Bitcoin's Resurgence: Navigating Legal Waters and ETF Aspirations

The current surge in the valuation of Bitcoin appears to be riding the wave of recovery following the correction on November 21, with the digital currency bouncing back from $35,651 to an intraday high of $37,431. This resurgence is not merely a numerical fluctuation but is intricately linked to the recent settlement between Binance and the United States Department of Justice (DOJ). The settlement, amounting to $4.3 billion, has injected a fresh dose of optimism into the market, as traders speculate about the imminent approval of a spot BTC exchange-traded fund (ETF). This, in turn, is anticipated to usher in a substantial influx of capital into the realm of Bitcoin, casting its positive impact on the broader crypto market.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Now, let's navigate through the underlying factors steering the current upswing in the value of Bitcoin.

The Binance controversy concludes with a resolution

The resolution of the Binance saga through a settlement presents a complex narrative. Initially, the market responded with a blend of uncertainty and positivity, as reflected in the fluctuation of Bitcoin's price, which briefly touched $37,397. This movement was triggered by Binance co-founder Changpeng "CZ" Zhao's admission of guilt and the subsequent settlement with the DOJ. However, as the market took its time to digest these developments, a notable observation emerged: Binance did not experience a mass exodus of funds, a phenomenon notably absent compared to FTX's liquidity crisis.

Here's our latest update on @binance, 12 hours after our previous one

— Nansen ???? (@nansen_ai) November 22, 2023

At the time of writing, withdrawals are continuing, and we're not seeing a mass exodus of funds

Over the past hour on Ethereum, Binance has a $17M negative netfow (more leaving the exchange than what's… pic.twitter.com/yQPtMl5ue8

