoin futures open interest chart (screenshot). Source: CoinGlass

Read more about: Crypto Bank SEBA's Hong Kong License Achievement

Trending

Press Releases

Deep Dives