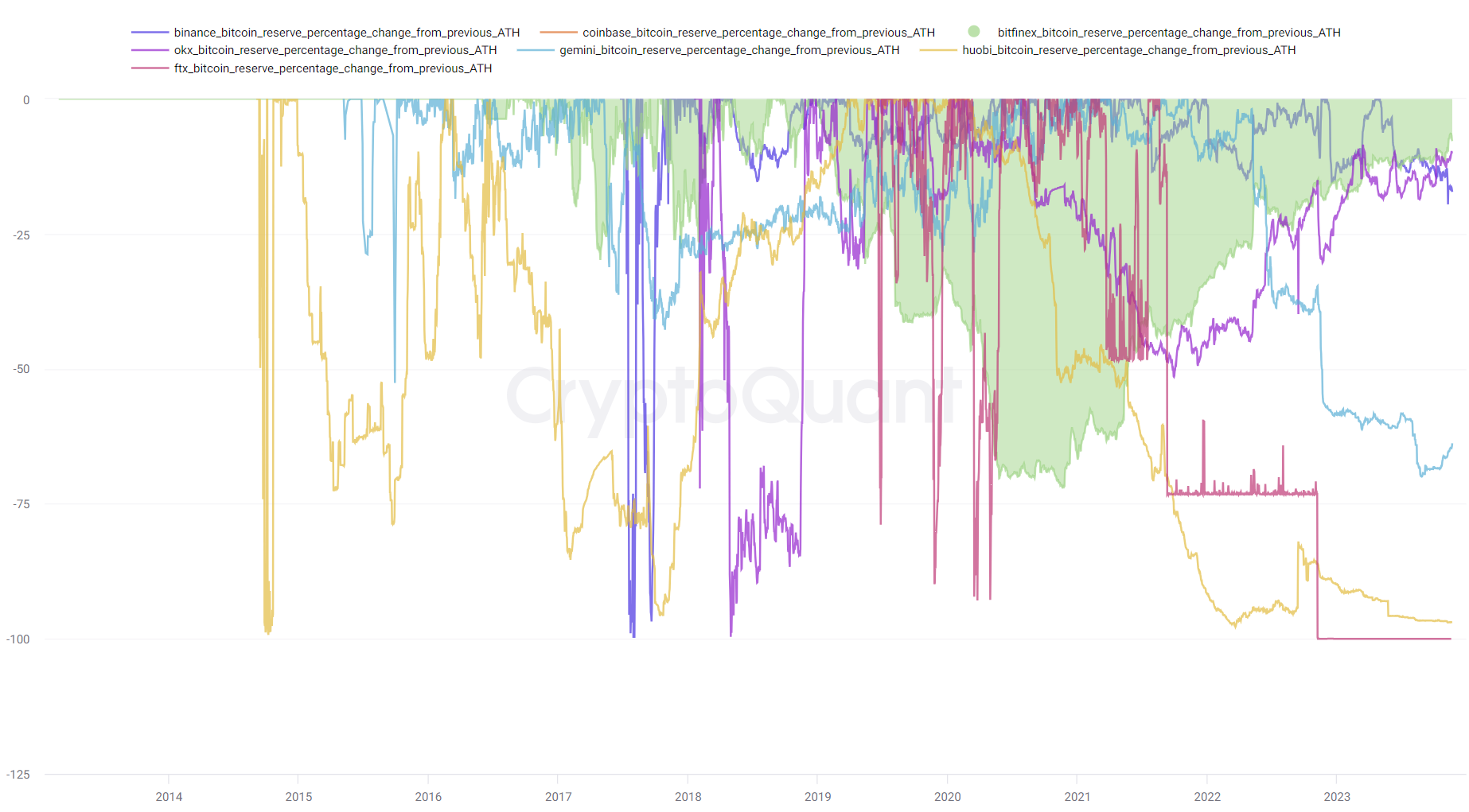

Despite the settlement with the DOJ, Binance's Bitcoin reserves witnessed only a 17% decline from their all-time high. To put this into perspective, FTX's BTC reserves plummeted by a staggering 99.9% during the run in November 2022.

Exchanges’ Bitcoin reserves compared with all-time highs. Source: CryptoQuant

Exchanges’ Bitcoin reserves compared with all-time highs. Source: CryptoQuant

While Binance's current Bitcoin reserves mark their lowest point since 2017, the exchange maintains a position of dominance by holding the largest amount of BTC compared to other centralized exchanges.

#Binance Bitcoin reserve analysis after the settlement with the DOJ.

— Julio Moreno (@jjcmoreno) November 22, 2023

Is better to make analysis of reserves in relative terms.

1. Reserves, which were already declining, are now down 17% from their previous all-time-high, the lowest since 2017.

2. However, Binance’s Bitcoin… pic.twitter.com/lpY2u65V5p

The possible approval of a spot Bitcoin ETF enhances positive market sentiment

The potential approval of a spot BTC ETF emerges as a beacon of hope, standing against a backdrop of various macroeconomic headwinds. Despite the challenges, Bitcoin's value continues its upward trajectory, achieving a remarkable year-to-date gain of 124%, accompanied by a notable increase in volatility. Analysts in the Bitcoin space draw parallels between the Binance-DOJ settlement and a similar deal involving Arthur Hayes and BitMEX, seeing it as a bullish sign for the approval of a spot Bitcoin ETF.

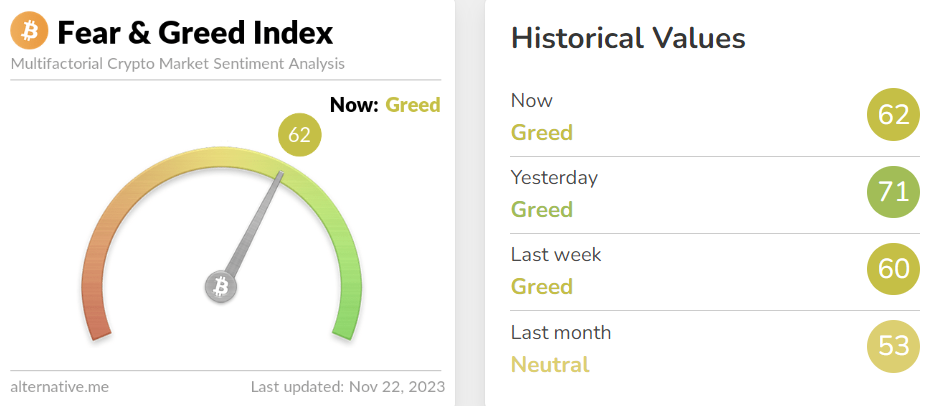

As the Bitcoin Fear & Greed Index steadfastly holds its ground in the "Greed" zone, indicating sustained elevated market sentiment compared to the previous month, the Securities and Exchange Commission (SEC) maintains its stance.

Fear & Greed Index. Source: Alternative.me

Fear & Greed Index. Source: Alternative.me

Despite a flurry of spot Bitcoin ETF proposals in mid-October, the SEC, as of yet, has not granted approval, even with applications from major entities such as BlackRock, Fidelity, ARK Invest, and 21Shares. Having postponed approvals beyond the November 17 deadline, the SEC's next checkpoint is scheduled for January 10. Notably, executives from both Grayscale and BlackRock engaged in discussions with the SEC on November 20, specifically focusing on the approval of a spot Bitcoin ETF.

According to reports circulating in the financial sphere, an ETF approval holds the potential to generate a staggering $600 billion in new demand. CryptoQuant analysts go a step further, speculating that an ETF approval could catalyze a monumental $1 trillion increase in Bitcoin's market capitalization.

Adding to the speculative fervor, Galaxy Digital puts forth a prediction of a 74% price surge in the first year following the launch of a spot BTC ETF.

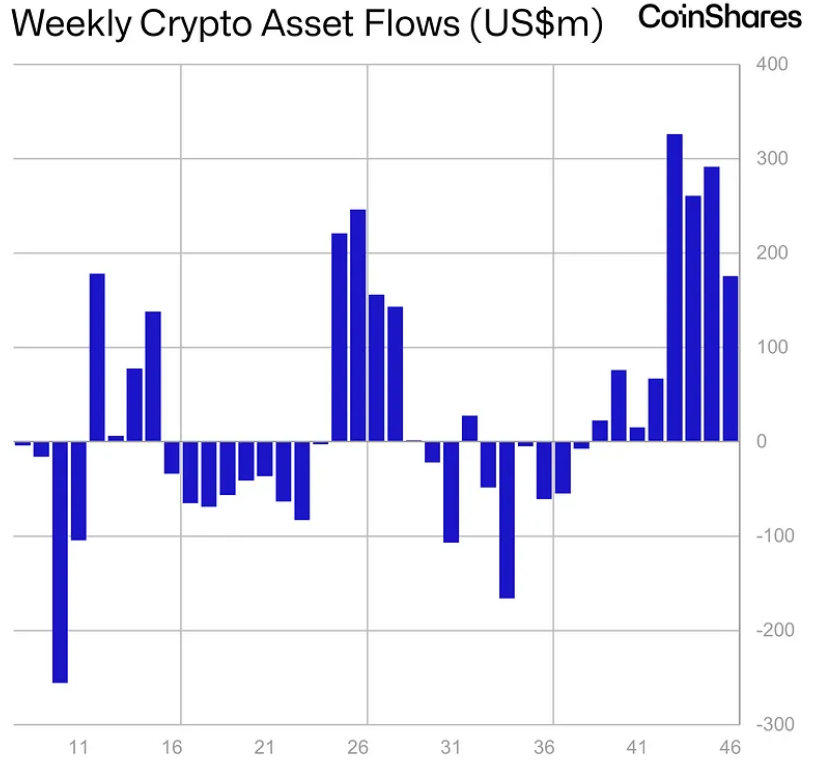

Over $1 billion flows into institutional channels

In the realm of institutional dynamics, the landscape is witnessing a significant influx of funds, surpassing the $1 billion mark. While some investors await the liquidity infusion that approved ETFs could bring, institutional players have already taken strides in allocating funds to Bitcoin and the broader crypto space. Insights from CoinShares reveal that over the past year, institutional investors have injected more than $1 billion into crypto funds, with a substantial portion—over $240 million—flowing specifically into Bitcoin. The past week alone has seen a noteworthy institutional inflow of $155 million into Bitcoin.

Crypto asset institutional investor inflow. Source: CoinShares

Crypto asset institutional investor inflow. Source: CoinShares

In summary, the current surge in Bitcoin's value is not a solitary event but rather a complex interplay of factors, ranging from legal settlements and regulatory prospects to market sentiment and institutional dynamics. As the crypto landscape continues to evolve, these elements intertwine to shape the narrative of Bitcoin's trajectory in the financial ecosystem.

Read more: Expert Opinions Diverge: Navigating Spot BTC ETF Speculation and Coinbase Concerns

Trending

Press Releases

Deep Dives